Want unlimited access to top ideas and insights?

Mortgage application activity decreased from one week earlier as rising interest rates cooled borrowers' interest in getting a loan, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending Jan. 18 found that volume fell by 2.7% on a seasonally adjusted basis and by a miniscule 0.3% on an unadjusted basis

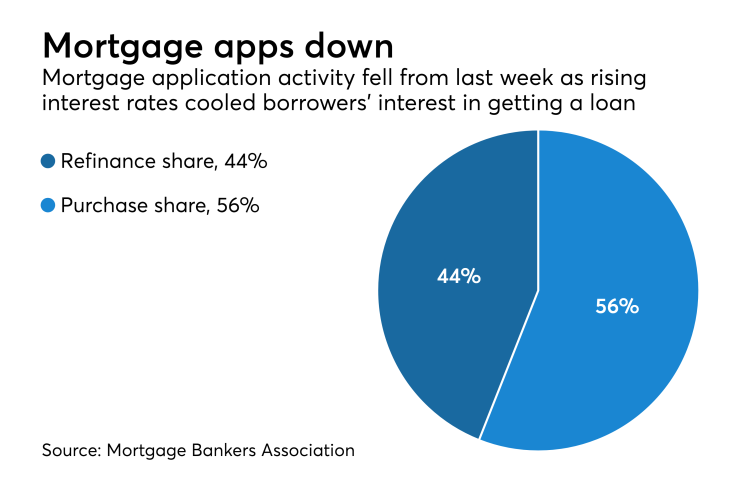

The refinance index decreased by 5% while its share of mortgage activity decreased to 44.5% of total applications from 46.8% the previous week.

The seasonally adjusted purchase index decreased 2% from one week earlier, while the unadjusted purchase index increased 4% compared with the previous week and was 13% higher than the same week one year ago.

"Mortgage application activity cooled off last week after two consecutive weeks of sizeable increases," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Both purchase and refinance applications saw declines but remained at healthy levels, with the purchase index remaining close to a nine-year high, and the refinance index hovering near its highest level since last spring."

"Reversing the recent downward trend, borrowers saw increasing rates for most loan types last week, as better-than-expected unemployment claims, easing trade tensions and stabilization in the equity markets ultimately led to a rise in Treasury rates," Kan said.

Adjustable-rate loan activity decreased to 8.3% from 9.2% of total applications, while the share of Federal Housing Administration-guaranteed loans decreased to 10.5% from 10.9% the week prior.

The share of applications for Veterans Affairs-guaranteed loans decreased to 10.3% from 10.4% and the U.S. Department of Agriculture/Rural Development share decreased to 0.4% from 0.5% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased 1 basis point to 4.75%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate increased 6 basis points to 4.59%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 6 basis points to 4.82%. For 15-year fixed-rate mortgages, the average decreased 1 basis point to 4.12%. The average contract interest rate for 5/1 ARMs increased 4 basis points to 4.12%.