Ohio has become the latest state to start including mortgage servicing rights holders in its increased regulation of nonbank servicers under a new law.

The law, HB 489,

A mortgage servicer is defined in the law as "an entity that, for itself or on behalf of the holder of a mortgage loan, holds the servicing rights, records mortgage payments on its books or performs other functions to carry out the mortgage holder's obligations or rights under the mortgage agreement."

"If the security for that loan is an Ohio property, that's where this is going to impact national lenders," said Bob Niemi, a former Ohio regulator. Niemi currently serves as a senior adviser for financial services at law firm Bradley Arant, but is not an attorney.

The new law's passage follows a series of attempts over the years to bring regulation of nonbank servicers in line with practices suggested for accreditation by the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators, said Niemi, who is a former deputy superintendent for the Ohio Division of Financial Institutions and a former National Mortgage Licensing System ombudsman.

While

Examples of other states that have done this include Arkansas, which imposed a $5,000 fine on the passive holder of an MSR package that contained 169 loans secured by properties in the state in 2017.

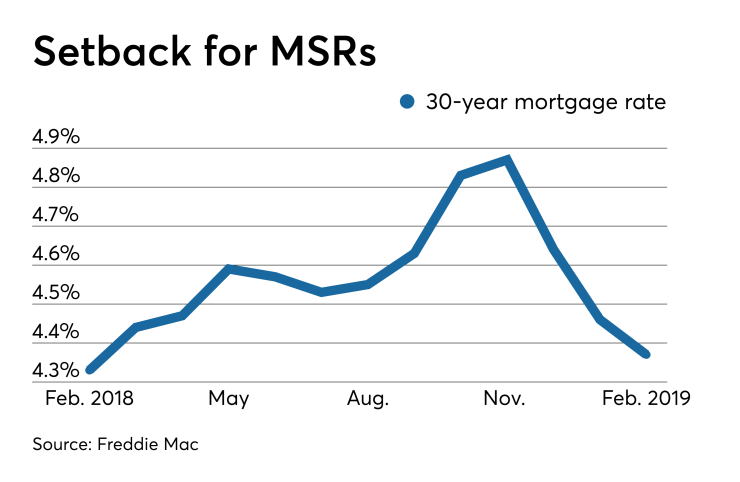

Any additional compliance costs could be particularly hard on MSR holders now due to the recent run of declining rates since November that has hurt valuations.

But exactly how and whether Ohio intends to enforce the new law remains to be seen. Niemi encourages MSR holders to consult their attorneys and check with state authorities if they have compliance questions.

Technical corrections could still be made to the Ohio law in response to such concerns if state officials were amenable, but they would have to pass through a bill submitted to the legislature to do it, he said.

Jonathan Dever, a Republican Ohio state representative who at one time was considered a top