Private mortgage insurers could be forced to raise their prices if Federal Housing Finance Agency's

The proposal would require all private mortgage insurers to hold more assets (and eventually more capital) on their books to comply.

"If premium rates are not increased, returns in the business will decrease," explained Mike Zimmerman, who is the senior vice president of investor relations at MGIC Investment Corp. "If a company wants to maintain the same level of returns that they are having today...with these rules, there are only a couple of choices. Either raise premiums or you don't serve that segment of the market."

However competitive, pressures between the seven active underwriters could hold back any potential price increases, Zimmerman said.

All the private mortgage insurers say they support the aim of tougher capital requirements. But the specifics of FHFA's proposal have caused a split between the four stand-alone MIs. One side stand the incumbents MGIC and Radian; on the other, the startups Essent and National MI.

"We're in favor of robust capital rules. We are not in favor of capital goals that needlessly over-penalize the industry," said Zimmerman.

Both Essent and National MI support the standards as proposed.

"Updating the [eligibility requirements] is important to the health of the housing finance system in general, and the mortgage insurance industry in particular. We believe that the proposed risk-based capital adequacy framework is fundamentally sound," said Mark Casale, the chairman and CEO of Essent in a press release.

As for National MI, the company "believes that the proposed eligibility requirements for private mortgage insurers will go a long way to help restore confidence in an industry affected by the recent housing crisis," its CEO Brad Shuster said in a press release.

If insurers were to raise prices, the monthly cost would likely become too steep for this product to serve the lower credit score borrowers. Those borrowers could have to turn to the Federal Housing Administration program for mortgage insurance coverage and if that happens, the risk to the taxpayer is increased, Zimmerman said.

That outcome would undermine policymakers' goal of expanding credit opportunities, Zimmerman noted, a point echoed by others in the industry.

"We're hoping that the regulators will rethink the rule. I think the rule as it is written makes it difficult for the mortgage insurers to write a lot of business at the lower end of the market, the borrower with FICOs lower than 720," said Bose George, who is an analyst with Keefe Bruyette and Woods. Others have put the point where the market would be cut off at scores of 700 or 680.

This is the market segment that the Federal Housing Finance Agency has been trying to increase credit availability to. Between this new rule and premium increases for the Federal Housing Administration mortgage insurance program, these potential homebuyers will not be able to enter the market.

The vast majority of new private mortgage insurance being written today is for borrowers with FICOs over 720. The proposal would lock the MIs into only being able to serve that group. It would be hard to broaden the credit box because the MIs would not be able to make an appropriate amount of income from policies to borrowers with lower credit scores, George said.

The management team at Radian Group Inc. in Philadelphia sounded a warning about this possibility.

"For some of the higher loan-to-value ratio and lower FICO loans in order to maintain returns on that business, pricing would have to likely change pretty significantly. As you go up the credit spectrum and get better and better credit loans, lower LTVs, much less change if any would be required," Radian's chief financial officer Bob Quint said in a conference call.

As a result, private mortgage insurers, which have been hard at work the past few years trying to regain market share lost to the Federal Housing Administration's insurance program as well as to piggyback mortgages, could end up having to make price increases to serve this market which would make the product uncompetitive. (A piggyback mortgage is an 80% first mortgage combined with a 10% second mortgage. Because the 10% second is combined with the borrower's 10% down payment, no mortgage insurance is required.) Reports started

It is unlikely that the two stand-alone legacy private mortgage insurance companies

FHFA's initial proposal calls for private mortgage insurers to have liquid assets (also known as available assets) greater than or equal to a minimum required asset level.

That is defined as the greater of "a risk-based standard representing claims from the approved insurer’s book of business forecast to be paid over the remaining life of existing policies under a stress economic scenario," an FHFA document states; or a minimum of $400 million as a condition of on-going approval.

Even without having to raise more money, the rules will hit MGIC and Radian harder than their competition because they are still dealing with sizable (albeit ever shrinking) inventory of delinquent loans, plus having to make accommodations to meet the requirements going forward, said George.

"We think that both of them can comply without raising capital," he said, adding that both should also be able to comply without having to cede risk through additional reinsurance policies, although there is a possibility they might have to go that route.

That being said, Mortgage Guaranty Insurance Corp. and Radian Guaranty will be able to meet those requirements as currently stated without needing to raise outside capital, both companies declare.

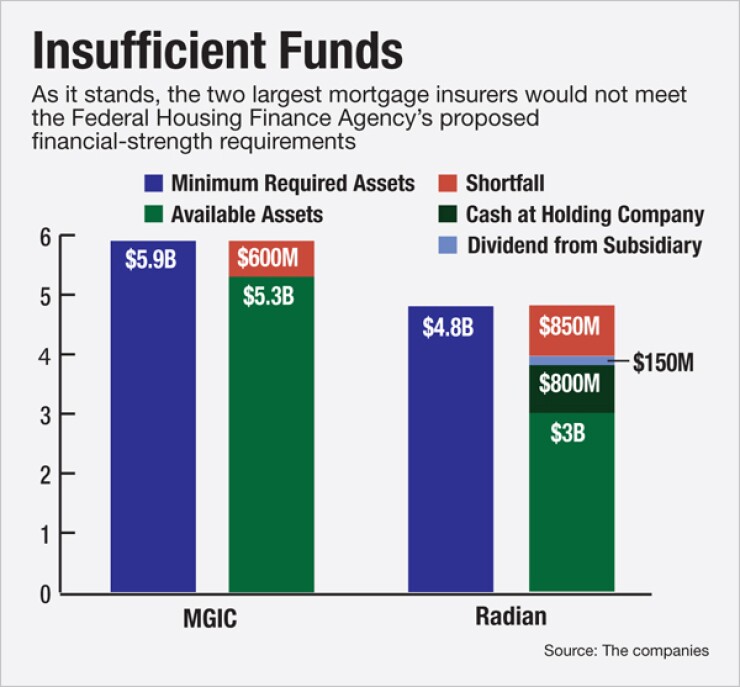

MGIC's minimum required assets under the proposal is $5.9 billion. The mortgage insurer has available assets of $5.3 billion, leaving it with a shortfall of $600 million.

By the time the rules are expected to go into effect in 2017 this shortfall is expected to be reduced to $300 million.

MGIC does not have a capital deficiency; it has excess claims paying ability. "We're not insolvent, we're not anywhere close to that," Zimmerman said.

To offset the remaining amount, the company says might be able to draw upon $515 million of cash at the holding company level as well as $100 million in assets from other MGIC Investment Corp. subsidiaries.

The projections include receiving full credit for MGIC's existing reinsurance approximately $500 million of credit expected at Dec. 31, 2014, increasing to $600 million of credit two years later. But the company is not expecting regulators to give it full credit for this reinsurance. If needed, it will consider obtaining additional reinsurance.

During the conference call, Radian Group CEO S.A. Ibrahim said Radian Asset Assurance, the financial guaranty subsidiary which stopped writing new business in 2008, received permission from New York State regulators to pay a $150 million dividend to Radian Guaranty. It has been paying dividends to the mortgage insurer since 2008 and is expected to continue in the future, Ibrahim said.

But under the proposed standards, "Radian Guaranty's investment in Radian Asset Assurance is not proposed to be included as an available asset," Quint added.

Right now, Radian has required assets of $4.8 billion and available assets of $3 billion. Taking into account $800 million of cash at holding company level and the $150 million RAA dividend, the company estimates its shortfall is $850 million.

To help bridge that gap, "we believe that we will be able to convert its future economic value estimated to be in excess of $1 billion consistent with reported statutory capital into available assets in the future," Quint said. Furthermore, Radian Group recently completed its acquisition of Clayton Holdings, which should also contribute capital to the mortgage insurance unit.

The other two legacy companies, Genworth and United Guaranty are subsidiaries of companies that underwrite other insurance lines (UG's parent is American International Group), as is the new parent of what was formerly known as CMG.

Arch views the new capital standards as a stepping stone to grow its insured portfolio.

As the subsidiary of a Bermuda-based insurance company, Arch MI is already compliant with the proposal, according to David Gansberg, its president and chief executive.

"Arch brings fresh private capital to the industry as well as being an existing company, with operations that have been continually running for 20 years," he said.

CMG's business came exclusively from credit unions. Right now, Arch insures nearly 50% of CU originations.

"For the past five months, we have been trying to expand the business over to the mortgage banker side and actively sign up lenders," said Gansberg.

"We are grateful that we are in compliance with the financial requirements of the PMIERS. We think that makes a strong case to our lender customers that we are a great option for them to do business with."

When asked if the rules would impact the company's ability to compete with Essent, National MI or Arch MI, Zimmerman replied "categorically, no!"

FHFA has asked for comments regarding the proposal, for which MGIC and Radian both state they will make submissions. Based on what has happened with other proposals such as the qualified mortgage and qualified residential mortgage rules, it is very possible the capital requirements could end up looking substantially different than what was first proposed.

There needs to be stricter capital rules for the MIs than there was prior to the mortgage crisis. However, there are ways for FHFA to tailor the rule so it is not so punitive on the lower credit score segment of the market, George said. This includes FHFA revisiting the contingent capital portion of the proposal, which would require insurers to add capital when conditions worsen.

Even so, because the rule is not going into effect until 2017, and those problem books of business should no longer be an issue for the older MIs, the effect should be same on all of the companies, George said.

But with expected lower rates of return, the private mortgage insurance business, which has been very successful (with one notable exception below) raising capital since the end of the bust, could see investors deciding to stay away.

It is also unlikely we will see any more new companies or resurrected existing companies come into the space. Old Republic International tried twice