The nation's homebuilders are being held back by a dearth of money to acquire and develop land. And as a result, buildable lots are in short supply — and far more expensive.

Funding needed to construct houses is fairly plentiful, according to the National Association of Home Builders' chief economist, David Crowe. But builders are still having trouble lining up financing to purchase land and put in the streets, curbs, sidewalks, sewer lines and other pieces of necessary infrastructure, he said at the group's recent annual convention in Las Vegas.

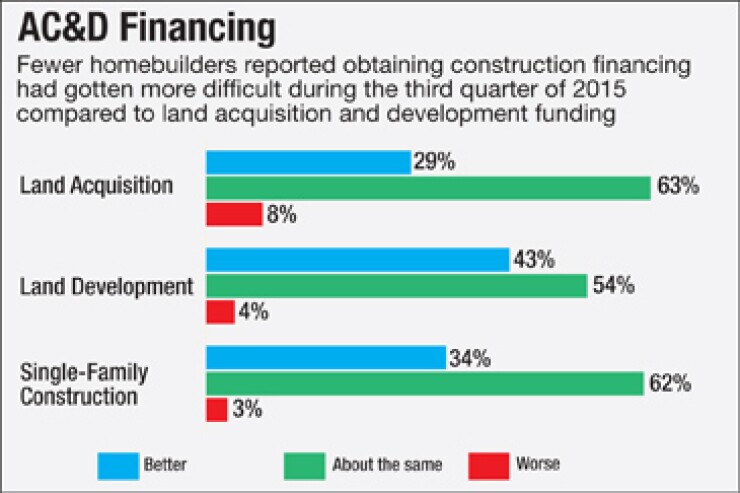

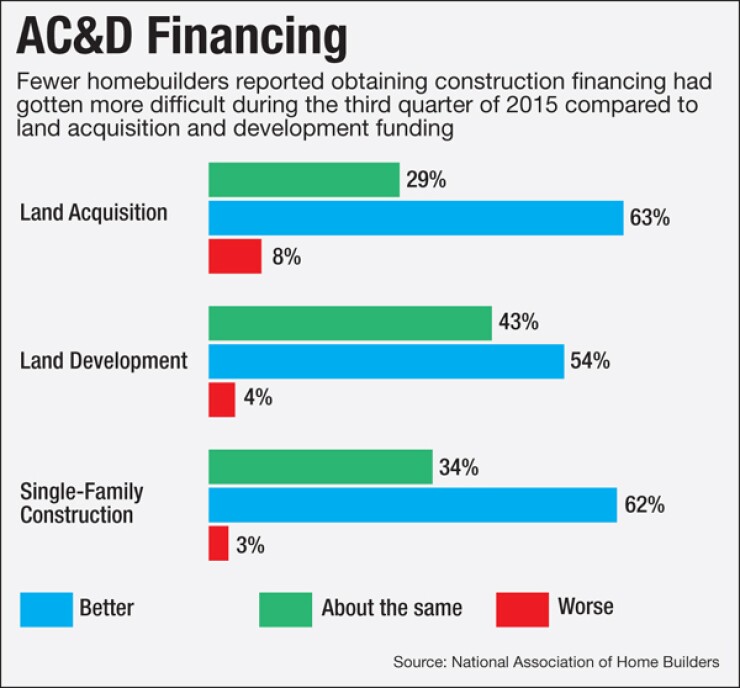

While construction lending has begun to open up, there has been only a slight increase in development funding and money to buy raw land has been even harder to come by, according to a recent NAHB membership survey.

Acquisition, development and construction financing, also known as AD&C funding, is the lifeblood of the residential construction industry. Without it, home building slows to a crawl. Even if just one part of the three-legged funding stool is weak, the business can become unsteady.

According to the FDIC, the regulator of commercial banks, the main source of builder financing, AD&C funding has been increasing steadily for the last several quarters. But because each of the three types of loans is lumped into one for statistical purposes, it tends to mask the underlying problem of the lack of acquisition and development financing.

There seems to be some overall relief," said Crowe, noting that the problem of obtaining AD&C funding has declined substantially. "It's getting better but it's not back to normal."

Money to build is "significantly more available," the NAHB economist added. "That's not to say it's as plentiful as it was in the early 2000s. But it's getting better."

But what hasn't returned is money to buy and develop the land. That doesn't hurt the

As a result, some builders, such as custom builders that construct one-of-a-kind homes, are turning to construction-to-permanent financing. In these transactions, the ultimate buyer obtains a loan to buy the lot, develop it and build the house. After construction is complete, the loan is converted into permanent financing, and the builder is never on the hook for a dime.

Crowe said he's seen a pick-up in construction-to-permanent financing. He's also seen more builders turning to the private equity market for their financing. However, he "hasn't seen much" in the way of crowdfunding.

The shortage of builder financing shows up in the lack of ready-to-go construction sites. According to a survey of NAHB members in January, the issue has risen to second on a list of builders' concerns behind the lack of quality workers.

Building sites in the prime "A" locations are all but gone, so less desirable locations are moving up, according to Brad Hunter, chief economist and director of strategic consulting at Metro Studies, a market research firm in Palm Beach Garden, Fla.

"There are 'A' locations and then there are the rest," Hunter told a convention session. "But nowadays, with land so scare, 'C' spots are now considered 'B' by many builders, and even 'A' by some."

As builders fight over the best spots, the price of land goes higher and higher, contributing to the eventual cost of the house. The average sales price of a house started in 2015 was $351,000. That's nearly $100,000 more than in 2009 and well above the peak of $305,000 in 2006 before the housing collapse, according to the Census Bureau.

In August, 59% of builders reported that the supply of lots in their market was "low" or "very low," up from 43% in September of 2014 and the largest low supply percentage since the NAHB began asking that question nine years ago. Moreover, the higher percentage included 20% who characterized the supply as "very low."

Also in that survey, 34% said the price of developed "A" lots was higher than a year ago, while 15% said the price of "B" lots was substantially high and 11 said the same about "C" lots.

"Supply and demand is in full force again," said Mark Stephens, a builder in the Portland, Ore., area.

"Probably just like everybody else, land is very hard to find," in the Portland area, Stephens said. "Consequently, we have to pay more, 15% to 40% more. Land is in limited quantity, and everything has a cost."