Securities backed by reverse mortgages could perform better if recent reforms cut the number of defaults, but amassing loans for securitization is taking longer.

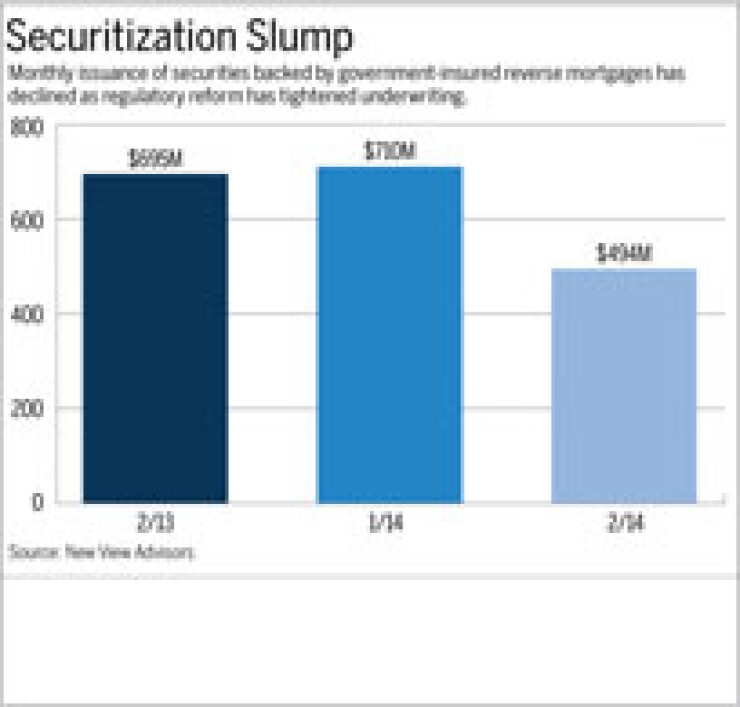

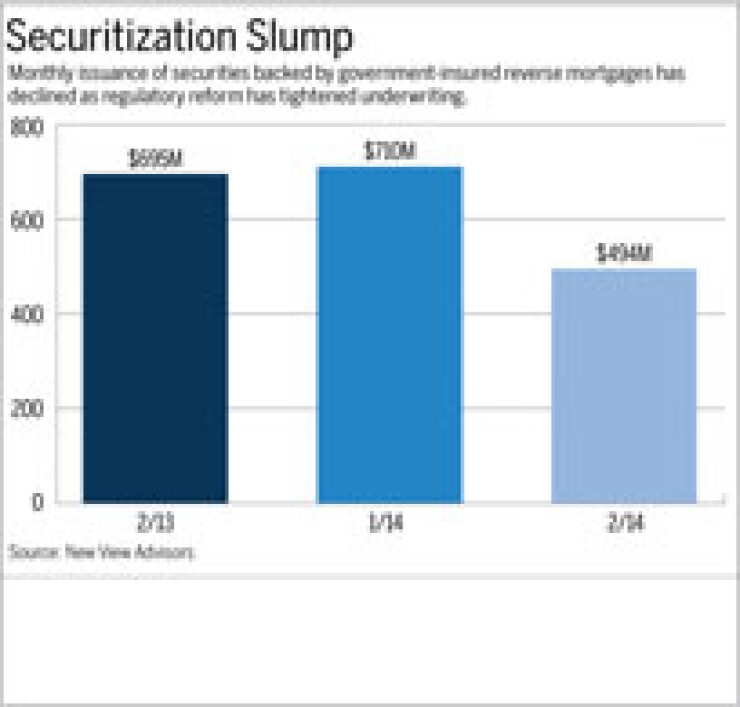

Issuance of bonds backed by Home Equity Conversion Mortgages fell to a five-year low of roughly $494 million in February, according to a report by New View Advisors LLC, a consulting firm in New York that specializes in reverse mortgage capital markets. This was the lowest issuance since May 2009 and down from $695 million in February 2013.

There has long been apparent demographic promise in the size of the senior market these products serve, but difficulties ensuring borrowers fully understand and fulfill their responsibilities related to the lending contract (such as paying property taxes and insurance) have challenged performance.

Particularly high losses on reverse mortgages as a result of the downturn hit the Federal Housing Administration's mutual mortgage insurance fund hard. Even though the government insures these loans, and timely payments of principal and interest on the securities they back, defaults make it harder for bondholders to predict prepayments.

Ongoing reform may remedy these concerns about collateral performance, but it appears to be adding to downward pressure on origination volume.

"I think that is the big question in our industry," says Michael McCully, a partner at New View Advisors. "Everybody believes that the long-term health of the FHA's MMI is critical for the success of the program. So now that the FHA has made all of these changes to ensure that, what will that do, long term, to volume?"

Reform generally aims to make sure consumers can maintain the home, and that they understand that after a borrower dies, heirs may repay the loan under certain terms or else give the property to the lender. The result is tighter underwriting.

This tightening has put some downward pressure on volume, Reza Jahangiri, president and CEO of American Advisors Group, a lender in Orange, Calif., said at a recent National Reverse Mortgage Lenders Association meeting.

The drop followed a rush to the program ahead of the

There has been some rebound in retail originations but wholesale volume remains low, Jahangiri says.

Any rebound is likely to be slow-moving and limited. HECMs originated by responsible lenders take a long time because it is

Also, more reform in the works could

The government is sensitive to volume concerns because it has a stake in the primary and second markets for reverses. The Federal Housing Administration insures the Home Equity Conversion Mortgages that dominate the market and Ginnie Mae separately insures HECM securitizations.

However, performance woes linked to HECMs have put a huge dent in the FHA's finances. So the government can ill afford too much loosening of origination guidelines.

HECMs have to be sustainable for borrowers and HUD, Karin Hill, the director of single-family program development at the Department of Housing and Urban Development, said in response to origination concerns raised at the Eastern Regional NRMLA meeting.

"It has to perform well. That's paramount," McCully says. "If there were continued losses in the FHA, I think they would abandon the program or make changes until it stopped losing money. I would suggest the product today probably makes money again for the FHA."

Lenders have similar concerns about performance as they face

One fear about reform's effects on the market has proven unfounded, McCully says.

"There was a concern back in the summer of 2013 that with another LTV cut that the volume would drop and investors would lose interest because of the lack of supply and liquidity. That has not proven to be the case," McCully says.

Instead, he finds interest in them has picked up.

"The securities perform so well that what we're seeing with the drop in volume is the simple economics of supply and demand. As there is less supply, the demand has driven prices up, not down," he says.

Also, HMBS can be re-securitized through real estate mortgage investment conduits, and the cash flows from their draws occur over time. This helps bolster supply.

The underlying HECM volume question does remain a concern, though, McCully says.

There are hopes that reformed HECMs with the right marketing will draw a more affluent borrower base that will help volumes grow despite the tighter guidelines, or that private-label products will re-emerge to fill gaps receding government reverses might leave. Recently there has been only one private market reverse mortgage program available and it has made up just about 1% of the overall market, according to McCully. That could change, he says.

"While the snapshot today of the industry is that the borrower profile is really similar to what it has been over the last 25 years or so, there are millions of potential borrowers that are not attracted to reverse mortgages for various reasons," McCully says. "If you can make the product safe and sound and take away all of the negative stories and headline risks, clean all of those issues up, you'll start to attract a whole new type of borrower. That's really the long-term hope for the industry.”