-

Home equity investment platforms continue to attract dollars from the venture capital community but also face a proposed de facto ban in one state.

February 4 -

The reverse mortgage companies squeezed thousands of dollars out of aging homeowners through various illegal fees, according to a new class action suit.

January 30 -

The partnership also includes a $50 million equity investment in Finance of America, securing long-term alignment between the companies.

December 15 -

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

December 12 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

Home equity is becoming a data-driven asset that demands sharper valuation and analytics as lending options expand, according to Clear Capital's EVP of Strategy and Growth.

December 10Clear Capital -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9 -

Bank statement loans, a home equity credit card and a blockchain investment product are among the new offerings designed to reach an $11 trillion market.

December 5 -

Billions in home equity sit untapped as second-lien loans struggle to gain traction, writes the chairman of Whalen Global Advisors.

December 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Fortress has been one of the most active home equity investment firms in November, investing $1 billion in Cornerstone.

December 1 -

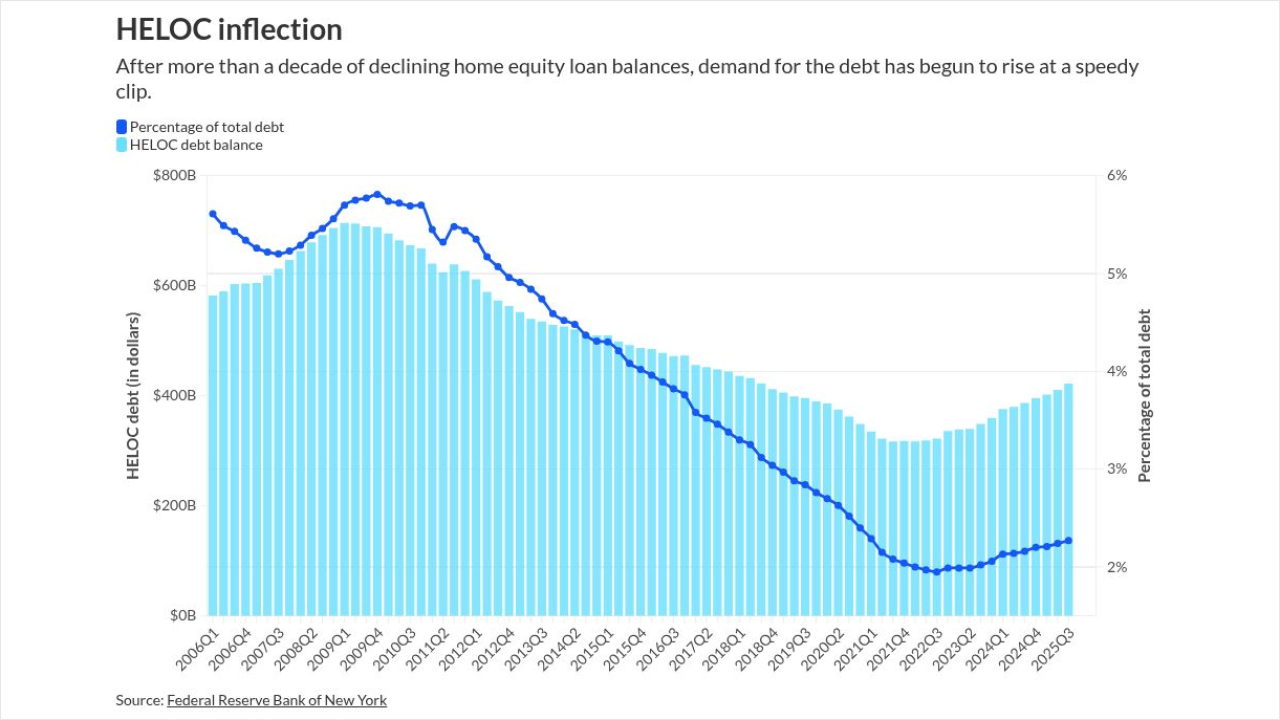

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

Refinancing pushed mortgage originations higher as rates eased, and home equity lending kept growing, but rising delinquencies signal mounting borrower stress.

November 3 -

Uncover how high-speed internet access drives property valuations, creates lending opportunities, and transforms mortgage markets nationwide.

October 30 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

The judge sided with Massachusetts officials in a review of their lawsuit against Hometap, who pushed back on descriptions of its products as "illegal" loans.

August 26 -

Borrowers also showed a higher tendency to tap into home equity, with related originations rising at the fastest rate in three years, Transunion said.

August 15 -

The company also added a new marketing executive to drive growth, with current expansion coming after it also secured an origination purchase deal last month.

August 6 -

Mortgage tech firms are seeking to take advantage of the expected growth of HELOCs with new platform integrations and enhancements of existing tools.

July 29 -

The agreement with D2 Asset Management doubles the firm's previous commitment to Unlock, as current economic trends provide momentum for the growing sector.

July 23 -

Secondary market interest in home equity contracts is drawing new participants, with 2025 securitization activity ahead of last year, industry leaders said.

June 13