The strong credit quality of mortgage originations and profit margins that exceed other capital allocation options have drawn a growing number of new or returning players back into the business of offering warehouse lines of credit to mortgage lenders.

But the combination of lower-than-expected mortgages rates and greater demand for purchase loans is helping fuel the trend, as volume for both mortgage lenders and warehouse lenders so far this year has exceeded 2014 levels.

"What we're seeing 2015 Q1 compared to 2014 Q1, it's night and day," said James Reynolds III, managing partner at due diligence firm Reynolds Group in Summit, N.J. "The medium-sized and large independents [mortgage bankers],where we're focused, are experiencing very strong volumes. It flows through to the warehouse lenders."

Warehouse lenders provide interim funding to close mortgages designated for sale to investors. Many large banks exited warehouse lending during the market downturn. Since then, new warehouse lenders have emerged, including Silvergate Bank, which opened in April 2009, and Impac Mortgage Holdings, which got back into warehouse lending after a six-year absence in September 2013. As recently as a year ago, smaller warehouse lenders'

Nondepository warehouse lender NattyMac in Clearwater, Fla. — a subsidiary of Stonegate Mortgage — is among the warehouse lenders experiencing a recent surge in volume. Stonegate Mortgage's warehouse lines of credit provided to correspondent originators, for example, increased 44% to $472.4 million in the fourth quarter of 2014, compared to $328.2 million in the third quarter of 2014.

"We have had a large amount of new applications every single month and been successful in adding new clients," said Steve Landes, president of NattyMac. He added the lender's utilization percentage — the proportion of a warehouse line that originators have drawn on to fund loans — is "strong."

Depositories have favored warehouse lending over alternatives like federal funds, the overnight loans between member banks of the Federal Reserve System that are used to stabilize surpluses and deficiencies in required reserves. At the same time, warehouse lending has been more attractive to nonbanks because it allows them to capture more business through their correspondent channels.

Throughout the industry, the year has started off with a bang for mortgage and warehouse lenders alike. Consumer

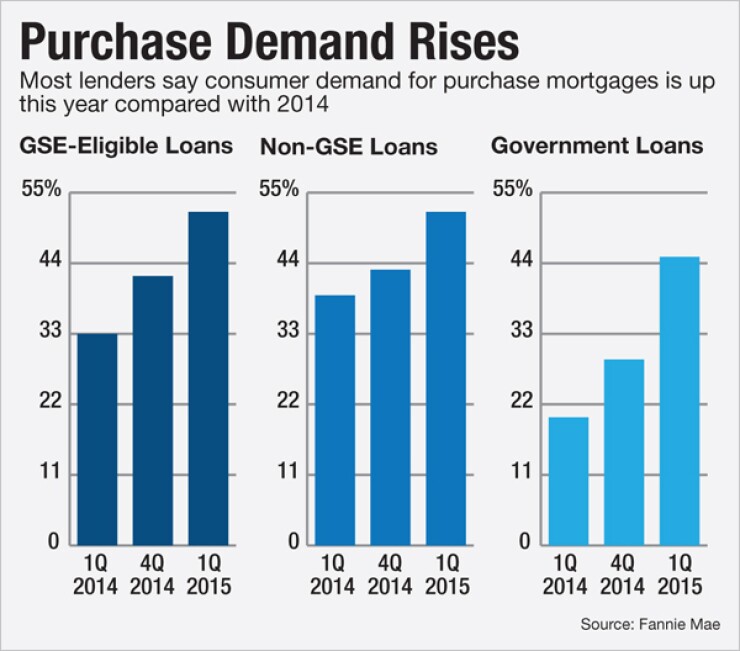

More than half of lenders said demand for government-sponsored enterprise mortgages has improved, up from just 33% in the first quarter of 2014. Similarly, 52% of lenders also found non-agency loan demand improved, up from 39%. In addition, 45% reported government lending demand has improved, up from 20%.

Warehouse credit supply is keeping up with demand, said Les Acree, who works in Fishers, Ind., as an executive vice president at lender Freedom Mortgage.

"Warehouse lending, as you've seen more players come into the market, is readily available for those who qualify," he said.

Warehouse lenders price interest rates using the 30-day Libor, with originators currently being charged between Libor-plus 1.75% and Libor-plus 3.0%, according to David Fleig, president and CEO of investment firm MorVest Capital. That, combined with the $20 to $50 transaction fee collected on every loan, makes warehouse lending more attractive to depositories than the current 0.25% federal funds interest rate.

"The internal calculations for each bank on the projected ROA [return on assets] on warehouse lending will vary of course by their cost of funds, etc., but suffice it to say that warehousing is quite profitable as compared to other investments of cash with a similar duration (most loans only stay on warehouse lines for a week or so; range is say 5 to 25 days)," Fleig said.

However, a warehouse lender's returns vary considerably depending on the size of the mortgage lender using the line of credit, Reynolds noted. And lenders have so far been tepid about extending warehouse lines to niches like the

Only 10 to 15 of the roughly 75 warehouse lenders that Reynolds is familiar with are comfortable operating within the regulatory boundaries for extending lines to mini-correspondents.

"We've been to a number of places recently where they've dropped it," Reynolds said.

Small emerging bankers can get warehouse lines, but they have to operate as a standalone entity and must agree to absorb a lot of the risk themselves to do it, Acree said.

"If you're going to play in that space, you're going to have to give a personal guarantee," he said. "The regulators really want to see an arm's-length transaction and that the smaller lender who has a warehouse line has more than one investor takeout, even for QM loans."

Regulators also want these originators "to show that they're really moving from the broker role more to the banker role," Acree added.

Multiple investor takeouts also are a prerequisite for

So far, most non-QM originations have been jumbo mortgages that have strong credit underwriting, but still don't qualify for the safe harbor protections because of their large principal amounts.

"We hear a lot about non-QM loans with lesser credit grades, but we really haven't seen them," said Acree.