-

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

January 30 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

On Jan. 26, use of the new Uniform Residential Appraisal Report shifts from limited production to the optional phase, giving lenders 10 months to get ready.

January 26 -

Tri-merge mandates prop up a credit bureau/FICO oligopoly, raising mortgage costs with little benefit despite risk concerns, the chairman of Whalen Global Advisors argues.

January 22 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

What's said in the online video, which replicates the president's voice with his permission, may be as important to lenders as how the message is delivered.

January 20 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

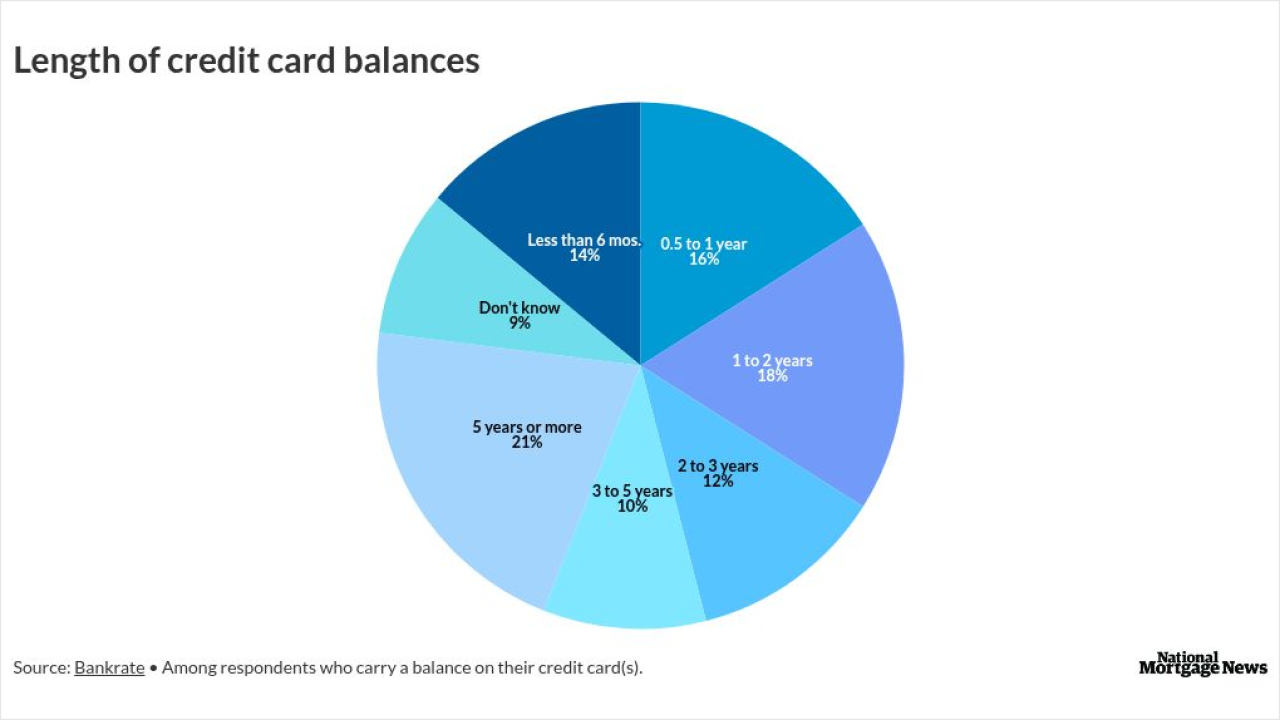

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Loanlogics rolled out the LoanBeam NQM income analyzer in October and has four users for the non-qualified mortgage underwriting technology, including Pennymac.

January 7 -

The deal comes as technology experts see likely 2026 artificial intelligence breakthroughs in mortgage to come through improved underwriting.

January 7 -

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

January 6 -

The Federal Home Loan Bank of Chicago will be offering more funding and higher per-member limits as part of its 2026 Community Advance program.

January 2 -

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

December 26