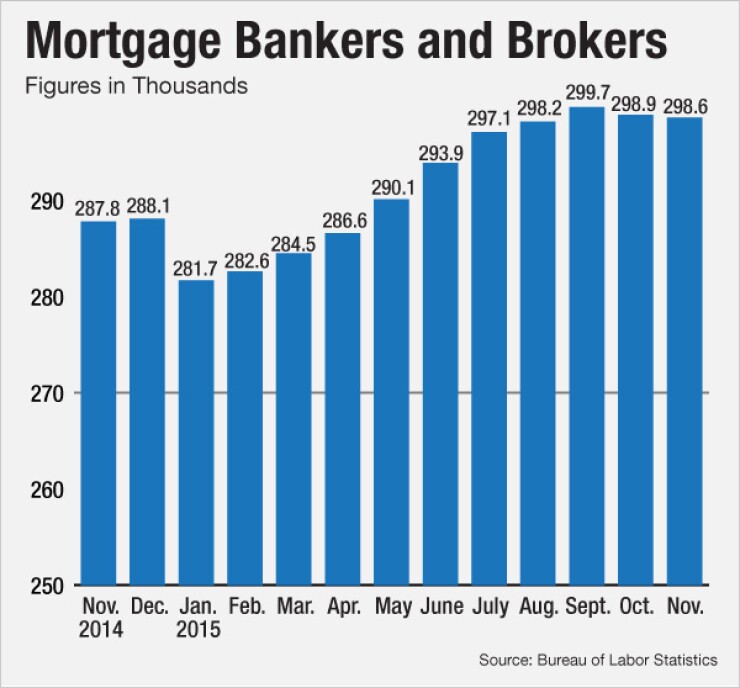

Nonbank mortgage lenders and brokers cut a few hundred employees from their payrolls in November as employment in this sector continues to fall short of the 300,000 mark.

The employee count at nonbank mortgage lenders fell to 298,600 in November, down 300 full-time positions from October, the Bureau of Labor Statistics reported Friday.

Hiring generally is slow this time of year, especially when mortgage rates are expected to rise. Economists at the Mortgage Bankers Association expect higher purchase mortgage activity in 2016, up 10% from 2015, coupled with a 36% drop off in refinancings.

Overall, the MBA is forecasting total originations of $1.32 trillion in 2016, down from $1.46 trillion in 2015.

Still, Friday's national jobs report showed unexpected strength in other sectors as U.S. companies hired 292,000 new employees in December. And the jobs number for November was revised upward from 211,000 to 252,000. The BLS industry-specific estimates lag national reporting figures by one month.

While the U.S. unemployment rate remained unchanged at 5%, the robust jobs number could signal stronger than expected home sales this year.

The BLS report also shows construction companies and homebuilders added 45,000 new workers to the payrolls in December. Half of those workers are involved in single-family and multifamily construction.

"Over the year, construction added 263,000 jobs, compared with a gain of 338,000 jobs in 2014," BLS commissioner Erica Groshen said.

Fannie Mae chief economist Doug Duncan noted the warmer than usual winter conditions has allowed builders to ramp-up construction and increase the supply of homes for sale.

"If this plays out, it will be good news on the housing supply side," he said. Up till now, the inventory of homes for sale has been limited, which has "led to strong price appreciation and rising affordability constraints," Duncan said in a statement Friday.