-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

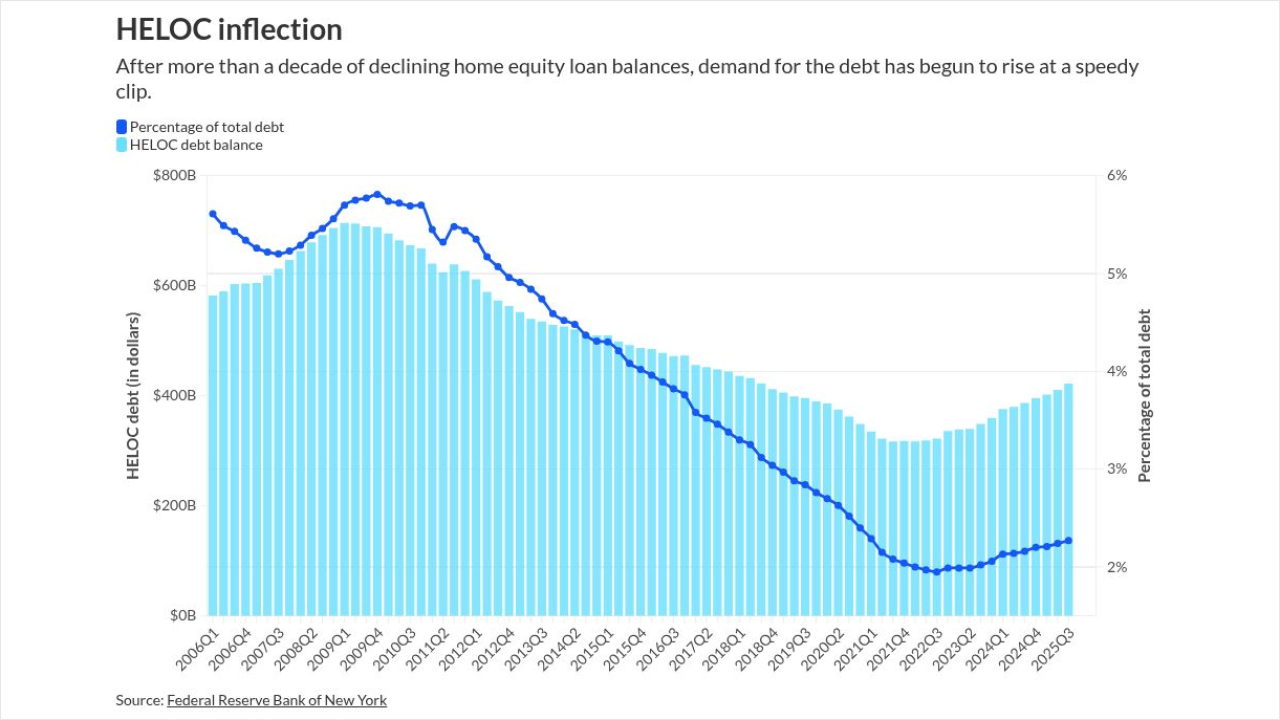

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

The Consumer Financial Protection Bureau has released a packed agenda centered on rewriting rules ranging from small business lending to open banking while rescinding several rules finalized under the Biden Administration last year.

September 5 -

Mortgage delinquency rates increased versus the second quarter of 2024, with certain markets, especially in the South, reporting higher levels of difficulty.

September 5 -

The bank will deploy Nova Credit's Cash Atlas software to determine borrowers' creditworthiness by looking at bank account data, and the vendor's Credit Passport to bank newcomers to the country.

September 3 -

Late-payment rates among U.S. borrowers rose again in the second quarter, according to a report from the New York Fed. The trend reflects a sharp increase in student loan delinquencies, which have been climbing as pandemic-era policies have expired.

August 5 -

Fears of identity theft are top of mind for many Americans, even as many admit they're open to lying themselves in order to get mortgage credit.

July 30 -

The Senate Banking Committee is now proposing to cut the cap by which the Consumer Financial Protection Bureau can request funds from the Federal Reserve to 6.5% of the Federal Reserve's operating budget after its opening bid of 0% was rejected by the Senate parliamentarian.

June 27 -

The Department of Justice is seeking to terminate a Biden-era lending discrimination settlement with Lakeland Bank. Last month, the DOJ took similar action in a case involving Mississippi-based Trustmark National Bank.

June 2 -

From reduced demand for auto loans to a slowdown in mergers and acquisitions, here's some of the new trade war's potential fallout for lenders.

April 7 -

The law would have expanded the state's 12% interest rate cap in a manner that would have effectively banned fintech lending in the state.

March 25 -

As a market leader, Rocket Companies rebranding comes in the foreground of several court battles and fluctuating earnings performance.

February 10 -

The Alabama-based regional bank reported stronger earnings on a bump in capital markets fee revenue and lower expenses, but its total loans declined and its charge-offs increased. It expects only modest loan growth this year.

January 17 -

The post-pandemic increase in consumers falling behind on their credit card bills seems to be tapering off. "For 2025, we're seeing a lot of stability in delinquencies," an industry researcher said.

December 13 -

California's Department of Financial Protection and Innovation is requiring registration by mid-February of debt settlement firms, earned wage access providers, private secondary education financing and student debt relief services.

October 24