Redwood Trust is adding to its single-family rental lending business by purchasing CoreVest American Finance Lender from its management team and affiliates of Fortress Investment Group.

Redwood will pay approximately $492 million in cash and stock; the shares will be payable to the CoreVest executive management team and vest over a two-year period.

The assets purchased include securities collateralized by single-family rental loans and business purpose residential loans to real estate investors, including residential bridge loans and SFR loans.

"CoreVest is a best-in-class operator in the business-purpose lending sector, an area of residential lending that increases liquidity in the housing market by enabling investors to efficiently finance purchases of both single-family and multifamily investment properties," said Redwood CEO Christopher Abate in a press release.

"Additionally, CoreVest is the standard-bearer for BPL securitizations, having completed more such transactions than any other issuer. Integrating the CoreVest operations and suite of products with our own market-leading consumer mortgage banking and securitization platform will create the preeminent specialty finance operator in our industry."

Fortress

Redwood deepened its presence in the SFR business, first in April 2018 by taking

"We're poised to enter a new phase of growth by leveraging Redwood's significant, permanent capital base and deep residential credit expertise," CoreVest CEO Beth O'Brien said in a press release. "Our clients will continue to experience our high level of service, but with an even greater commitment to delivering customized funding solutions at highly competitive rates."

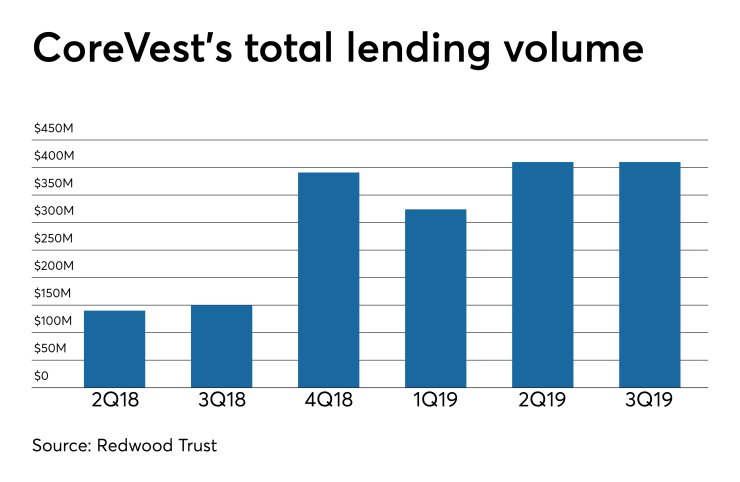

Since inception, CoreVest funded a total of over $4 billion in loans, with $1.2 billion of that total coming over the past four quarters. In the third quarter of 2018, CoreVest acquired Black Square's bridge and construction lending business.