-

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

February 4 -

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

February 3 -

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

February 2 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29 -

The moderate leverage reflects the quality of RMBS pools from recent issuance years. Borrowers have a non-zero WA annual income of $1 million, with liquid reserves of $594,348.

January 23 -

The notes are expected to pay coupons of 4.94% on notes in the A1FCF tranche, rated AAA from KBRA and Fitch Ratings, to 6.78% on the B1 notes.

January 16 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

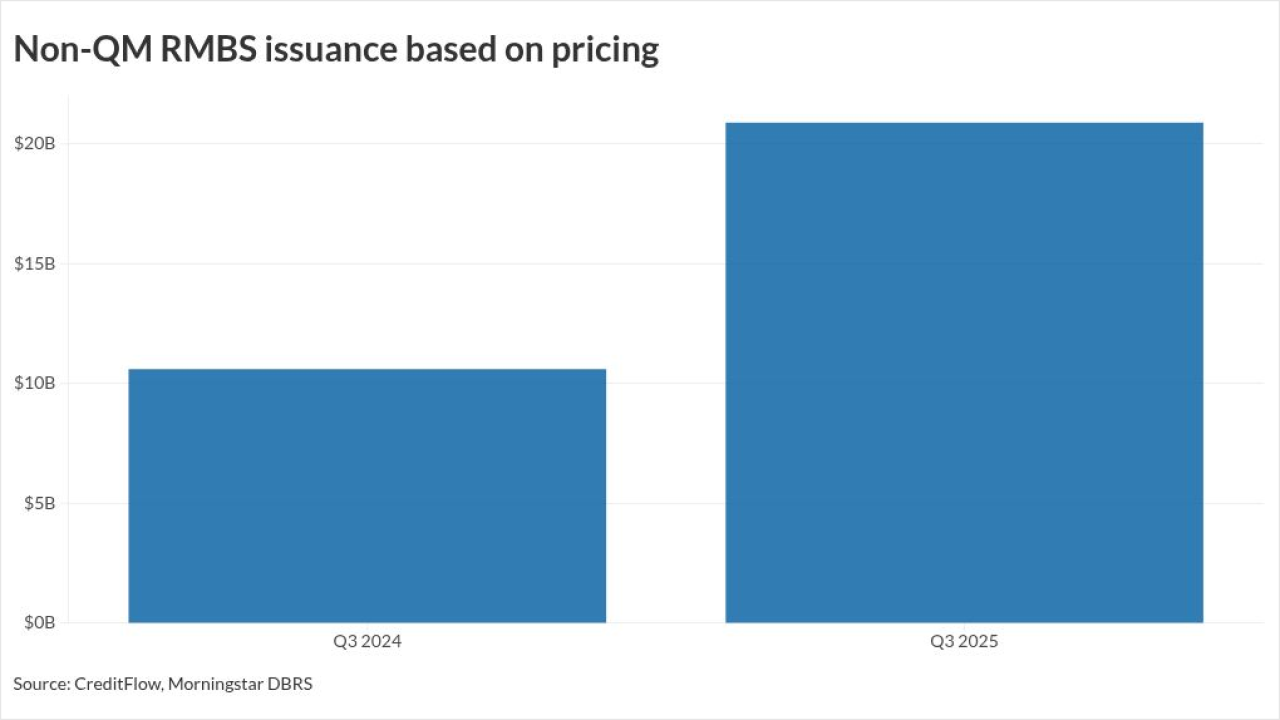

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

Second-lien mortgages make up the collateral pool. Those assets normally have a high expected loss severity, but the borrowers appear to be of prime credit quality.

November 11