Servicers are in a bind.

While origination is finally getting a break from costly, wide-ranging operational changes, more lie ahead for servicing.

Fannie Mae and Freddie Mac are both planning investor reporting overhauls, consumer regulations continue to change for servicers, and a long run of low rates has constrained the value of servicing rights and revenues.

Automating processes could, in theory, help. But the sophistication of mortgage automation has lagged other industries and the hurdles to technological advances are particularly high for servicers, whose work is viewed as disconnected from mortgage revenue.

"On the origination side, a bad consumer experience or perceived bad consumer experience can drive business away because a consumer has a choice," said Karl Falk, CEO of servicing technology company ShortSave. "On the servicing side, the consumer does not have a choice. They can't pick and choose their servicer even if the loan or its servicing is sold numerous times. So I think the necessity has never really been there to provide many technological innovations."

The Consumer Financial Protection Bureau's growing oversight of servicing has changed that by making investment in technology for handling borrower-facing workflows a necessary compliance cost.

Despite this, the CFPB has found that automated compliance has come up short in some servicer examinations.

"There were significant technology issues that were found across the board at a number of different institutions, and it points at a problem that's been there for quite some time," said Alanna McCargo, co-director of the Urban Institute Housing Finance Policy Center and a former senior director of servicing at Fannie Mae. "The cost of servicing has continued to rise for performing and nonperforming loans, and the technology investments needed to automate and improve the servicing process and servicing transfers haven't been a priority."

"The good news is there is an opportunity now for fintech innovators," said McCargo.

Fintech via Regtech

The volume of higher-cost distressed servicing is down from its Great Recession peak. However, servicing costs across the board remain high by historically standards, largely due to extensive compliance requirements that have been implemented by the CFPB and other regulators. As a result, virtually all of the technological advances that have come to the servicing industry over the past few years have focused on reworking processes to meet regulatory requirements.

"Servicing wants innovation that doesn't come with risk," said Chris Saitta, the founder and former CEO of servicing technology firm Equator, and current chairman at secondary market platform Resitrader.

And that is exactly what the CFPB has been driving servicers toward by warning them earlier this year that they

"Outdated and deficient servicing technology continues to pose considerable risk to consumers in the wider servicing market," the CFPB wrote in a June bulletin of supervisory highlights.

Specifically, the automated processes that the CFPB find fall short are systems designed to handle transfers and loss mitigation. Rules require transfers to take place in a timely manner without delaying or interrupting loss mitigation, but the bureau has found such delays and interruptions still occur.

Part of the problem lies in how workflows are managed rather than technology itself, but the CFPB has also found there have been shortcomings in the automation, too.

"None of these problems is insurmountable, however, with the proper focus on making necessary improvements, especially in the information technology systems necessary for effective implementation," the CFPB wrote.

In other words, servicers and their vendors need to

"I think now is a good time for servicers and vendors to be thinking about investing in a fulsome strategy around the future," said McCargo. "You've got to invest in technology or you're going to continue to have a lot of operational burdens."

Legacy System Hurdles

In the origination side of the industry, lenders have their choice of more than a dozen providers for their core loan origination systems. But in servicing, the market for core system of record platforms is

Legacy systems are updateable, but updates can take time depending on the breadth of the technology, and often the updates have to be layered on top of the pre-existing functionality.

"There are certainly issues with underlying servicing technology," said Craig Focardi, a principal executive advisor in retail banking at consultancy CEB TowerGroup.

Core servicing systems of record were built long before modification and other loss mitigation efforts that the CFPB now regulates became widespread in the wake of the Great Recession, so the technology wasn't originally set up to accommodate the data that servicers have had to use in those workflows.

As a result, loss mitigation automation had to be built separately and interface with core systems leading to more complex exchanges of data in transfers.

Developers also were slow to build loss mitigation systems during the downturn because servicers were at first more interested in staffing up to reactively handle the flood of distressed loans than proactively automating.

Mortgage servicers and their technology vendors have since taken steps to modernize their own or other legacy systems by doing things like buying or building a middleware integration layer between the core system and the customer-facing automation they use. That approach is often easier to implement than updating their original technology.

"The servicers we are working with are hungry for solutions, but they have a system that they can't migrate away from quickly, easily or readily," said Ruth Lee, executive vice president at Titan Lenders Corp., a subsidiary of compliance and quality control firm MetaSource.

Dominant technology provider Black Knight, for example, will only assist with inbound servicing transfers to its system.

Black Knight and Fiserv said their systems have supported compliance but there has been room for improvements, which they have been making over time.

"We're conscious of the challenges servicers face and our current systems fill that need," said Fiserv product manager John Park. "We're making enhancements to our current tools to make that a more efficient and better process."

Fiserv has been working on an improved product that it said should help with the compliance challenges that the CFPB has identified in servicing transfers and loss mitigation, he said.

Black Knight had technology available to support transfers when the original round of CFPB servicing rules went into effect in 2013, and about a year and a half ago made improved automation available.

More recently, it has released technology aimed at improving loss mitigation execution and record keeping.

"There's a lot of functionality we've built," said George FitzGerald, an executive vice president in servicing and default technology management at Black Knight.

As the industry gets a better grasp of the nuances of new regulations, vendors are able to improve upon their initial products they roll out to address certain needs. But the initial implementations of new technology are often more challenging because of the tight timelines servicers have to comply.

"I think the CFPB can be a little bit unrealistic," about the work and timelines involved in updating systems to accommodate new rules, said Mario Duckett, senior vice president of enterprise content solutions at MetaSource, a middleware provider for servicers and other industries, like health care.

The bureau clearly has considered, and even goes into detail, about vendor costs in its recently released final rule outlining new foreclosure protections servicers must comply with in the next 12-18 months.

The new foreclosure protections will ensure that even as distressed loan volumes dwindle, there will need to be more innovation when it comes to automated workflows in servicers' compliance-sensitive loss mitigation functions as well as transfers.

Lost in Translation

Workflows in servicing transfers are a particular challenge.

Even when two servicers use the same system of record vendor and handle similar types of loans, there is data mapping work that must be done when servicing rights change hands, said Sue Johnson, a vice president responsible for performing servicing applications at Ditech.

"We still need to have a mapping session to validate and ensure that the sellers' information is being interpreted correctly for conversion into the buyer's system. Over time that's evolved, but it's certainly not a 'push the button'" procedure, said Johnson.

In most cases, servicers have their documents imaged and there are differences in how they organized those images as well as which imaging system they use, said Johnson.

"They may index them differently or bundle them differently," she said.

Only repeat transfers with a well-known and consistent counterparty become simple over time, said Johnson.

As the challenges with transfers illustrate, data standards could help servicers, but it's something the dynamic nature of rules and reporting in the business have made tough to obtain.

"The biggest thing, if you could wave your magic wand, would be to have standardized data," said Saitta.

Standardization is challenging not only because of CFPB regulations, but because Fannie Mae and Freddie Mac have new investor reporting requirements that will be changing in the next couple years in conjunction with the creation of their common securitization platform.

Data standards in servicing are "not a simple task because the roadmap isn't certain," said Mark Landschulz, executive vice president and director of performing servicing at Flagstar Bank.

While the government-sponsored enterprises have taken pains to minimize disruption to lenders and servicers, the investor reporting has clear implications for the industry.

The Fannie Mae change slated for early next year, for example, involves a temporary post-delivery transfer moratorium between Feb. 1 and March 31 of next year.

"It will have an impact on the amount of FNMA servicing traded in the fourth quarter, as sellers and buyers prefer to have a short interim servicing period," Matt Maurer, managing director at broker MountainView Servicing Group, said in an email.

There are longer-term implications for servicing data fields as well.

Vendors like Black Knight are aware of Fannie and Freddie's reporting changes and have been discussing how to prepare for the transition with servicers like Flagstar. Fannie's changes are slated for this year, and Freddie's are scheduled for 2018.

Moving Beyond Compliance

The recent declines in delinquent and defaulted loans should have given servicers and their vendors some breathing room to focus on innovations that would revitalize and reshape the industry. But the ongoing changes to GSE and regulatory requirements have consumed the excess bandwidth, particularly for smaller servicers.

Still, organizations with the right resources and mindset have the opportunity to differentiate themselves through technology.

"Every organization is different," said Landschulz. "We're consistently investing in new technologies."

This will be particularly important for subservicers that are increasingly taking mounting operational challenges off servicers' hands.

But right now, servicers are still playing catch-up when it comes to their technology.

"There is a desire to make servicing consumer experiences more like those in other digital aspects of their lives," said Park. "If they bought something on Amazon, that's a fulfillment standard people have in their heads. That's starting to come over in the servicing world as well."

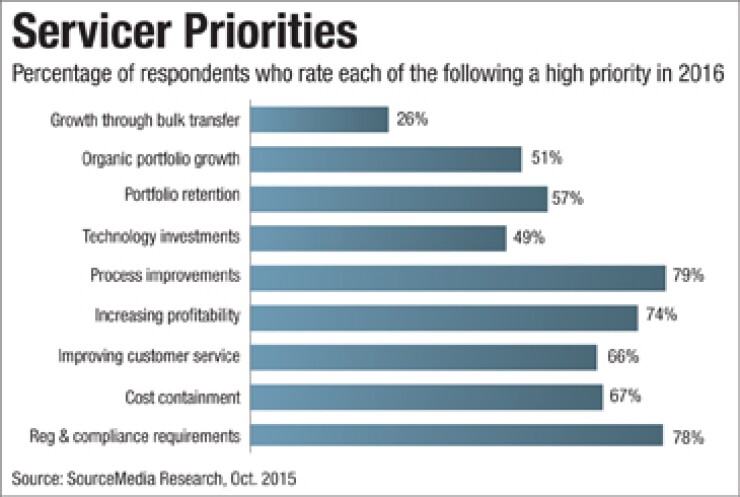

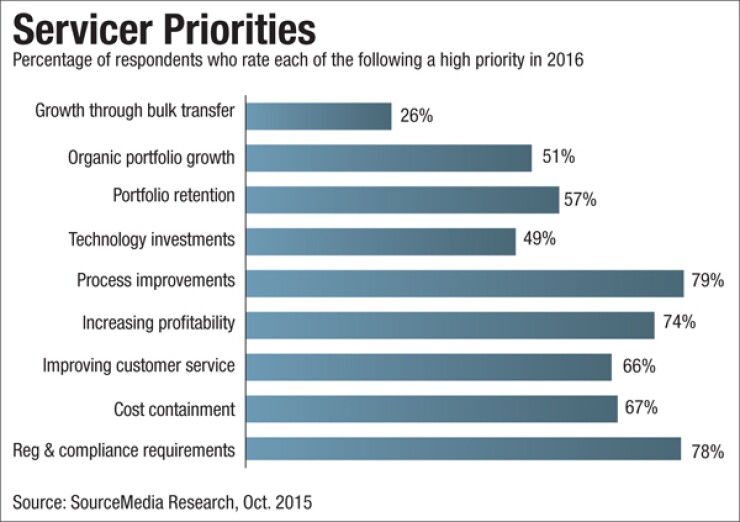

That approach is a departure from the longtime industry status quo that doesn't consider servicing as a transactional experience for consumers. Part of that shift in attitude is due to the long run of low mortgage rates that's making portfolio runoff prevention a new priority for servicers.

At the same time, CFPB rules are requiring more borrower outreach — giving servicers more than one reason to rethink what they can do to improve the customer experience.

Servicers have started to follow lenders' leads when it comes to communicating with borrowers through a range of automated channels with more user-friendly, low-cost interfaces, like interactive voice response, mobile and online.

"The servicers are following the lenders from a technology point of view," said Pramod Karachur, a project manager at vendor IndiSoft, a servicing technology vendor and developer behind the Hope LoanPort platform used by housing counselors, servicers and borrowers to manage loss mitigation.

Servicing technology has made some progress, but it could go further.

"A lot has been done," said Focardi. "Challenges that remain are that the data is not always real time, so checking status on a mobile device or by the contact center agent may be a day behind."

Mortgage servicers should realize that innovations in technology aren't just a drain on their bottom lines, but could actually improve them.

While servicers and vendors still have trouble seeing beyond their budgets, they're at least more open to considering investments in innovations beyond compliance requirements than they were a few years ago.

"There are a lot of efficiencies that can be built into a system that might make the cost of servicing less," said McCargo.

"That's where I think technology could really be helpful, and that's where the forward-looking organizations are going to be able to make those investments. They will have better a servicing business and revenue model."

Still, it won't be easy. "We're starting to hear more discussions along those lines, even though servicers are in a tough position," said Park. "They are expected to give an A-level service, but at C-level costs."