-

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

Facebook and other social media platforms are a powerful way to connect members and loan officers, but lenders must ensure they first have a culture of compliance.

March 13 Gremlin Social

Gremlin Social -

A newer set of issues and opportunities presents itself for those embracing technology, involving everything from business strategy to cybersecurity.

March 22 -

When Redtail Technology moved into its new building 18 months ago, CEO Brian McLaughlin ensured it had homey touches, like comfortable seating, a basketball court and slides.

February 24 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

Fiserv Lending Solutions' rebrand to Sagent Lending Technologies reflects the company's focus on a more efficient process for mortgage and consumer lenders.

September 20 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

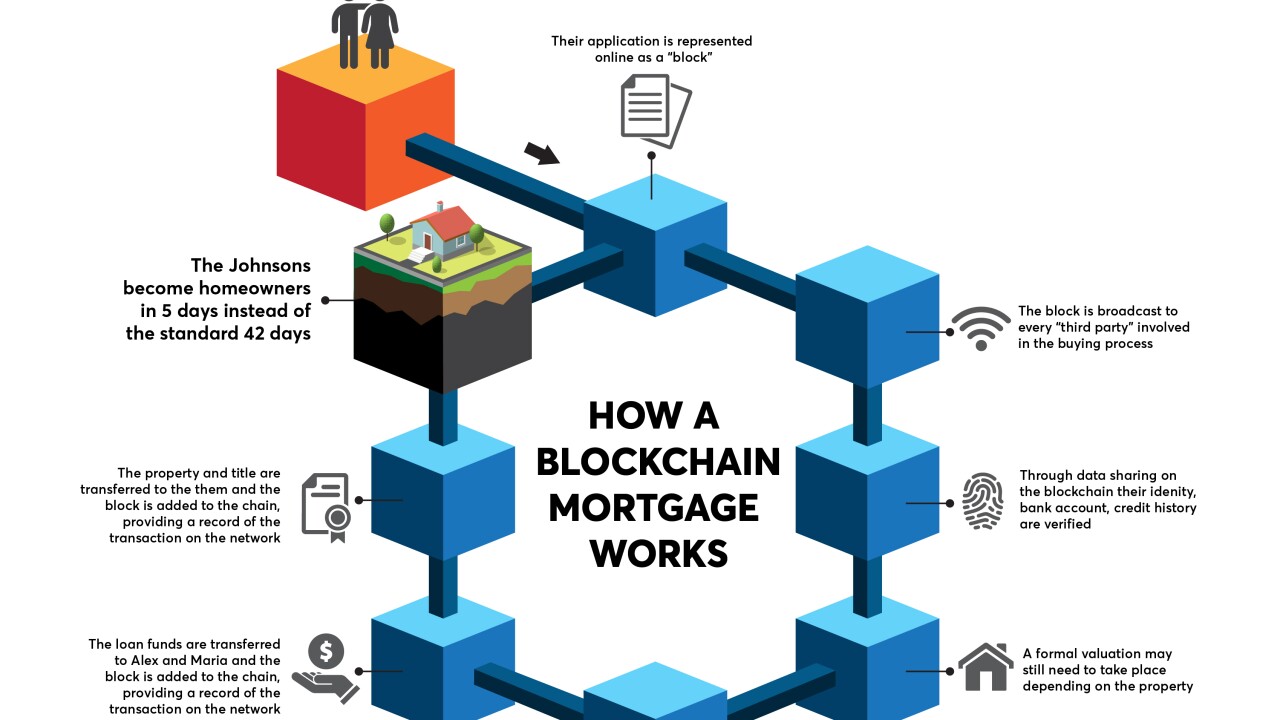

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

QuestSoft is buying data verification and audit services firm Investors Mortgage Asset Recovery Co. at a time when lenders are more widely using technology to verify information.

February 1 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

Optimal Blue, a mortgage technology provider owned by private equity firm GTCR, has acquired Comergence Compliance Monitoring.

May 31 -

All post-closing reviews of new Federal Housing Administration-insured mortgages must now use the defect taxonomy, effective immediately.

May 16 -

Accenture acquired BeesPath's ClosingBridge product to become part of its Mortgage Cadence loan origination software and help lenders with TILA-RESPA integrated disclosure compliance.

April 13 -

American Mortgage Consultants has acquired a business unit that handles due diligence and quality control for residential mortgages from Stewart Lender Services.

January 10 -

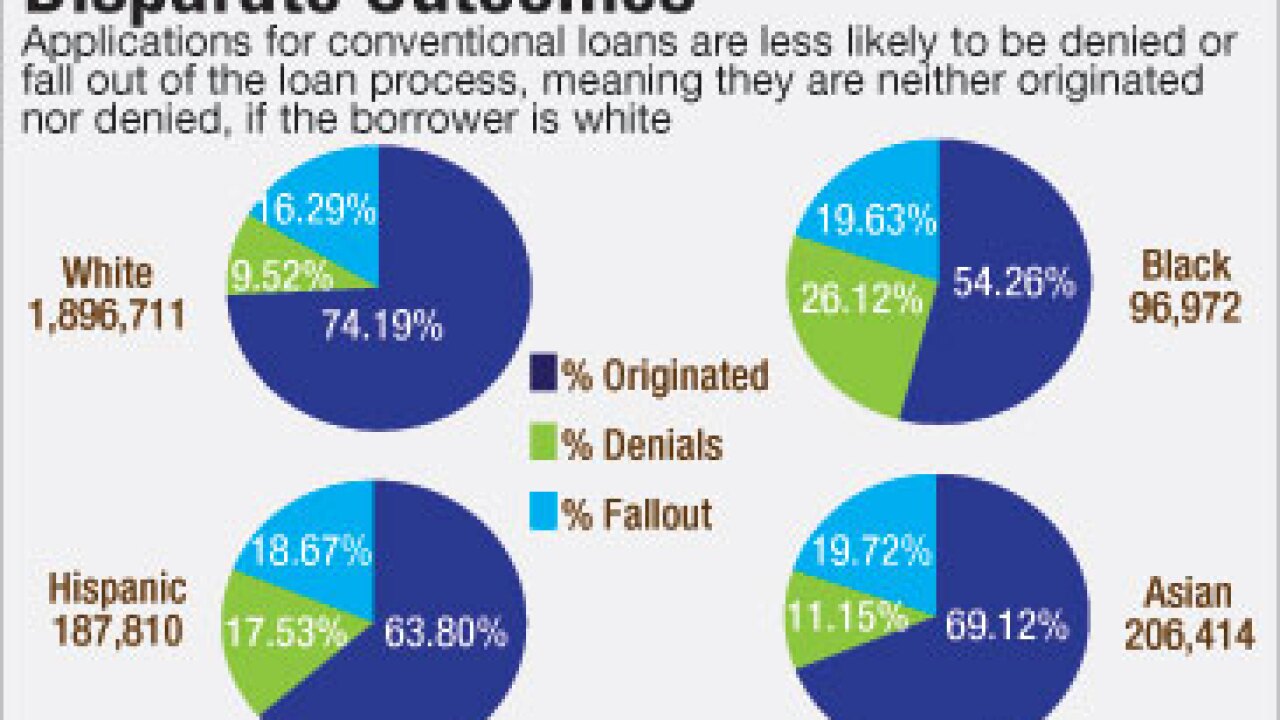

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29