Stop complaining, and start doing something about it.

That is the mantra of more and more mortgage servicers worried about the long-term harm to their business from rising compliance costs.

Executives are more actively discussing with regulators how rules might be streamlined while simultaneously experimenting with automation or economies of scale that could raise their productivity.

"Servicers are coping with all the increased pressures on costs," said Kevin Brungardt, the chairman and chief executive of RoundPoint Mortgage Servicing in Charlotte, N.C.

Regulators have a tremendous hand in determining servicers' costs, J. David Motley, vice chairman of the Mortgage Bankers Association, told attendees Wednesday at the group's servicing conference in Orlando, Fla.

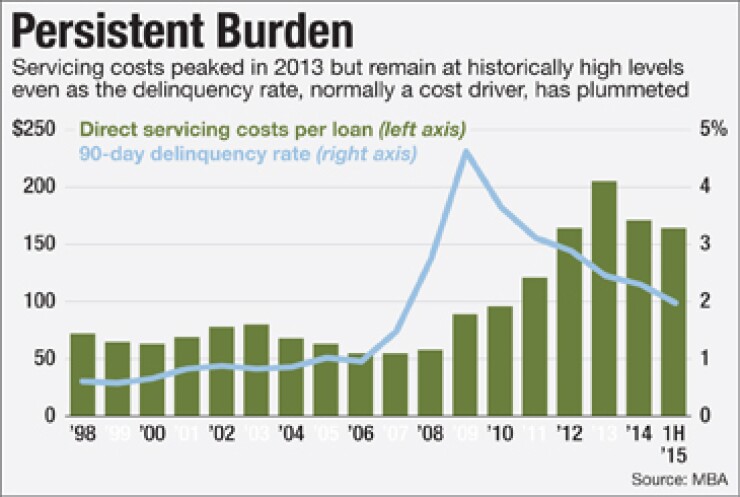

Motley, the vice chairman and president of Colonial Savings in Fort Worth, Texas, said he has seen his company's per-loan servicing costs rise to $195 recently from $130 in 2012 despite the fact that the delinquency rate — typically a big factor in driving up costs — has fallen to 3% from 4% during that same time period. He blamed the jump in expenses on increased spending to satisfy new government rules.

Servicing executives have been seeking fixes in existing regulations and getting more involved in the shaping of future rules and policies.

Some efforts are reactive, such as attempts to better understand how to work within the Federal Communications Commission's new limits on robo-calls.

Banks and other businesses may not place robo-calls to a cellphone without the consumer's prior consent. Violations are subject to strict liability — $500 for each unsolicited call, or $1,500 if the company intentionally makes a call after the cellphone user denies permission. Callers are liable even if they have the permission of the person they are trying to reach but the phone number has been reassigned to another individual. There are some exceptions, such as in cases to collect on government-backed debt.

The rules complicate servicers' jobs, but it is not impossible to get the consent of borrowers in order to stay in touch with them, said Barry Hays, senior vice president and co-founder of interactive voice response vendor TeleVoice.

"Servicers, through all of their communication channels, find creative ways to check for and solicit consent," said Hays.

Other efforts to minimize regulatory risks are more proactive. Some Quicken Loans executives at the conference, for example, were wearing "One Mod" T-shirts to call attention to efforts to develop a standard for the loan-modification process.

The standardization push stems from recent meetings involving the mortgage industry, government agencies and other players about how mod policy should be shaped after the Home Affordable Modification Program ends, said Mike Malloy, the vice president of servicing at Detroit-based Quicken Loans.

Standardized mod features could include simpler documentation and payment reductions policies that could make the process more equitable across the country, Malloy said.

Government agencies have been considering the notion but do not appear to be committed to it. Malloy described the effort as a work in progress.

Allison Brown, program manager in mortgage servicing at the office of supervision policy at the Consumer Financial Protection Bureau, said her agency's needs are different from, say, Fannie Mae's and Freddie Mac's when it comes to the question of what they would want to see in any modification program. Fannie and Freddie might want mods that fit in with their secondary-market programs, but the CFPB is more interested in making existing modifications clear and consistent and holding lenders accountable for their practices.

Since the government's HAMP program has been extended and the worst of the housing crisis has passed, some servicers at the conference questioned whether a successor is necessary. However, most agreed it is worth exploring whether mod standardization can, will or should occur.

"Can we standardize that economic decision? I don't know," said Ed Fay, founder and CEO of Fay Servicing in Chicago.

Being more actively involved in discussions of possible future government policy instead of just focusing on current rules could help give the industry more control over its servicing costs, Motley said.

"We can decide to dwell on the past, or we can learn from it," he said.