Investors who want the troubled Ocwen Financial to stop servicing their mortgage-backed securities should think again.

That is the surprising conclusion of a new Morgan Stanley report, which argues that Ocwen has some redeeming qualities hidden beneath all the regulatory, consumer and investor complaints about how it does business.

Statistically Ocwen's servicing of its legacy residential mortgage-backed securities stacks up well against the performance of its rivals, and Ocwen is more aggressive when it comes to savings borrowers' homes, the report said.

"It doesn't appear in investors' best interest to replace Ocwen as servicer," Morgan Stanley researchers conclude in their report.

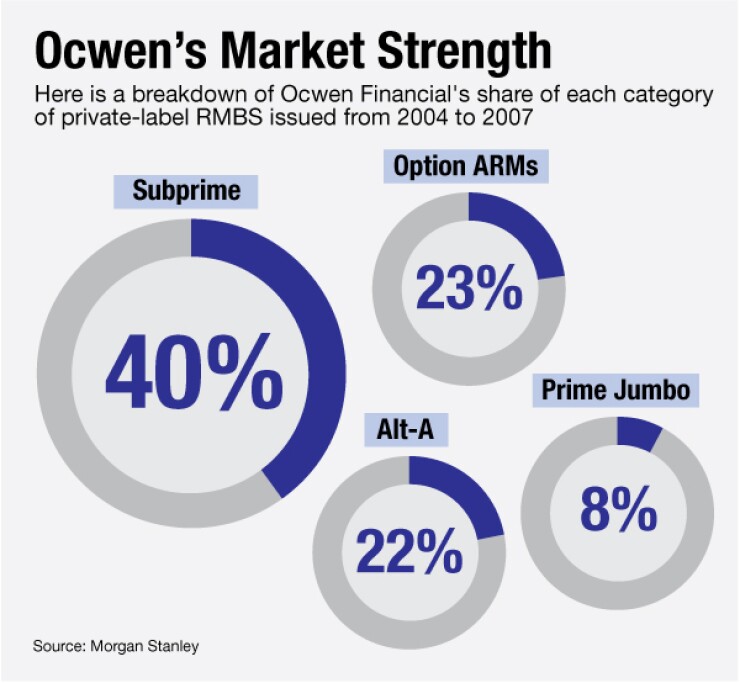

Much has been made of how tough it would be to dismantle Ocwen given its market share and of the difficulty in finding others to take over its responsibilities. Ocwen services more than 25% of the nonagency RMBS market, including 40% of the subprime subset of the market.

Transfers are disruptive, the report noted. "It also is not outside the realm of possibilities that a new servicer would require a higher servicing fee to step into Ocwen's shoes, a development that would decrease a deal's excess interest each month," it said.

"The further down the credit-quality spectrum you go, the more you need to concern yourself with the details," when it comes to the question of whether keeping legacy RMBS servicing with Ocwen is desirable, the report noted.

Transferring to another nonbank servicer really would not make much of a difference, at least at this point, in the handling of advances, the report said.

"Since the beginning of 2014, Ocwen's advance rate on its delinquent mortgages has been close to market average," the report said. Its advance rate has fallen "well short" of bank servicers', but bank servicers are extremely unlikely to want to have anything to do with Ocwen's servicing. Also the more distressed collateral typically handled by nonbanks likely accounts for the difference.

Modifications are a different story. Ocwen's modification rate is similar to its peers, but "the characteristics of modifications appear substantially different," the report said.

One might think given allegations that Ocwen has neglected borrowers that this would reflect a higher eviction rate, but the opposite is actually true, the report said.

"Since the beginning of 2011, [Ocwen was] more likely to perform a principal modification, and from 2011 through 2014, [Ocwen was] far more likely to cut a borrower's monthly [principal and interest] payment by 50% or more," the report said. "This modification style does appear to have been effective in keeping borrowers in their homes."

Such relief may or may not be advantageous to legacy RMBS investors depending on where they sit in the capital stack, and they would generally want pretty strong justification for deep principal cuts. Still, the collateral involved is probably highly distressed, and the actions may have been the best economic option.