Want unlimited access to top ideas and insights?

It used to be very easy to qualify for Property Assessed Clean Energy financing in California, and that made it a popular option with many contractors pitching energy and water efficiency upgrades. PACE creates a lien that is repaid via a homeowner’s property taxes, and until recently, it was not subject to the same kinds of consumer protections as a mortgage; the primary requirement was having enough equity in your property. A homeowner looking to replace windows or an HVAC system or install solar panels could be approved for financing within a few minutes.

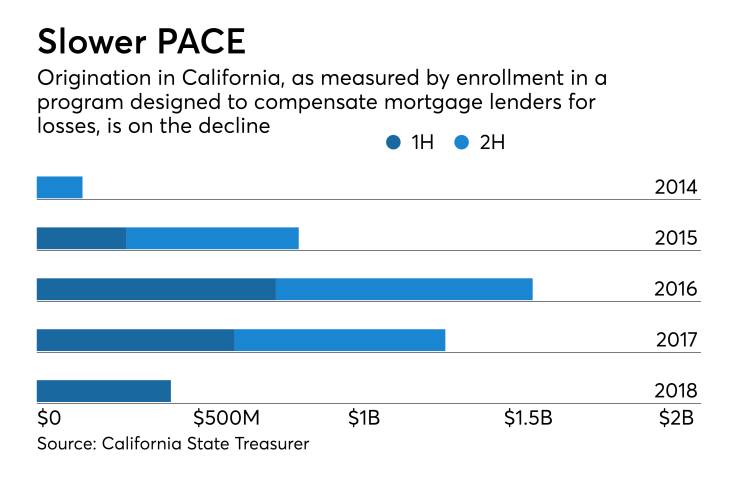

Between January 2014 and June 2018, over $3 billion of efficiency upgrades were financed with PACE, according to data from the California State Treasurer.

Not everyone with equity in their homes can afford to pay thousands of dollars a year in additional property taxes, however. After several years of criticism from consumer advocates that contractors misrepresented how the financing works, legislation was passed late in 2017 establishing new underwriting guidelines for PACE that include income verification and ability-to-pay standards.

Since the rules took effect in April 2018, origination has fallen sharply. In the first half of last year (the latest data available from the California State Treasurer), new financing was $430.4 million, less than two-thirds of the $677.9 million financed in the second half of 2017.

PACE administrators say contractors are now much less likely to suggest this form of financing unless a homeowner is unable to qualify for any other kind of financing, such as a home equity loan or unsecured loan.

“It’s become more of a second-look product,” said James Vergara, managing director of capital markets at PACEFunding.

Vergara attributes this to the additional time now required to underwrite PACE. “In general, before we could just approve a borrower in five to 15 minutes; now we have to collect income documentation, we have to have an underwriter verify that the documentation matches the borrower’s stated income, run a [payment] waterfall and come up with an [assessment of] ability to pay and have it work,” he said.

PACEFunding is a relative newcomer in California, so it hasn’t had to make as many changes to its underwriting process as some bigger competitors; the lender’s origination volume has actually been rising, albeit from a low level. “The way we’ve grown our volume over the past year is by investing in headcount and staffing up,” Vergara said. “We have more people involved in the underwriting process and confirmation process. We’ve also invested in technology to help streamline the income-verification process.”

Other PACE administrators are also adapting, to a point. "Software and data solutions can only help so much, given the extremely high level of documentation requirements and our inability to fully utilize existing technology tools — we are limited in this area," Ygrene Energy Fund said in a statement provided to Asset Securitization Report. In addition to the underwriting and documentation requirement's the PACE administrator cited the additional contractor requirements imposed by the new regulations, which it said "far exceed what is already in place for other financing options that homeowners have."

"The new regulations have definitely hampered our ability to provide homeowners with the fast, efficient, and accurate customer service that they have come to expect," Ygrene said in the statement.

Not only is overall PACE origination volume down sharply, however; there also appears to be some adverse selection. Since borrowers with better credit are less likely to get pitched on PACE, the credit quality of the pool of applicants has declined.

In a statement provided to Asset Securitization Report, Renovate America, the biggest PACE administrator in California, said that the state’s underwriting criteria are in many cases less flexible than those of the Federal Housing Administration and, to some extent, Fannie Mae. For example, borrowers who made a single late payment on a mortgage in the past 12 months are now ineligible. Borrowers are also excluded for two years after exiting bankruptcy; and if they make a single late payment in those initial two years, they can be excluded from taking out PACE financing for up to seven years.

“These underwriting criteria are arbitrarily removing homeowners who might otherwise pass the income verification screen,” Greg Frost, a spokesman for Renovate America, said in the statement.

“At a time when Californians have seen electricity prices rise three times faster than in the rest of the country, when the bankruptcy of PG&E threatens to raise electricity prices further, and as the need to reduce climate-changing emissions becomes greater by the day, the disabling of PACE carries negative economic and environmental consequences for this state,” Frost said.

In the first few months after the income verification component of the law took effect, Renovate America saw a decline in the share of applications from consumers with FICOs of 661 and higher, and an increase in the share of applications from homeowners with FICOs of 660 or less.

Frost said this negative credit migration in the profile of applications suggests that home improvement contractors are not leading with PACE in higher credit profile homes because they know the customer does not want to go through the required “hassle factor” when other options are available.

Still too soon to see any impact on performance of PACE ABS

Both the decline in origination volume and the potential for adverse selection are a concern on Wall Street, where PACE liens are bundled into collateral for bonds that can be marketed as “green.” Residential PACE securitization volume fell from $1.5 billion via seven deals in 2017 to $693 million via three deals in 2018, according to Finsight. Issuance is expected to be around the same level this year, with some of the volume potentially coming from first-time issuers.

While the overall credit quality of applicants may be declining, rating agencies say this is not showing up in pools of PACE liens that have been securitized, at least not yet.

“If businesses are indeed under pressure because of reduced volume due to cumbersome consumer protection laws, the fear of adverse selection is understandable," said Rohit Bharill, head of ABS at Morningstar Credit Ratings, which has been rating PACE securitization since 2016. "However we have yet to observe any trends to be able to comment on them,” Rohit said.

“We are keenly focused on it, but we have not seen any change in origination characteristics” in PACE financing originated in California, said Irene Eddy, the lead PACE analyst at DBRS, which has been rating deals in this sector since 2015.

Eddy said it would be too soon to see any change in performance, since most homeowners who obtained PACE financing in California after the consumer protection laws took effect have yet to make their first payment.

In February of 2018, DBRS published a report evaluating the performance of PACE financing for the 2013-14 through the 2016-17 tax years in the 10 California counties that have the highest number of liens. It found that the delinquency rate peaked at a range of 2% to 4% one month after the first installment payment was considered past due, and then fell to under 1% within 12 months. In month 22, PACE delinquencies were at “an exceptionally low” level ranging from 23 basis points to 27 basis points, DBRS said.

Eddy noted that, over the past year, there has been a shift in the mix of collateral from issuers Renovate America, Renew Financial and Ygrene Energy Fund to include more financing from Florida and Missouri, the two other states with active residential PACE programs.

However, PACE origination has yet to reach a level in either Florida or Missouri that could offset the decline in California. And lawmakers in Missouri have introduced two bills that would centralize oversight with the state’s Division of Finance, among other changes, potentially impacting activity in the state.

Consumer advocates question how much the decline in origination volume in California is attributable to the state’s consumer protection laws, since the drop began before the new rules took effect.

Origination peaked at $824.4 million in the second half of 2016, according to the state treasurer’s office. So the decline started in 2017.

They note that some fintech lenders, such as GreenSky, have arrangements with contractors for point-of-sale financing similar to those of PACE administrators

Consumer advocates say current regulations may not be adequate

Consumer advocates are also unhappy with the new regulation, though for different reasons. “Our experience is that the new laws have not as yet translated to a decline in complaints about the PACE program,” said Jennifer Sperling, an attorney at law firm Bet Tzedek. “Because of the delay between funding and recording of a PACE lien onto the property, clients whose transactions funded after July 1, 2018 will not see their first property tax increase until they receive their 2019-2010 property tax bill in October 2019. For that reason, it is too soon to tell whether the new laws intended to protect consumers are adequate to fully do so.”

Sperling added, “For the clients we have encountered who entered into transactions after April 2018, we are still investigating, but it is not clear if all of the new requirements are being followed.”

In January 2018 comment letter, Bet Tzedek and eight other legal services organizations said that the laws do not go far enough to protect consumers. Among other shortcomings, contractors are only obliged to make a “reasonable estimation” of a consumer’s ability to meet “basic household living expenses,” and that estimation can make based on number of people living in the house. The signatories believes that contractors should be required to inquire about caretaking, medical expenses and debt.

“The ‘finance first, evaluate later’ business model implied [in the new law] is unlikely to prevent extension of credit to homeowners with inadequate ability to repay,” the letter states.

Among other areas ripe for rulemaking, the signatories said, are tracking of price data for PACE-eligible products and services.

With both PACE officials and consumer advocates pushing for changes, it remains to be seen whether this form of financing will regain its former appeal with either contractors or homeowners. If nothing else, lenders are hopeful that the expansion of eligible upgrades to include weather resiliency will help. The same legislation gave communities in high fire zones the ability to use PACE to finance wildfire safety improvements

“I hope that the market recovers to the heights we saw in 2016 or 2017,” Vergara said. “It should be safer product for folks who really need it, who can’t access unsecured loans. So it’s funding improvements that wouldn’t get installed otherwise. From an impact standpoint, that accomplishes what it was set out to accomplish.”