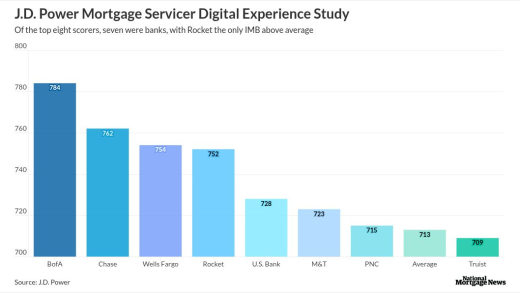

Bank of America was the leader in this study, with Rocket as the only nonbank mortgage lender which got a score higher than the industry average.

The accusations could have broader implications for secondary market supervision as technology potential improves the speed at which detection can occur.

Rep. Maxine Waters, D-Calif., the Committee on Financial Services' ranking member and other members of her party plan to confront HUD Secretary Scott Turner.

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

-

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

-

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

-

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

-

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

-

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

-

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

The proposals offer lenders both cause for celebration and for concern.

-

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

-

This proposed Libor replacement is an imaginary, backward-looking benchmark dreamed up by the economists at the Fed with no discernible market.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Tavant Technologies

- Sponsor Content from Equifax

- Partner Insights from Tavant Technologies

- Partner Insights from Capsilon