Fraud

Fraud

-

Fraudsters and modestly dishonest employees can use generative AI to quickly create convincing fake utility bills, pay stubs, passports and other documents banks rely on.

February 5 -

Jonathan Yasko pleaded guilty to diverting monies in real estate transactions to cover unrelated closings, and to pay for his own cars and personal travel.

February 3 -

The ex-employee was accused of violating conflict of interest rules and submitting falsified documents for $1.7 million worth of loans in her six-month tenure.

January 19 -

The industry vendor SitusAMC has not publicly disclosed how many consumers, nor how many banks and lenders, were impacted in a cyberattack last fall.

January 16 -

The lender claims the ransomware gang behind a breach provided proof it deleted compromised customer information, and it hasn't appeared on the dark web since.

January 15 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

On Thursday, prosecutors unsuccessfully tried again to ask a grand jury in a different Virginia court to return an indictment.

December 11 -

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

A former employee cited a ransomware gang's claim in October that it stole 20 terabytes of sensitive customer information from the industry vendor.

December 10 -

An attorney for Christopher J. Gallo, who is battling 18 federal charges, said the lender's 18-month delay in pursuing the sign-on bonus makes little sense.

December 9 -

Federal Housing Finance Agency Director Bill Pulte should be called to testify before lawmakers no later than the end of January, the Democratic members of the Senate Banking Committee wrote in a letter Friday to Republican Chairman Tim Scott.

December 5 -

The Troy, Michigan-based lender and servicer faces at least seven lawsuits over a hack in June allegedly perpetrated by a known ransomware gang.

December 2 -

The NPLA Watchlist helps lenders, brokers and service providers spot borrowers who may pose added risk.

December 2 -

Swalwell alleges Pulte obtained and used the lawmaker's personal mortgage records in violation of US privacy laws and constitutional protections for political expression.

November 25 -

The Justice Department subpoenaed a key witness in the case, questioning the conduct of Bill Pulte and Ed Martin.

November 25 -

A federal judge threw out the criminal charges against former FBI Director James Comey and New York Attorney General Letitia James, ruling that the prosecutor who brought the cases had been illegally appointed.

November 24 -

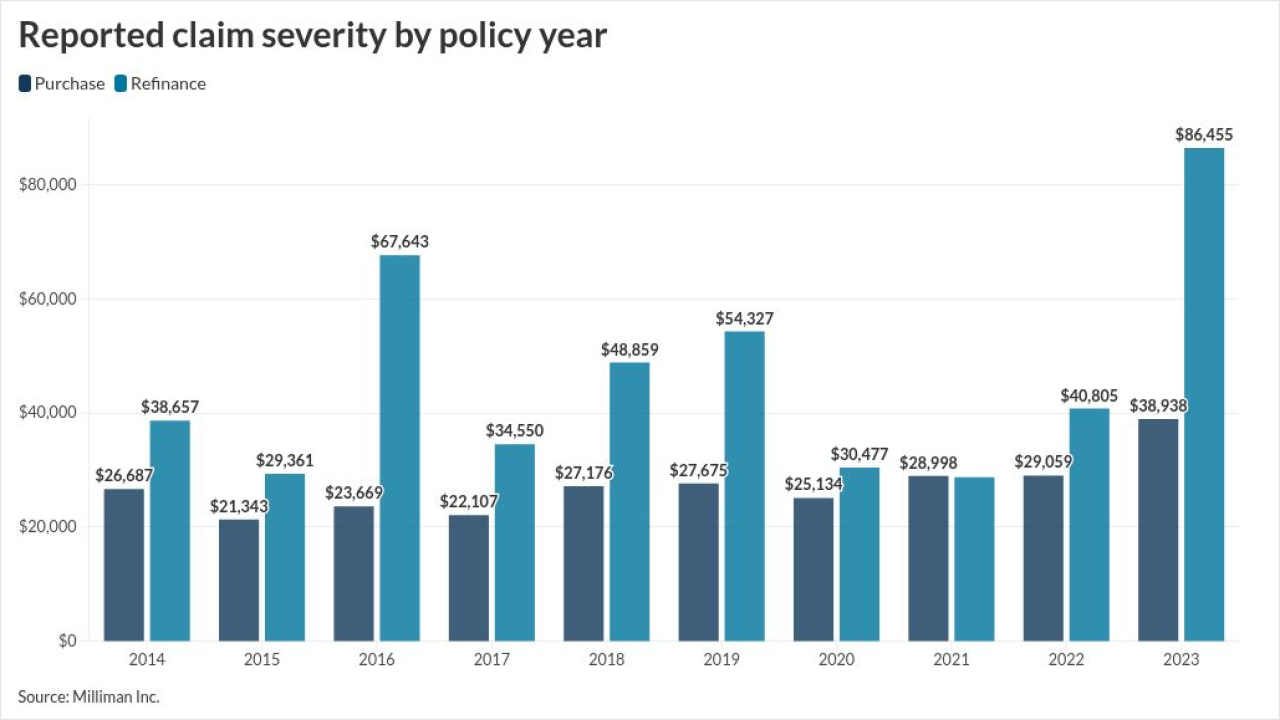

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

Federal Reserve Governor Lisa Cook's legal team argued in a new letter to Attorney General Pam Bondi that the claims "fail on even the most cursory look at the facts."

November 17