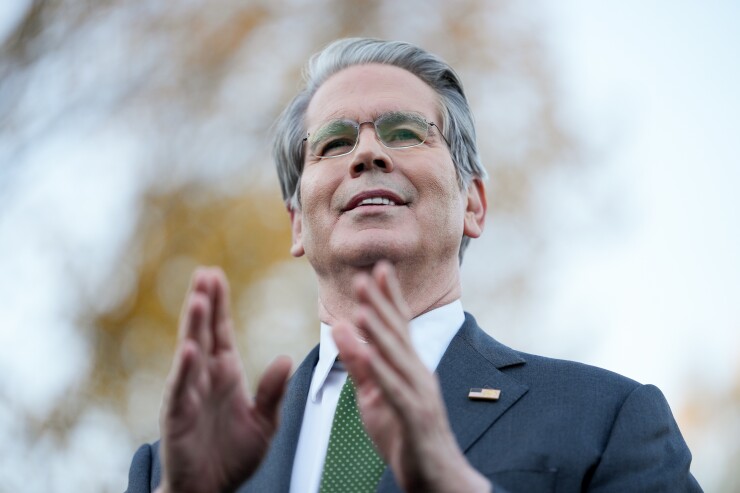

Treasury Secretary Scott Bessent said that a key theme of his interviews for the next chair of the Federal Reserve has been simplifying the US central bank, which he indicated has become too complex in how it manages money markets.

"One of the things in terms of the criteria that I've been looking for" has been the interplay of the Fed's various instruments, Bessent said on CNBC Tuesday. "I realize the Fed has become this very complicated operation."

READ MORE:

Bessent said his final second-round interview with the five candidates to succeed Chair Jerome Powell will be today, and reiterated that President Donald Trump may make his announcement on the nomination before Dec. 25. The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder.

The Fed now maintains a so-called ample reserves approach in controlling its policy interest rate, which involves holding a sizeable amount of Treasuries on its balance sheet. As part of the current operating system, it pays interest on the reserves that banks park with it, and for any cash that money market funds temporarily place at the Fed.

READ MORE:

"The Fed has taken us into a new regime — what is called ample reserves regime — and it looks like that might be fraying a bit here in terms of whether the reserves are actually ample in the system," Bessent said.

Policymakers last month

"There are all these facilities and operations, the standing repo facilities, and I think we've got to simplify things," Bessent said. He didn't specify how he thought the central bank ought to overhaul its current operations.

The Standing Repo Facility allows eligible institutions to borrow cash in exchange for Treasury and agency debt. It has seen regular use in recent weeks, reaching $50.4 billion on Oct. 31 — the most since the tool was made permanent in 2021.

"There's this very complicated calculus between the monetary policy, the balance sheet and regulatory policy," Bessent said. "And we've really emphasized in the interviews, what's the interplay for that calculus?"

The Treasury chief also said, "I think it's time for the Fed just to move back into the background," without detailing what that would entail. And he suggested central bankers may be speaking too often.

"We just need to calm down all these speeches by these bank presidents that are just redundant," Bessent said, appearing to single out reserve bank chiefs rather than Fed board members.

He also suggested he had issues with some particular Fed presidents.

"These regional presidents were supposed to be people from the district," Bessent said. "And we've got at least three, maybe four, of the reserve banks where people were hired from outside the district. They don't even live in their district. They commute back to New York."

READ MORE:

The interest-rate-setting Federal Open Market Committee comprises seven governors and five reserve bank presidents — the New York Fed chief and four others on a rotating basis. The presidents, unlike the governors, aren't nominated by the White House or confirmed by the Senate. The current roster of reserve bank presidents

Bessent also observed that "the governors seem to be leaning toward cutting rates."

Asked about Trump's suggestion earlier this month that