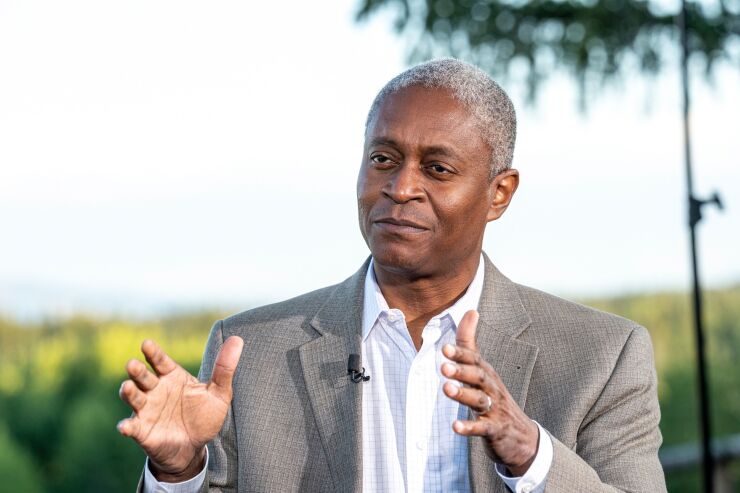

Federal Reserve Bank of Atlanta President Raphael Bostic said that while inflation is too high, policymakers can be patient for now amid evidence of

"I have the view that we can be patient — our policy right now is clearly in the restrictive territory," Bostic said in remarks Monday to the Cobb County Chamber of Commerce in Atlanta. "We continue to see signs that the economy is slowing down, which tells me the restrictiveness is working."

Nearly all Fed participants support

The Fed has hiked its benchmark rate by 5 percentage points since it kicked off its tightening campaign in March last year. While inflation has slowed from its 2022 peak, the pace remains well above the central bank's target.

Bostic highlighted that Friday's June jobs report showed a smaller gain in employment than economists had forecast. He also said that inflation "is too high, and we have got to get it back to our 2% target," though — speaking to reporters later — he highlighted that "underlying data" for prices "is actually telling a very positive story."

"We have got that momentum going" on disinflation, Bostic said. "You could see inflation getting back to 2% without having to do more."

At the same time, he anticipated that the July policy decision will be another "knife-edge" call. Financial markets show traders expect policymakers will raise the benchmark by another 25 basis points.

Expectations Key

The Atlanta Fed chief said he'd be concerned if expectations for consumer-price increases became "unanchored," which would mean policymakers "have to do a little more." But for now, "inflation is still moving steadily back to target" and inflation expectations are centered around 2%, he said.

"I am comfortable being patient," Bostic said.

Policymakers will get another key report with the release Wednesday of the consumer price index, expected to show annual inflation has slowed to 3.1% in June, the lowest point in more than two years. However, once volatile energy and food costs are stripped out, core CPI is seen rising 5% from a year earlier.

Asked about the potential hit to banks from

For many banks, their leadership remembers those times and is avoiding concentrations of their assets, Bostic said. "Bankers, they are provisioning more" for potential losses, he said, while adding that "we are going to stay diligent" with regard to financial institutions.