Even with a vibrant residential real estate market in Maine's major cities, homeowners in the state tend to stay put longer than those in the 50 largest American cities.

Many current homeowners are reluctant to move after getting pinched by the recession, seeing home prices and mortgage rates keep rising and worrying they cannot find a job in another area, according to LendingTree.

Homeowners in Pittsburgh, stayed in their homes the longest among the 50 largest American cities. They stayed 7.54 years, compared with 6.36 years for homeowners in Las Vegas, the shortest time in the nation. The average of all 50 cities was 7 years.

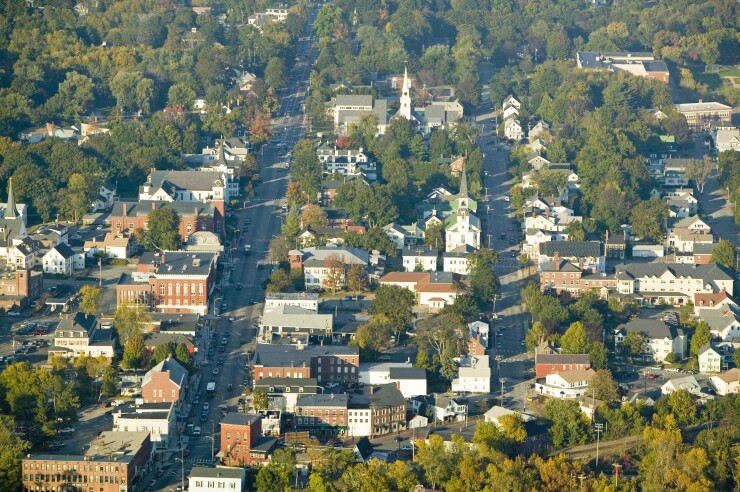

Portland and Bangor were not on LendingTree's largest city list. However, homeowners in both cities stayed put longer than those in the top 50 cities.

Owners in Bangor kept their homes for 8.25 years, compared with 8.2 years in Portland.

The average age of home occupants in both cities is about the same at 54 years old.

However, the median home value in 2017 in Bangor, at $136,000, is a little more than half that of Portland's, at $259,200.

The appreciation of the median house value from 2014 to 2016 was much higher in Portland, at 9 percent, than in Bangor, 1%.

Among the top 50 cities in the LendingTree data, were New England's Hartford, Conn., at sixth; Providence, R.I., at ninth; and Boston at 16th.

LendingTree said a lack of supply has been a persistent buyers' challenge in the housing market since the financial crisis. There are not enough houses on the market, which has contributed to significant price surges in many cities, including Portland.

Experts frequently attribute the inventory shortage to insufficient new construction, a result of many home builders leaving the industry after the financial crisis. Additionally, increasingly expensive labor and materials have reduced the margins on lower-priced homes.

There is also a decreased supply of existing homes for sale, which accounts for a much larger share of the total housing market than new construction.

Many current homeowners are reluctant to move after the recession. Reduced labor market mobility has also led to fewer people leaving their homes. More recently, rising mortgage rates have locked in many current homeowners, because a mortgage on a new home would mean an even higher interest rate.

LendingTree also found that cities with shorter housing tenure have greater price appreciation. The top 10 cities had an average tenure of 7.46 years and an average three-year home price appreciation of 12% from 2014 to 2017. The bottom 10, with an average tenure of 6.63 years, had average price appreciation 30%.

Higher housing turnover drives prices up, while faster price appreciation could be enticing homeowners to sell, LendingTree said.

The Northeast dominates the list of cities where owners stay the longest time in a home.

To determine the cities with the longest housing tenure, LendingTree pulled data in December 2018 from the U.S. Census Bureau's American Community Survey. The data, which is from cities and nearby areas, includes median home values.