Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

JPMorgan Chase's Corporate Client Banking and Specialized Industries Mortgage group is now accepting electronic promissory notes as collateral to fund warehouse loans.

May 2 -

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

Remodeling activity stepped up in recent years as homeowners stayed put for nearly twice as long as before the housing bubble burst, but several forecasts point to a potential slowdown on the horizon, which is a welcome sign for the mortgage business.

April 30 -

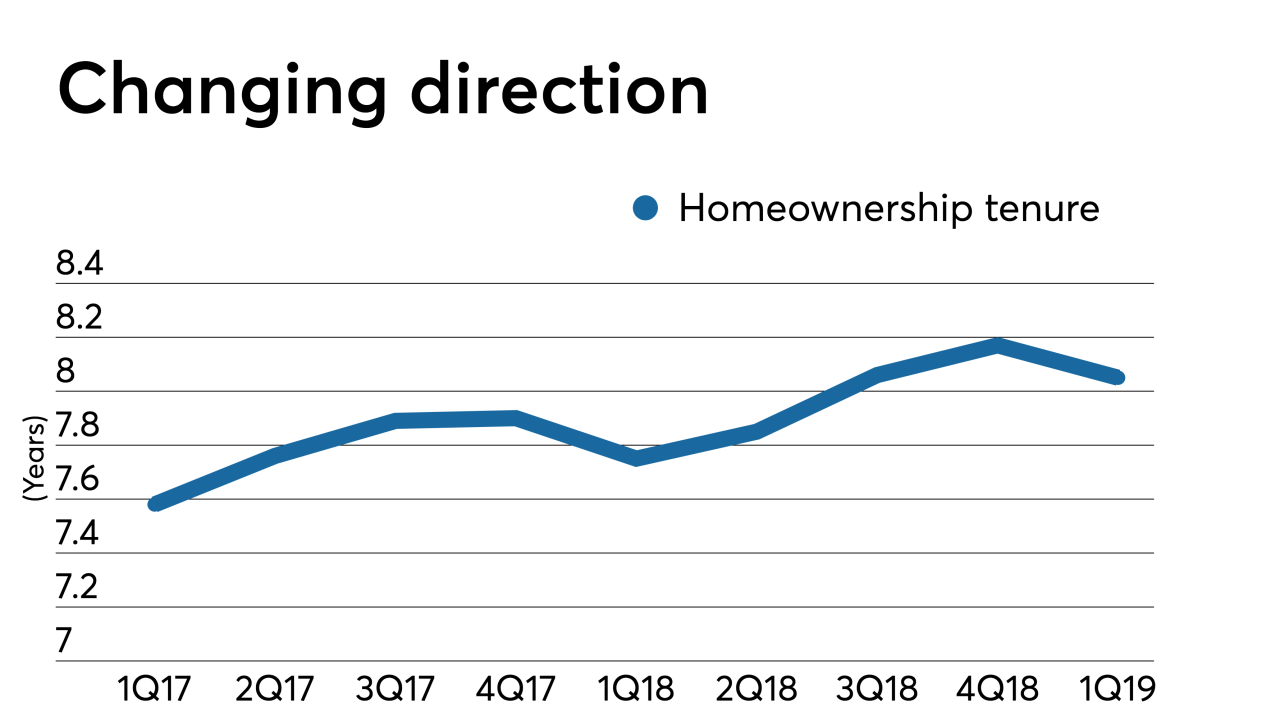

Homeownership tenure took a dip at the start of the year as the housing market cooled off. And while improved affordability helps, consumers are still staying put for nearly twice as long as they were before the crisis.

April 26 -

Plenty of homeowners succumbed to foreclosure when the housing bubble burst, but the effects on Hispanic and black communities in particular were heightened, with many still suffering, according to Zillow.

April 25 -

Quicken Loans parent company Rock Holdings is strengthening its investments in the Canadian market by acquiring a majority stake in Lendesk, a Vancouver-based mortgage fintech.

April 24 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

The mortgage industry identified two technology initiatives it claims have the greatest potential to improve processes and be the most broadly adopted over the next two years, according to Fannie Mae.

April 23 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

Homebuilders are growing more confident in the market for newly built single-family homes as demand grows. At the same time, mortgage companies are streamlining the new construction loan process, suggesting they, too, see value in the market.

April 16 -

The number of electronic notes added to the MERS eRegistry in the first quarter surpassed the amount added for all of 2018, signaling the mortgage industry's push for digital.

April 12 -

From Syracuse, N.Y., to Lake Havasu City, Ariz., here's a look at the top 12 cities where property taxes are skyrocketing, signaling a potential strain on some homeowners' ability to make mortgage payments.

April 10 -

Consumers believe softening home prices and mortgage rate declines are on the horizon, according to Fannie Mae. While these suggest positive sentiments on conditions for buyers, they signal rewards for those who wait.

April 8 -

Artificial intelligence, automation, electronic closings; the 2019 Top Producers identified the biggest technology initiatives bending the way mortgages get done.

April 4 -

Despite earning less, the share of single female homebuyers who recently made a house purchase doubled that of single men, according to the National Association of Realtors.

April 3 -

Bank of America is setting aim at low- to moderate-income and multicultural homebuyers and communities with the launch of its Neighborhood Solutions affordable homeownership initiative.

April 2 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1