Hannah Lang is a Washington-based reporter who writes about federal mortgage policy and the U.S. housing finance system for American Banker and National Mortgage News. She is a former multimedia reporter for the Capital News Service and a graduate of the University of Maryland at College Park.

-

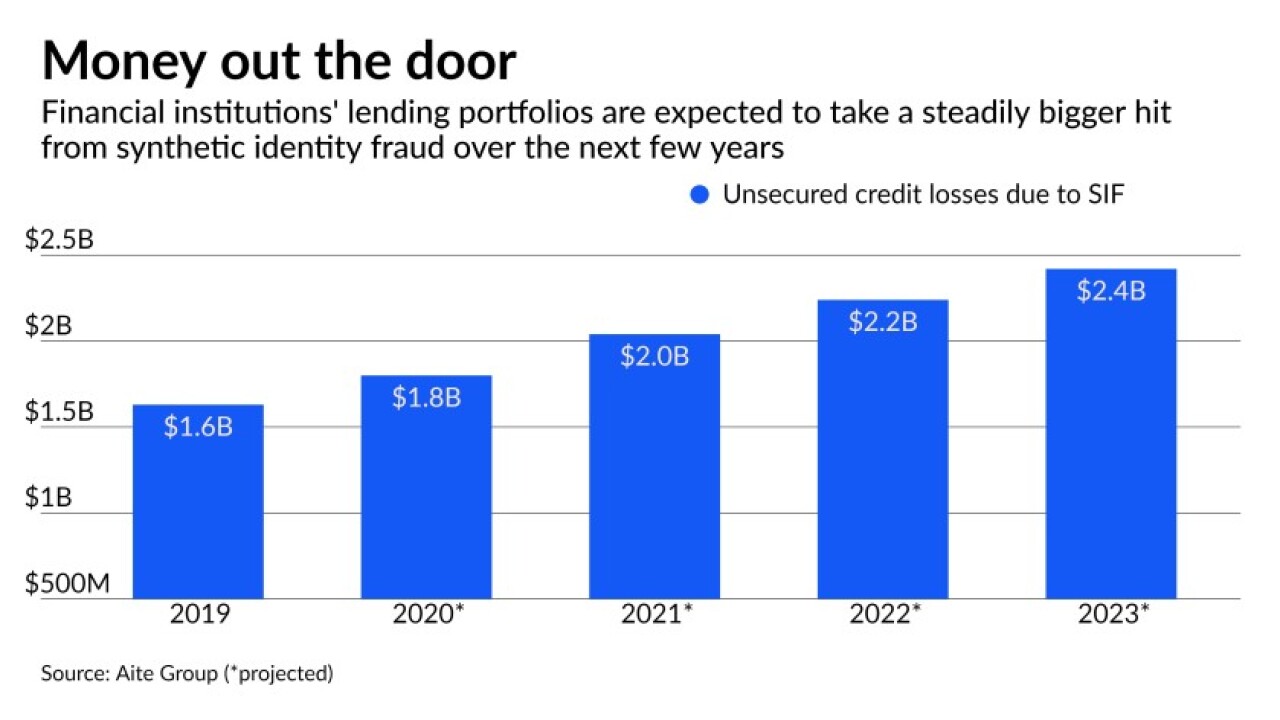

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

By Hannah LangJune 2 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

By Hannah LangMay 28 -

The Treasury secretary previewed President Biden's budget by urging lawmakers to fund the Financial Crimes Enforcement Network's establishment of a beneficial ownership regime.

By Hannah LangMay 27 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

By Hannah LangMay 18 -

Fannie and Freddie's regulator says the companies must comply with the new Qualified Mortgage standard by the summer, while the Consumer Financial Protection Bureau has extended the deadline to 2022. The conflicting timetables have stoked uncertainty in the market.

By Kate BerryMay 7 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

By Hannah LangMay 3 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

By Hannah LangApril 28 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

By Hannah LangApril 28 -

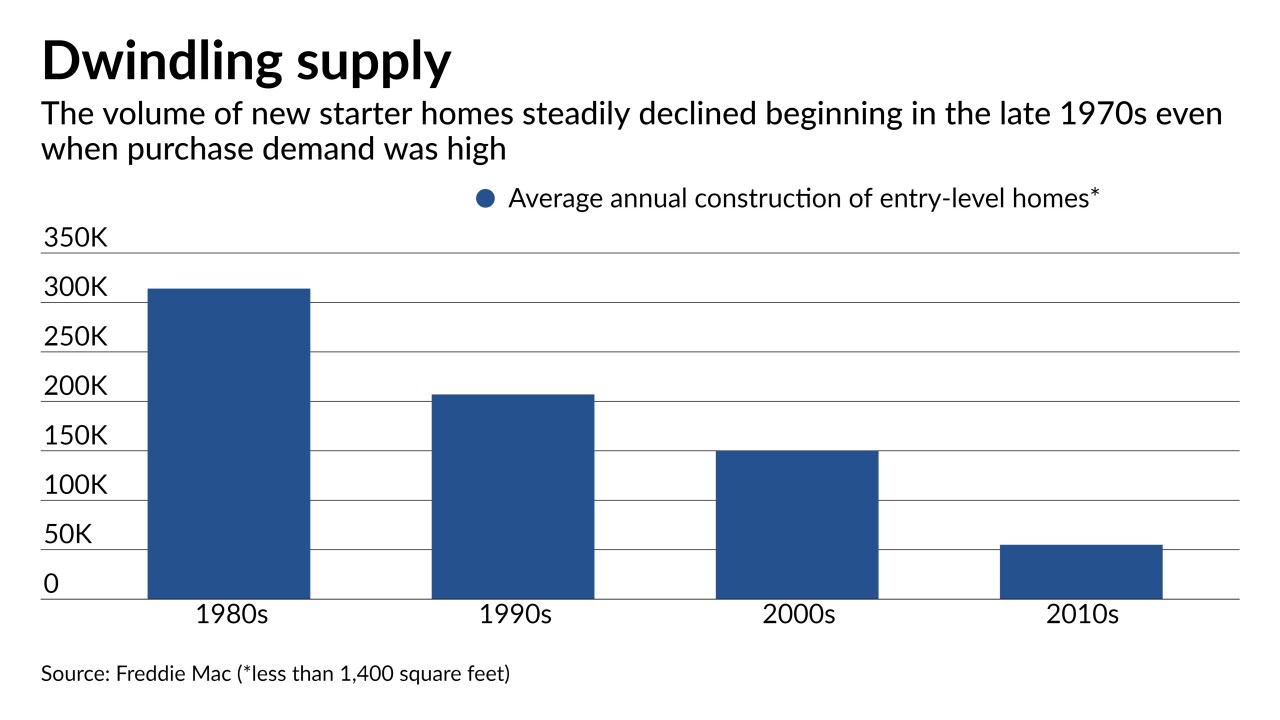

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

By Hannah LangApril 27 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

By Hannah LangApril 20 -

The Department of Housing and Urban Development will revive a 2013 rule that makes lenders liable for practices that were unintentionally discriminatory as well as 2015 guidelines for how local jurisdictions comply with the Fair Housing Act.

By Hannah LangApril 14 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

By Hannah LangApril 8 -

One official at the bureau said this fall could be an “unusual point in history” for the mortgage market as delinquent borrowers exit forbearance plans. The agency proposed new steps for servicers to help consumers stay in their homes.

By Hannah LangApril 5 -

The agency announced it was rescinding seven policy statements issued last year meant to help companies combat fallout from COVID-19 but that the bureau's current chief said came at the expense of consumers.

By Hannah LangMarch 31 -

Although the Federal Housing Administration's insurance fund is "well above" its legal minimum, HUD Secretary Marcia Fudge said the mortgage agency has no plans to cut prices.

By Hannah LangMarch 30 - LIBOR

The heads of the Federal Reserve and Treasury are urging passage of legislation that would replace Libor with the Secured Overnight Financing Rate in certain contracts. That would spare banks litigation over trillions of dollars of contracts when Libor expires in 2023.

By Hannah LangMarch 26 -

In its final days, the Trump administration imposed limits on Fannie Mae and Freddie Mac’s holdings of mortgages with loan-to-value ratios above 90% and certain other characteristics. Critics say the changes were unnecessary and disproportionately penalize borrowers of color.

By Hannah LangMarch 11 -

The mortgage giants were authorized to give just over $1 billion combined to the National Housing Trust Fund and the Capital Magnet Fund this year, the highest contribution ever. The amount reflects refinancing growth in 2020.

By Hannah LangMarch 1 -

Homeowners still deferring payments on federally backed loans as of Feb. 28 will be permitted to request an additional three months of relief.

By Hannah LangFebruary 9 -

Steve Daines of Montana, Bill Hagerty of Tennessee and Cynthia Lummis of Wyoming are joining the panel for the 117th Congress.

By Hannah LangFebruary 4