Joe Adler is the former Washington Bureau Chief of American Banker.

-

Questions surrounding Eric Blankenstein, a senior CFPB official whose racially charged writings from over a decade ago have led to calls for his resignation, have been referred to the agency's watchdog.

By Joe AdlerOctober 16 -

The uproar over the incendiary writings of a Consumer Financial Protection Bureau official have led to calls for his removal, but the agency’s interim chief says he won’t “let any outside group dictate who works here.”

By Joe AdlerOctober 11 -

The Banking Committee had delayed a vote on Kathy Kraninger’s confirmation after the Senate announced a short summer recess.

By Joe AdlerAugust 15 -

The D.C. movers and shakers at the center of the financial crisis — and the government’s response — have all moved on to new positions. Here's a look at what they did afterward.

July 30 -

The plan would end the GSE conservatorships and create an explicit federal guarantee, but it's unclear if even other parts of the Trump administration support it.

By Joe AdlerJune 21 -

The industry’s biggest legislative victory in a decade made it to the finish line Thursday.

May 24 -

The new request for information is the 10th in the series that is part of acting Director Mick Mulvaney’s “call for evidence” to assess the CFPB’s overall effectiveness.

By Joe AdlerMarch 28 -

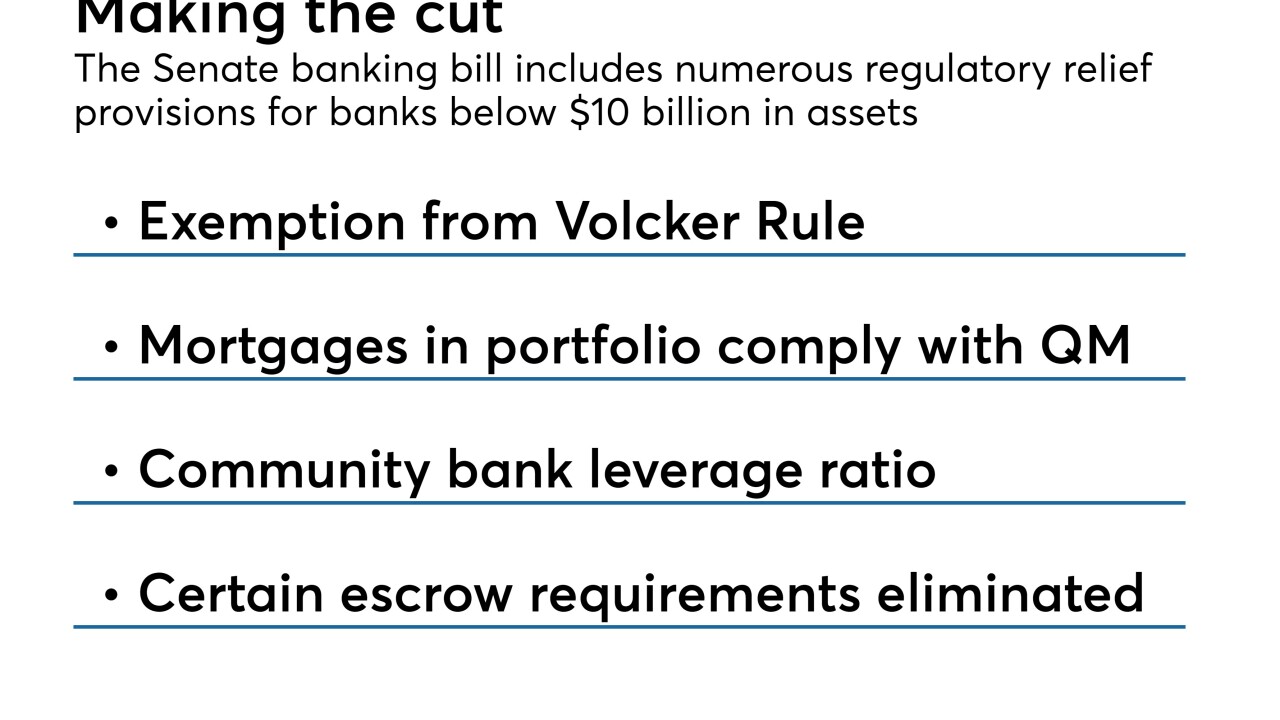

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

By Joe AdlerMarch 26 -

Sen. Elizabeth Warren, D-Mass., introduced a bill to create a permanent law enforcement unit to investigate criminal activity at large banks, just as the Senate was close to passing a regulatory relief package.

By Joe AdlerMarch 14 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

By Joe AdlerFebruary 2 -

Mick Mulvaney’s unapologetic memo to staff about the Consumer Financial Protection Bureau’s mission headlined a spate of developments this past week as he continues to transform the agency. Here are the key developments.

By Joe AdlerJanuary 29 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

By Joe AdlerJanuary 23 -

The Senate approved the final tax reform plan 51-48 early Wednesday, the second-to-last obstacle before sending it to President Trump for his signature.

December 20 -

The House vote moved a sharp reduction in the corporate tax rate for banks and other businesses to within a few steps of becoming law.

By Joe AdlerDecember 19 -

In a letter to President Trump, 44 Democratic senators said the White House's appointment of Mick Mulvaney as interim director of the Consumer Financial Protection Bureau "jeopardizes the agency’s independence and effectiveness."

By Joe AdlerDecember 4 - Finance and investment-related court cases

Financial services companies and groups are increasingly willing to take the regulatory regime to court in an effort to fight back — and so far, they appear to be succeeding.

April 26 -

Nearly 40 current and former congressional Democrats — including the namesakes of the Dodd-Frank Act — challenged the notion that Congress may not dictate the organization of federal agencies.

By Joe AdlerMarch 31 -

The Trump administration was set to release an executive order Friday calling for a review of the Dodd-Frank Act, but the immediate questions about the order focused on what authority the White House has to enact real change.

By Joe AdlerFebruary 3 -

The agency may finally be reaching resolution on whether Fannie Mae and Freddie Mac will allow principal reductions, two years into Director Mel Watt's tenure as agency director and nearly a decade after the mortgage bubble burst.

By Joe AdlerMarch 22 -

Comptroller of the Currency Thomas Curry said banks could consider loan-to-value ratios above 90% to help revitalize areas hurt by the housing crisis.

By Joe AdlerSeptember 9