Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

While home prices hit another record high, the supply of for-sale properties improved, according to Realtor.com.

July 1 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

Lending startup Tomo Networks will eschew refinances to focus exclusively on purchases.

June 30 -

Though their rate of ownership lags behind preceding generations, millennial interest in purchasing property grew the most of any demographic last year, according to First American.

June 29 -

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

A Realtor.com survey of consumers aged 18 to 25 found that 45% share are already saving for a home.

June 24 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

The financial services company will use its new capital to invest in artificial intelligence and machine learning to cut transaction times, as well as build its own servicing platform.

June 23 -

The strength of the housing market helped to increase forbearance exits while minimizing new requests, according to the Mortgage Bankers Association.

June 22 -

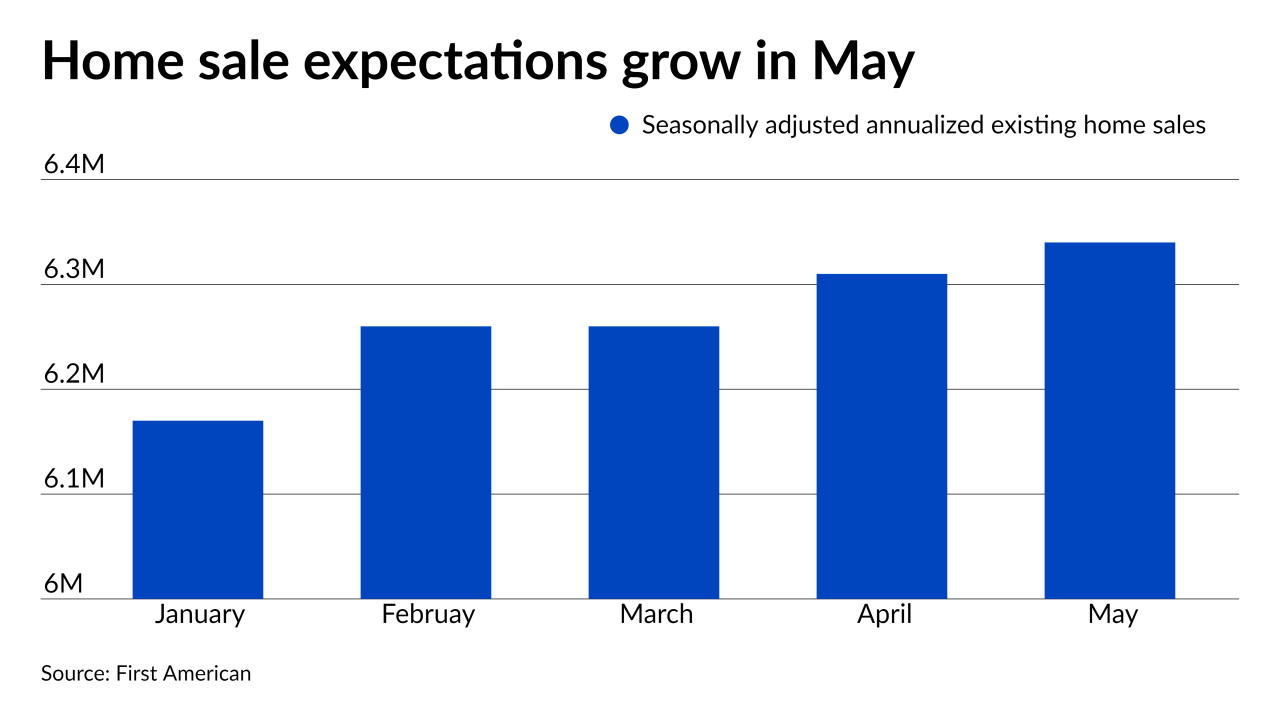

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

Announced the day before the first federally recognized Juneteenth holiday, the Black Homeownership Collaborative has a seven-point initiative to improve upon racial equality in home buying in the next nine years.

June 18 -

About 20% of the pandemic-related delinquent borrowers are up for review by the end of June, which could lead to vast improvement or deeper financial strife, according to Black Knight.

June 18 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

As home prices set new records, a shift in consumer attitude led to fewer bidding wars and a growing number of listings, according to Zillow and Redfin.

June 16 -

Although activity crept down in May from April, it posted “dramatic” increases from the year before, according to Attom Data Solutions.

June 15 -

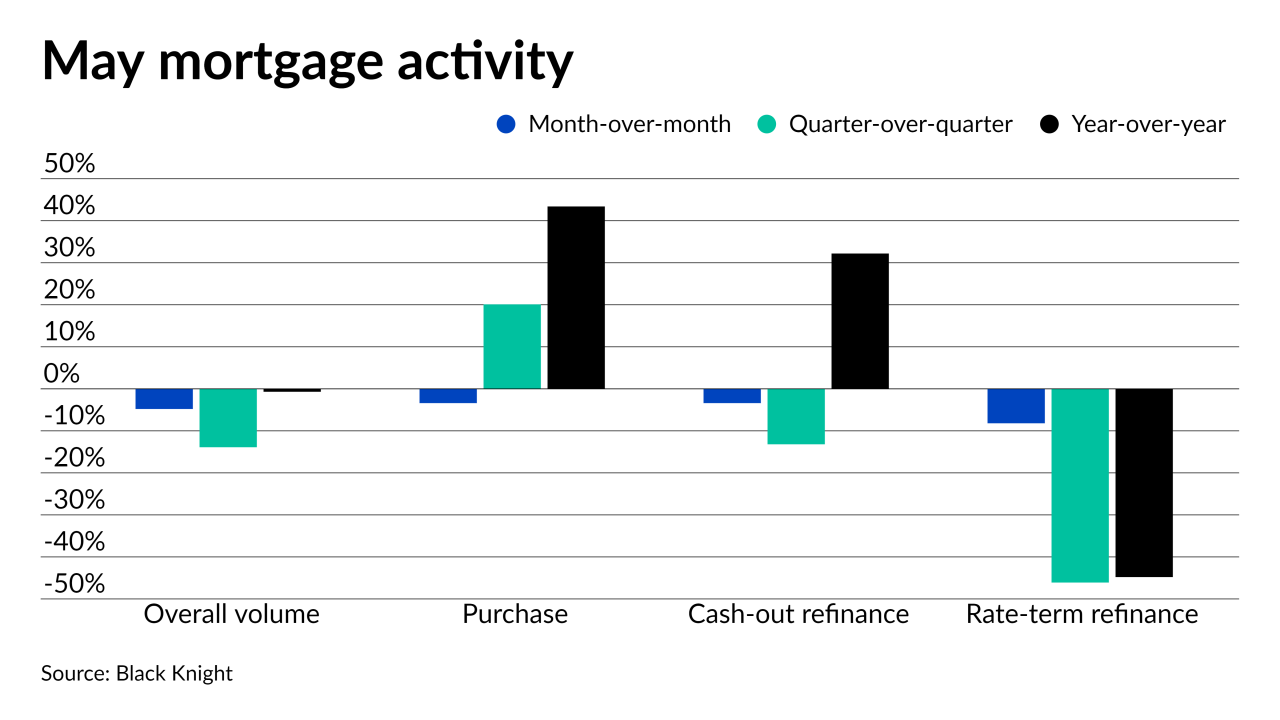

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

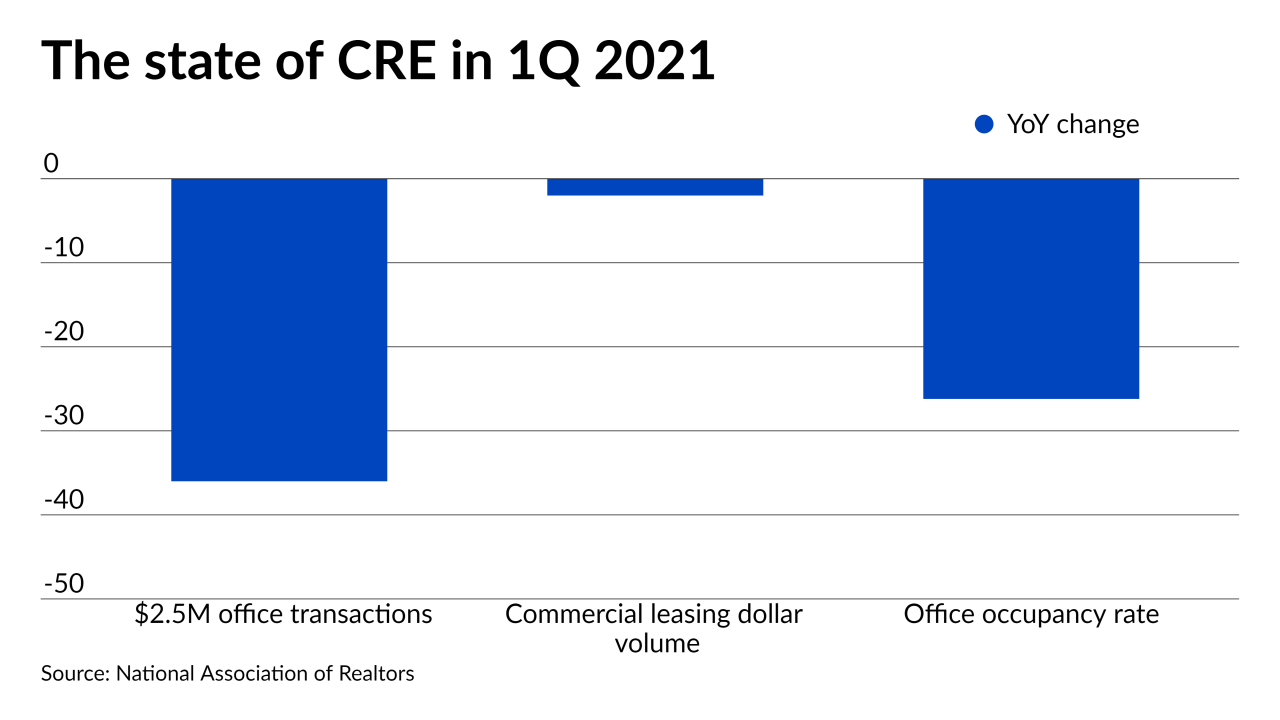

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

The continued home price spike also drove the negative equity share to an all-time low, according to CoreLogic.

June 10 -

Rising sea levels aren’t keeping buyers from scooping up oceanfront homes as work flexibility gives consumers wider options on where to live, according to Redfin.

June 9