Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Mortgage lenders and real estate professionals share their perspectives on the cities predicted to draw the most interest from home buyers in the next year, according to the Urban Land Institute.

November 24 -

As interest rates fluctuated and purchase volumes increased in the second quarter, mortgage loans were more prone to defaults, according to actuarial and consulting firm Milliman.

November 22 -

CalHFA’s executive director Tiena Johnson Hall discusses her agenda for encouraging affordable housing development in the inventory-strapped state.

November 19 -

Solidifi will team up with the initiative originally launched by the National Urban League and Fannie Mae.

November 18 -

Only eight states experienced annual appreciation viewed as sustainable, according to Fitch Ratings.

November 17 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

The fintech’s algorithms are programmed like "Tesla’s self-driving cars," according to the company’s CEO.

November 15 -

The majority of prospective home sellers want to list their properties in the next six months, according to a recent survey by Realtor.com.

November 11 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

The two fintechs’ venture looks to solve the long-standing problem of connectivity as the barrier to full lending digitization.

October 21 -

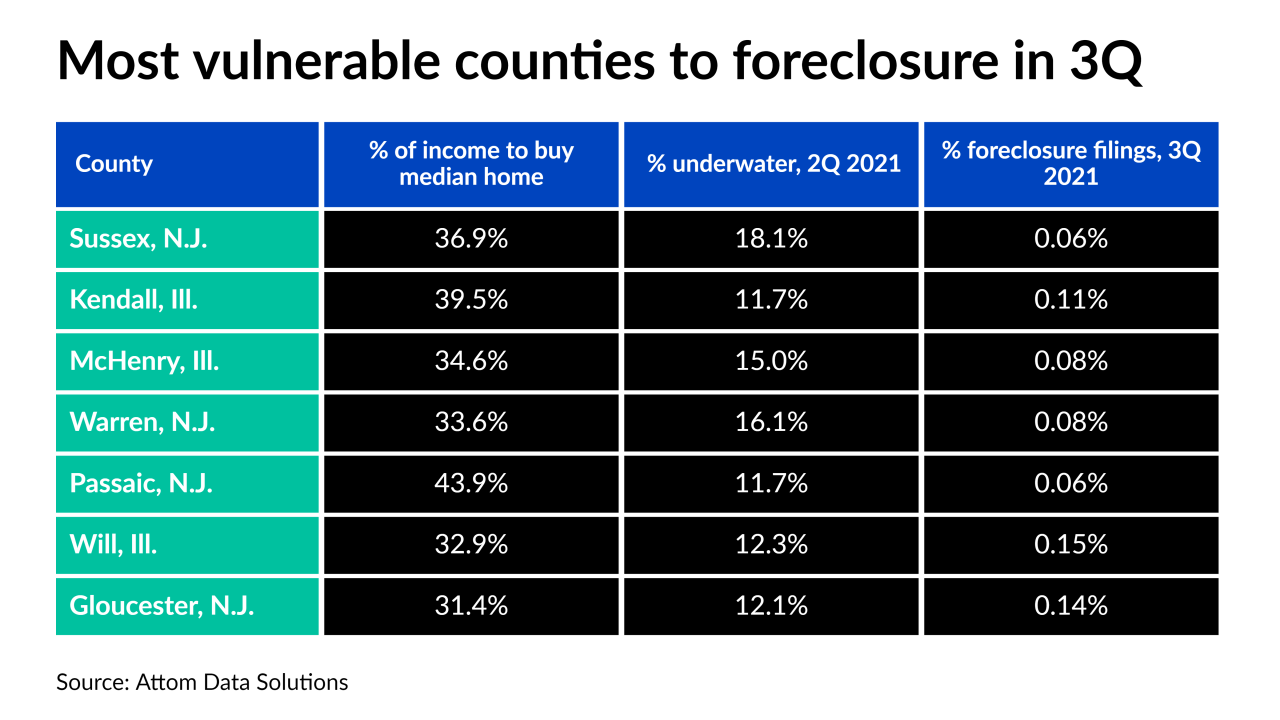

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The financial services technology provider will leverage multiple data sources to verify borrower salaries at a “flip of a switch.”

October 20 -

Listing times, price appreciation and inventory of for-sale homes all made incremental gains in favor of buyers, according to Zillow

October 19 -

The lack of inventory pushed the median housing price to double-digit annual growth for the 14th straight month, according to Redfin.

October 15 -

Rising inflation and moves by the Federal Reserve are expected to fuel interest rate growth into 2022.

October 14 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

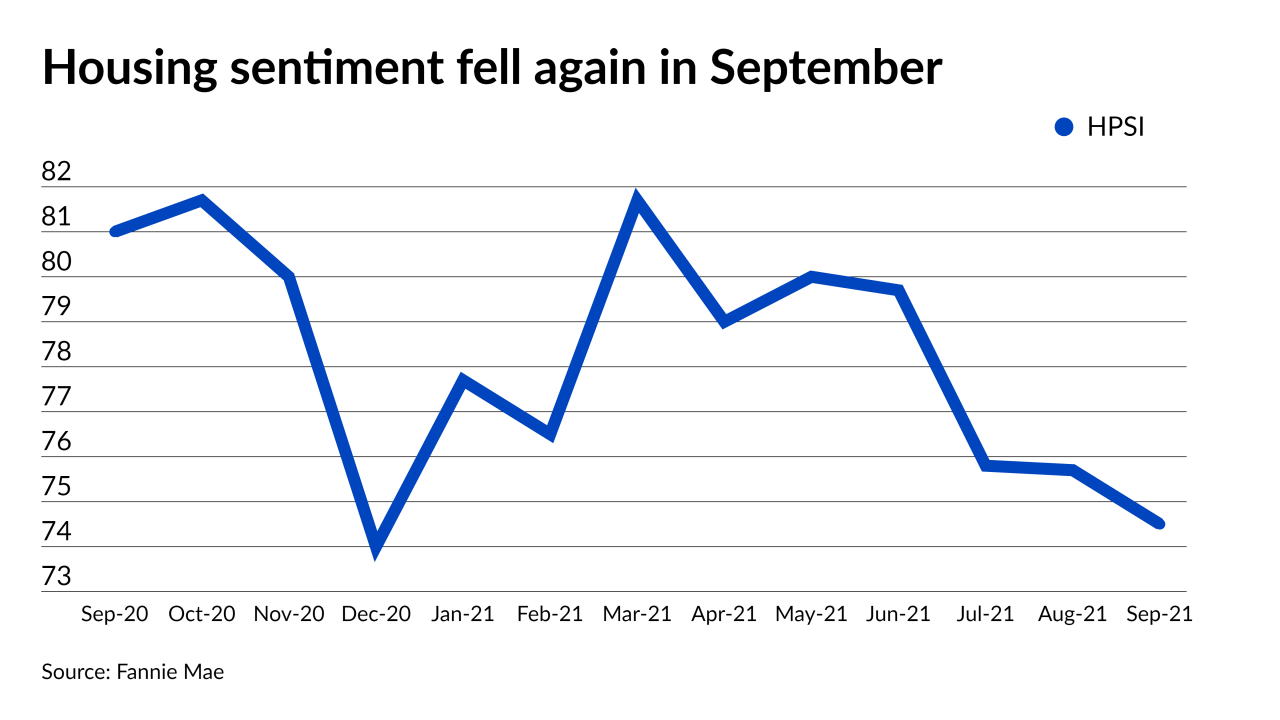

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7