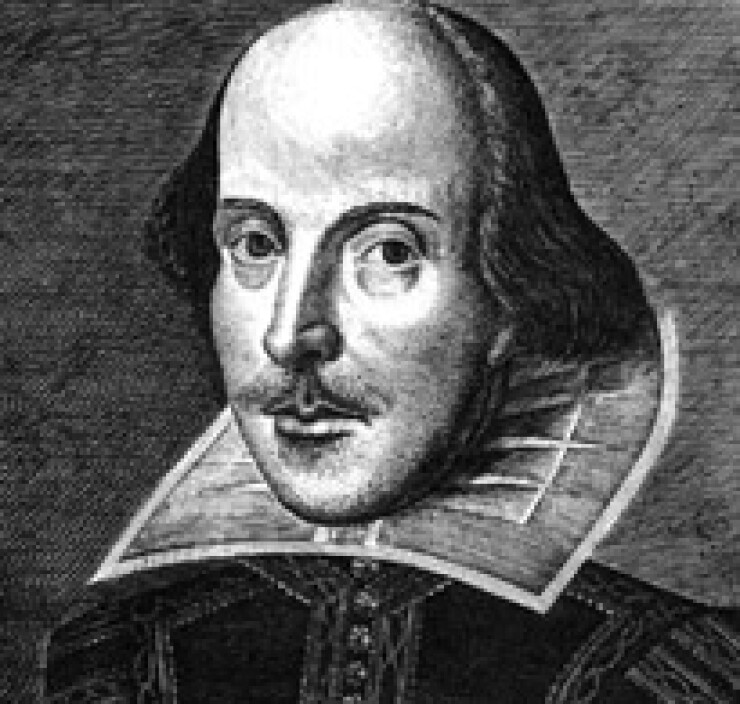

WE’RE HEARING if Shakespeare was writing the story of loan officer compensation in the mortgage business, it would definitely include a struggle between two rival forces, locked in a struggle that will leave the stage to the victor and complete failure to the loser. Remember, the Bard thought the whole world was the stage and he could direct all of the action on it, rather like the CFPB, I guess.

In our own struggle, the mortgage sales department and its executives make up the Capulet House. They want more pay to help them attract the best closers and build the business. Across the office is the CFO and his team, call them the Montagues. They seek iron-fisted financial control, lower costs and lower pay.

The reason this is a tragedy is that both sides believe in the same basic principle, “you get what you pay for!” But in our story, there is a third force at work, one not even the great poet could have foreseen. Enter, from stage left, the compliance group, with many sorts of questions about exactly how the production personnel are being paid.

Actually, this might make an interesting stage play if we weren’t being forced to live it out. Before it’s done, it could be just as bloody as the worst of Shakespeare's medieval productions. Companies that don’t get this right will go out of business, either for lack of good sales people or being forced to pay financially crippling noncompliance fines.

Compliance has the stronger hand here. It is the how that is making the job of the chief executive even harder, because you are no longer balancing the decision as a seesaw between sales and finance. You now have to balance all three, so it’s a three-legged stool that the chief executive has to be comfortable sitting upon.

What is making this struggle even more complicated is that the executive needs to consider these three factors carefully, while also looking out at the market. After all, for a lot of companies the market has gotten tougher, and they need to be sure to retain good sales professionals.

I recently

So, over the next few weeks I will be addressing all three legs of the stool—how much to pay, how little to pay, and how to pay in a manner that keeps you compliant with new regulations.

For the record, I know that “To be or not to be,” the quip my title is based upon, is not even in Romeo and Juliet, the play I compare to our LO Comp struggle. Believe me, Shakespeare would have approved of my use of poetic license here, so let’s not make much ado about nothing. See you next week.

Garth Graham is a partner with Stratmor Group, and has over 25 years of mortgage experience, from Fortune 500 companies to startups, including management of two of the most successful mortgage e-commerce platforms. He was formerly with Chase Manhattan Mortgage and ABN Amro, where he was a senior executive during the sale of its mortgage group to Citigroup.