CFPB News & Analysis

CFPB News & Analysis

-

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

The monthly volume of new mortgage securities insured by Ginnie Mae remained higher than it has been in more than two years in July, rising slightly on a consecutive-month basis.

August 13 -

With the agency mulling changes to the “Qualified Mortgage” regulation, mortgage lenders say little-known standards for how they document a borrower’s income would be a good place to start.

August 12 -

More applications for non-QM loans might close if lenders and originators beefed up efforts to address missing or outdated information, according to Computershare.

August 8 -

A gradual approach would help the market absorb loans affected by the government-sponsored enterprises' expiring qualified mortgage exemption, a Redwood Trust executive told analysts during a recent earnings call.

August 5 -

Many in the industry say releasing GSE-backed loans from stringent underwriting rules has helped the housing market recover, but a new level of regulatory burden could reverse those gains.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Eric Blankenstein, now at HUD, is under fire for asking a subordinate to defend him after it was revealed he wrote racially charged blogs 14 years earlier.

July 29 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

The agency’s director said it will let a temporary GSE exemption from the “qualified mortgage” regulation expire.

July 25 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

The timing of the settlement serves as a warning to other companies of the risks they face in an increasingly data-focused economy.

July 22 -

The agreement with authorities including the Federal Trade Commission and state attorneys general — and possibly the Consumer Financial Protection Bureau — may be announced as soon as Monday.

July 19 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

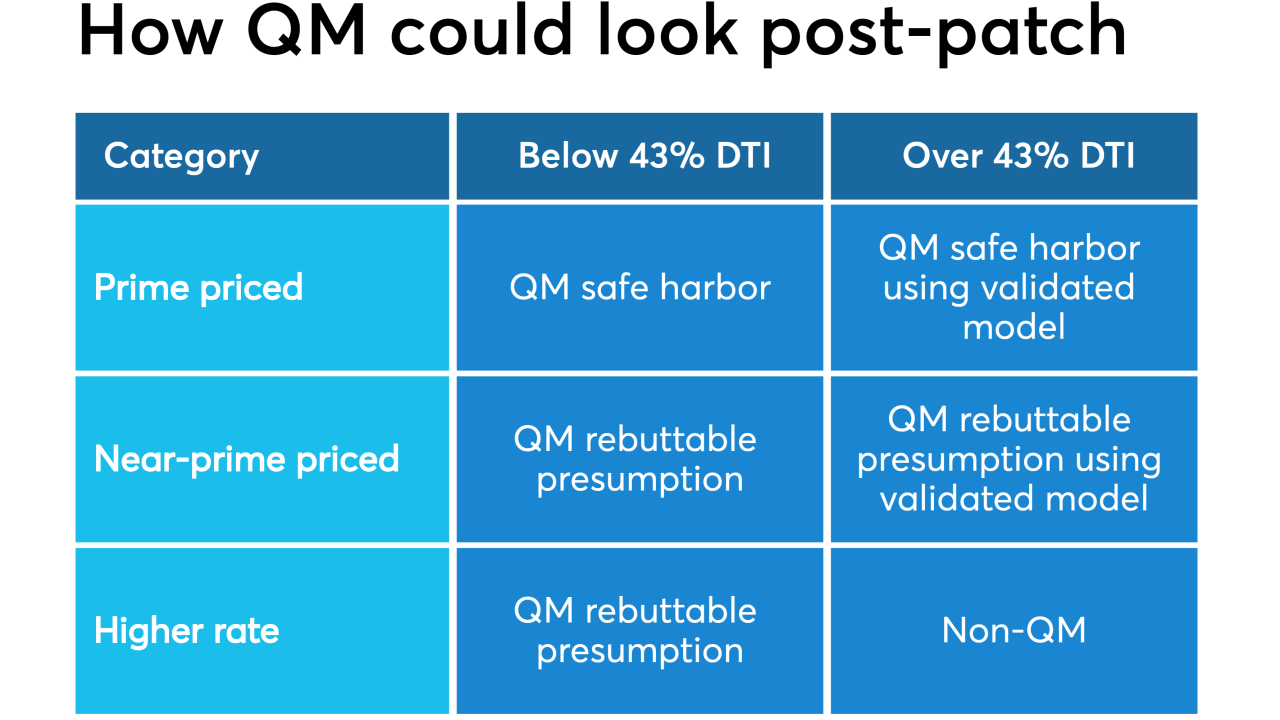

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

The CFPB did not file any fair-lending enforcement actions in the 2018 fiscal year and did not refer any Equal Credit Opportunity Act violations to the Department of Justice.

July 2 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Democratic lawmakers argue that Paul Watkins' former employment at a "homophobic hate group" makes him unfit to lead the agency's innovation office. Watkins says he did no advocacy work for that organization.

June 25