CFPB News & Analysis

CFPB News & Analysis

-

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The New Jersey mortgage lender and servicer won a huge victory in January when an appeals court threw out its fine levied by the consumer agency, but the court ruled against the claim that the agency's structure is unconstitutional.

May 3 -

The group says Mulvaney, who also runs OMB, was not totally forthcoming with the Senate Budget Committee about the foreclosure of a property he owns in South Carolina.

April 30 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

The CFPB finalized an amendment to its "know before you owe" mortgage disclosure rule that gives lenders more flexibility to adjust closing cost estimates and pass those increases on to borrowers.

April 26 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

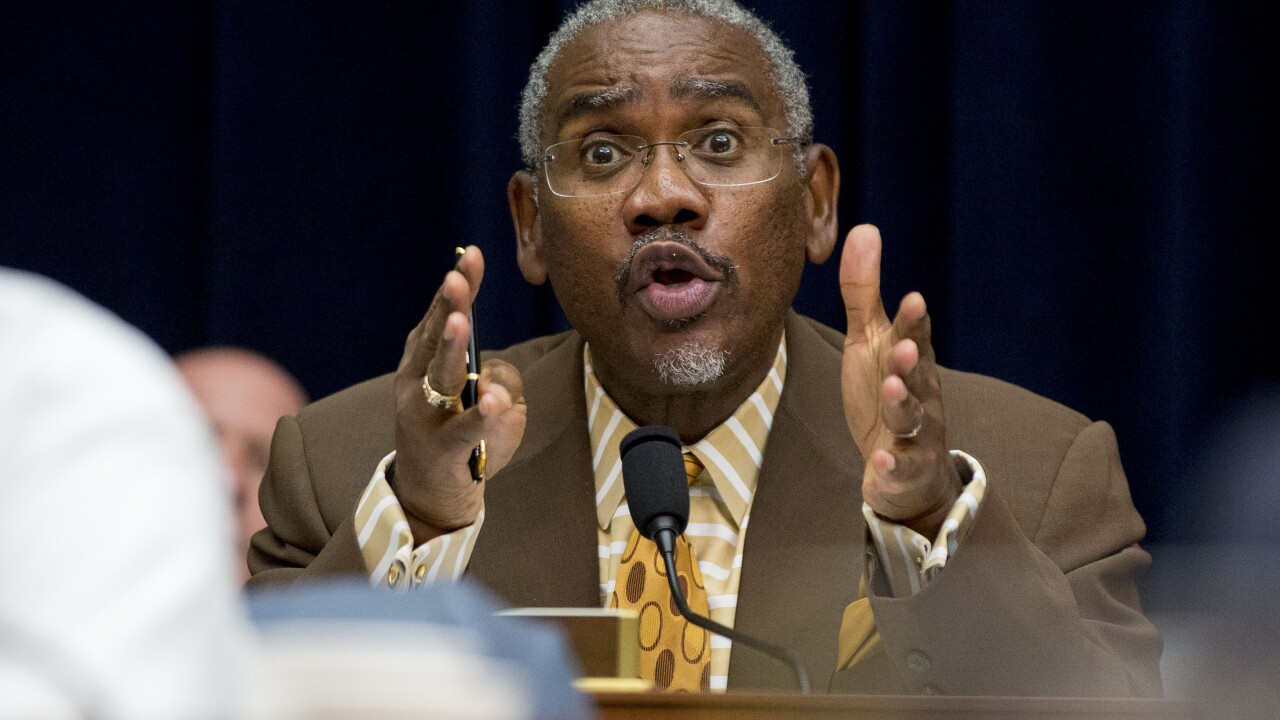

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The Consumer Financial Protection Bureau on Wednesday asked for public input on the way it receives and processes complaints from consumers in what the agency said was a preliminary step toward making improvements.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6