At the same time, state regulators are signaling that they

"I do think we will see more at the state level," said T. Robert Finlay, a partner at law firm Wright, Finlay, Zak LLP, during a panel on regulation at a recent industry conference about mortgage servicing rights.

And even if the states and CFPB are less active, servicers still need to remain compliant with the guidelines laid out by their secondary market business partners, including Fannie Mae, Freddie Mac, the Federal Housing Administration and Ginnie Mae.

So servicers and subservicers expect they will still be contending with high compliance budgets, as well as limited flexibility in the pricing that is ingrained in these agencies' policies, for some time to come.

The means the big question in servicing is still "How do you solve for that?" Steven Staid, senior vice president at PHH Mortgage, said at the conference.

Bigger servicers can turn to economies of scale, he noted. But smaller ones may not have that option unless they merge or agree to an acquisition. The alternative lies in finding ways to be more efficient with managing costs and processes.

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

Use dashboards

One remedy: online dashboards that give top executives a risk-ranked view of key performance indicators for compliance.

"You can have a mechanism that runs data that show whether you are complying, and then generates executive level, configurable reports. So somebody can sit there and say, 'We're looking at 20% of the loans and every month the number of findings are going up in bankruptcy processing,'" said Cam Melchiorre, president and technology vendor IndiSoft.

Just stop it

But don't just set and forget the stops, test them and make sure they work, advises Nicholas Corpuz, vice president of servicing at Subsequent QC, the quality control audit unit of risk management vendor Mortgage Quality Management and Research.

"There's a lot that goes on in these systems and there are ghosts in the machine," he said.

Mind foreclosure deadlines

While this is not a new compliance requirement, it tends to go through revisions, and historically has gotten lost in the shuffle when new loss mitigation rules are implemented.

So servicers should keep a particularly close eye on these deadlines as the next round of new CFPB servicing requirements goes into effect

Servicers should have supervisors take a closer look at loans at risk of missing this deadline to avoid losing out on claims payments, said Donna Schmidt, managing director at DLS Servicing Consultants LLC.

Automate loss draft claims

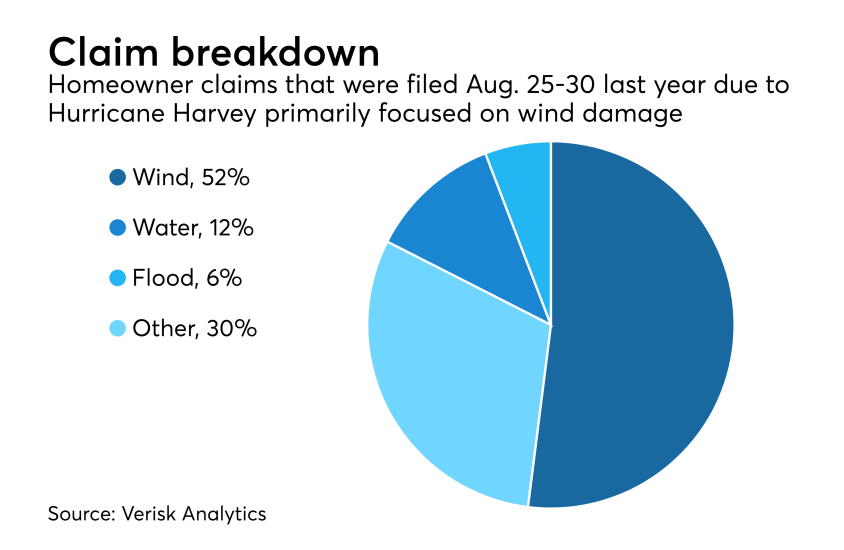

So today, the costs associated will making sure loss draft claims meet Fannie Mae's investor guidelines and other requirements can add up, particularly given that claims have proliferated in the wake of

One alternative that may be more cost effective is a white-label portal designed to coordinate and share information on collateral-related claims that are often paid jointly to servicers and consumers, said Denis Brosnan, president and CEO of vendor Dimont. The portal Dimont is testing "cuts out mail and paper," he said.

Renegotiate, when necessary

"There are ways to readdress some fees but you don't want to do that a lot. That's no way of doing business," Gene Ross, an executive vice president at ServiceLink subsidiary LoanCare, said at the IMN Residential Mortgage Servicing Rights conference.

Leverage market expertise

Compliance and marketing departments are often thought as being like "oil and water," that is, they don't mix; but if marketing expertise is being paid for in-house already anyway, why not use it?

Marketing executives "are good at putting together language that's less 'banking,'" Aaron Rybowski, chief compliance officer and senior vice president at WesBanco Bank Inc., said at the MSR conference.

Make robots do it

LoanCare is "experimenting with robotics" as a way to reduce costs, according to Ross.