-

The notes in Citigroup Commercial Mortgage Trust 2020-555 are backed by a beneficial interest in the trust’s $350 million portion of the 119-month fixed-rate commercial loan. The loan is secured by a 52-story New York luxury apartment building in Manhattan’s Midtown West submarket.

February 18 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

The loan participation is part of a debt refinancing package that paves the way for expanding the Parkmerced mega-development.

January 28 -

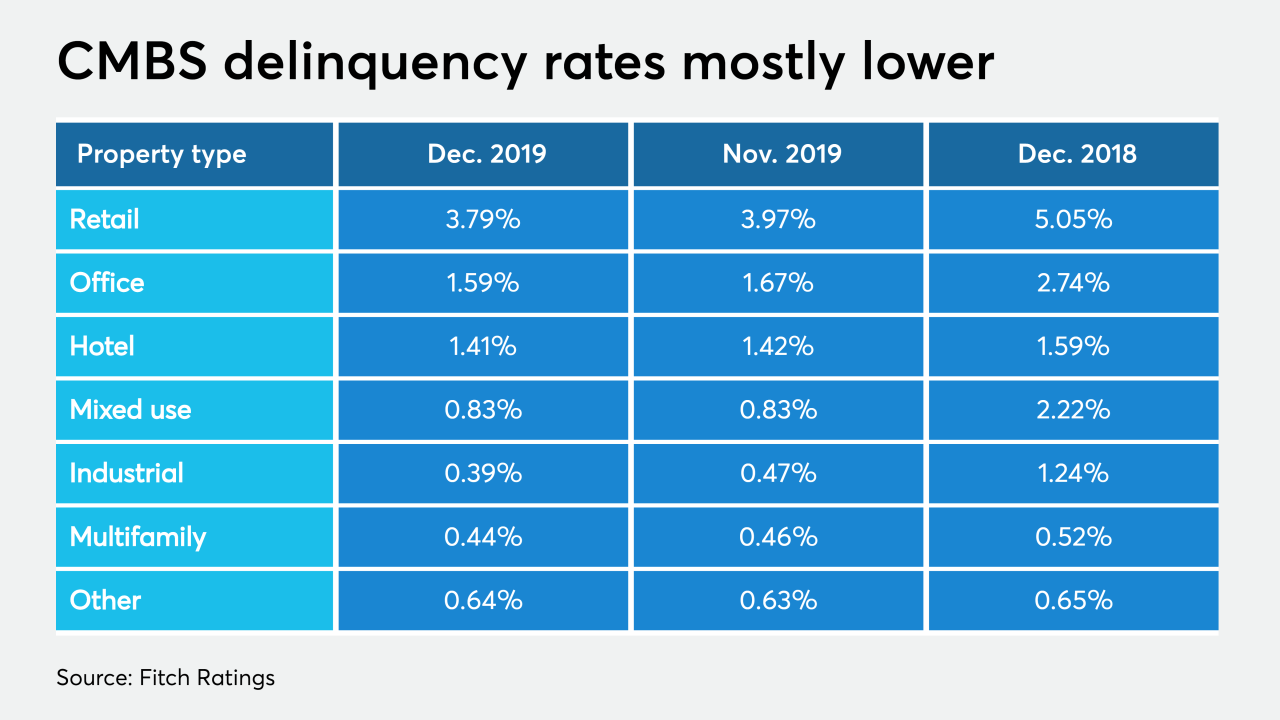

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

A New York-based real estate investment firm is financing its acquisition of a portfolio of nationally branded hotels via the commercial mortgage securitization market.

January 9 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

DBRS Morningstar's presale report raises concerns that the securitized loan for Onni Group's Wilshire Courtyard faces considerable risks from the business volatility of its largest tenant.

December 20 -

Blackstone Real Estate Partners is planning a $1.7 billion bond sale secured by a commercial mortgage loan that financed its newly acquired controlling interests in Great Wolf Lodge waterpark entertainment resort properties.

December 11 -

REIT Paramount Group is getting a $140M equity pay-out in a debt refinancing for the noted Broadway Theater district office tower, home to the Gershwin Theater and several prominent tenants.

December 10 -

According to presale reports, Ohana Real Estate Investors is sponsoring a $370 million bond sale backed by an interest-only, floating-rate loan financing its purchase of the Monarch Beach Resort in Dana Point, Calif.

December 4 -

According to presale reports, Ohana Real Estate Investors is sponsoring a $370 million bond sale backed by an interest-only, floating-rate loan financing its purchase of the Monarch Beach Resort in Dana Point, Calif.

December 4 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

Developer Stephen Ross' firm is among a trio of sponsors securitizing part of a $1.245 billion loan for another office tower development in New York's Hudson Yards submarket.

November 29 -

Blackstone Real Estate Partners is securitizing a new $343 million commercial mortgage that financed the parent firm’s recent acquisition of a portfolio of Southern California apartments.

November 21 -

The sponsors of the Class A structure, deemed a “trophy asset” by Kroll Bond Rating Agency, are placing $825 million of a $1.2 billion whole loan into a transaction dubbed CPTS 2019-CPT.

November 12 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The $50.4 million participation is the largest loan in UBS' next $807.3 million commercial mortgage securitization.

October 15