-

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

BX Commercial Mortgage Trust 2019-XL, via Citigroup, features 11 note classes backed by a floating-rate, first-lien mortgage on 406 Blackstone-owned properties with a tenant roster of over 2,000 lessees — including Home Depot, UPS, FedEx and Amazon.

October 7 -

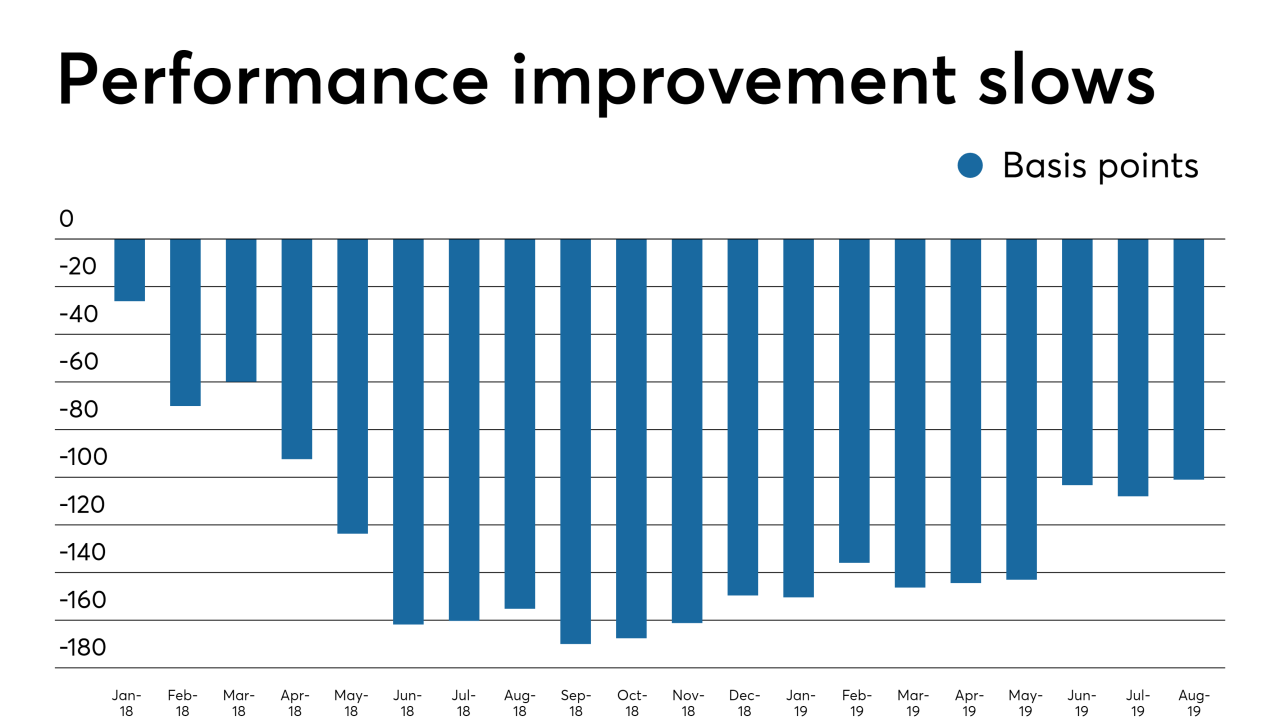

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

A Silicon Valley mega-office-tower complex that is home to both Amazon and Facebook corporate offices is making another appearance in a conduit commercial mortgage-loan securitization.

August 28 -

The collaborative workspace officer provider, which filed for its IPO last week, will be securitizing a $240 million loan used in the purchase of the San Francisco building where it leases space to member clients.

August 19 -

Bank of America is tapping the commercial mortgage-backed securities market to refinance the debt on its namesake Manhattan office building, providing BofA and building co-owner The Durst Company with a hefty cash-equity payout.

August 1 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Occidental Management is sponsoring a single-asset, single-borrower deal through JPMorgan backed by the fee simple interest from receivables of a lease-buyback arrangement with Sprint Corp.

July 16 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

Some commercial mortgage-backed securities due next year could have difficulty refinancing due to the recent Ridgecrest earthquake, according to a new Morningstar report.

July 11 -

The publicly traded real estate investment firm is backing the securitization via Citi with 156 properties in 28 states.

June 25 -

Blackstone's real estate affiliate and property management firm SITE Centers Corp. acquired the 12 centers across seven states in 2014.

June 21 -

The loan covering single-tenant distribution/fulfillment centers is the largest obligation in the transaction being rated by four agencies.

June 20 -

S&P says investors are asking more questions about how rising levels of self-storage property collateral is affecting conduit CMBS transactions.

June 17 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

The $161.5 million transaction backed by leasehold interests in the Jimmy Buffett-themed luxury hotel will include a $49.3M cash-out payment to the Denver-based PE firm.

May 20