The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a

That would be in addition to the drop in the rate to 89% in April from 98.5% in March.

A total of $7.72 billion in CMBS loans will mature through December. "We have valued approximately 97.9% of them and 23.1% have loan-to-value ratios greater than 80%," said the report written by Steve Jellinek and Beth Forbes. Approximately 8.3% of the mortgages had an LTV over 100%.

"Although LTV is a reasonable barometer in Morningstar's maturity analysis, a loan's refinancing ability is also subject to its debt service coverage ratio, debt yield, amortization and lease expiration risk. Beyond an individual property's performance, factors such as capitalization rates and specific real estate market trends also will influence a loan's refinance prospects," the report added.

Previously, Morningstar specifically mentioned mortgages

The CMBS delinquency rate rose for the first time in six months during April, up 1 basis point to 1.57%, the report said. The growth in CMBS issuances was not enough to offset a $217.8 million net increase in delinquent mortgages, to $13.73 billion.

This declined $4.63 billion or 25.2% from the unpaid principal balance of delinquent loans in April 2017, while the rate is 67 bps lower than one year prior.

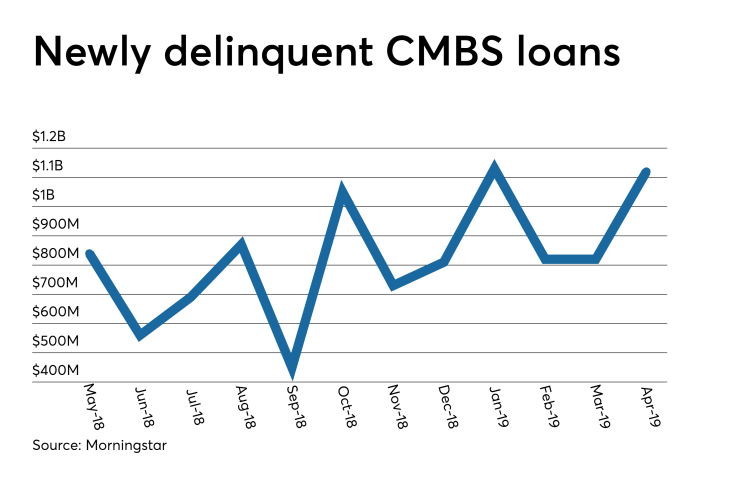

For the third time in the past 12 months, the volume of newly delinquency CMBS loans topped $1 billion, at $1.12 billion for April.

Much of the delinquent inventory consists of loans made before the crisis. Of the entire CMBS universe, 1.12% are delinquent loans made prior to 2010, while 0.45% were originated from 2010 through 2019.

"Since peaking at 8.5% in May 2012, the delinquency rate has steadily declined; however, we believe the rate will reach an inflection point in 2019 or 2020. The burning off of legacy loans has been a significant factor in the steady decline in recent years. However, its impact will eventually wane, with the legacy balance representing less than 3% of the universe today and declining rapidly," the Morningstar analysts said.

They predicted the delinquency rate to remain below 2% for much of 2019.

Meanwhile, the UPB of loans transferred to a special servicer rose for the second consecutive month, to $16.81 billion in April. In February, it was at a post-crisis low of $16.28 billion.

Over the past 12 months, the UPB is down by $5.05 billion.

Loans from prior to 2010 account for over 65% of specially serviced loans by UPB.