-

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

SunTrust sold an insurance financing unit that it deemed noncore, but it is on the lookout to buy more complementary businesses such as a CRE lender it acquired last year.

December 6 -

The Trepp CMBS delinquency rate is now 5.18%, a decrease of three basis points from the October level; declines were limited to the industrial, multifamily and office subindexes.

December 5 -

A New York banker who mastered the art of buying low and selling high, broke industry norms and learned from his mistakes in commercial real estate, John Kanas became a model regional bank builder. After stepping down as BankUnited's CEO last year, he wants to do "one more thing" before fully calling it quits.

November 28 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

Built Technologies successfully completed a capital raise, enabling the three-year company to expand its software offerings for both commercial and residential construction lenders.

November 20 -

Sterling Bancorp in New York is determined to turn Astoria Financial's largely residential operation into a commercial powerhouse. While investors are skeptical, CEO Jack Kopnisky has proven in the past that such an ambitious plan is doable.

November 13 -

Rather than pull up stakes and leave two low-income Mississippi towns at the mercy of payday lenders, Regions Bank donated the branches to a local credit union and kicked in another $500,000 for operating costs.

November 7 -

Capital Corps, led by Steven Sugarman, aims to provide financing to homeowners and small businesses that it believes are overlooked by banks. The firm features several former Banc of California executives.

November 6 -

Call-report data on commercial and industrial loans does not fully capture small-business lending by smaller institutions, a recent FDIC survey suggests.

November 1 -

The delinquency rate for U.S. commercial real estate loans in CMBS is now 5.21%, a decrease of 19 basis points from the September level, according to Trepp. That is the second-largest rate drop measured in the last 19 months.

October 31 -

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

October 25 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24 -

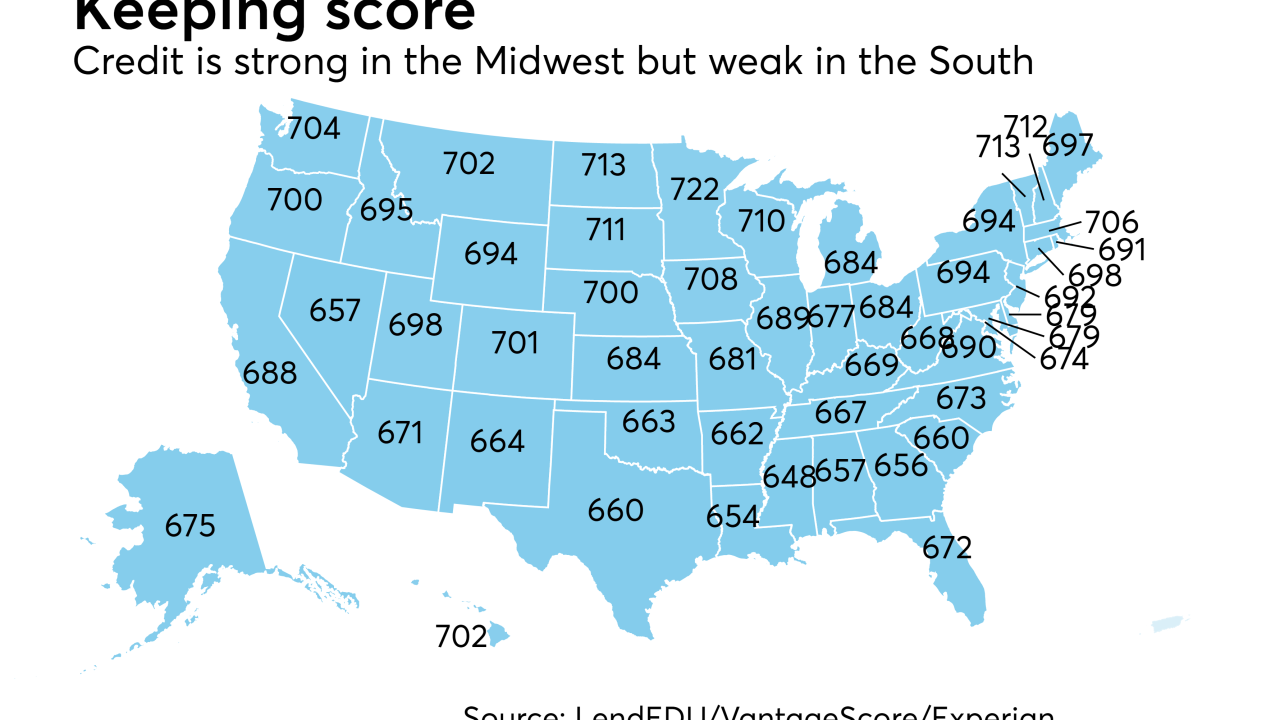

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

The $36.3 billion-asset bank reported double-digit growth in C&I loans, commercial real estate loans and specialty loans to the private-equity, entertainment and energy industries in the third quarter.

October 19 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16