-

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

Challenger banks aimed at Blacks, Hispanics, immigrants and other underserved groups are offering financial education and support for charities in addition to basic banking services.

December 31 -

Treasurer Ma has championed programs to give minority and women-owned businesses a seat at the table throughout her career. A mission of the Treasurer is increasing diversity to increase equitable outcomes.

August 20 -

The widespread protests that have followed George Floyd's death are, in part, a response to long-standing inequities in the Black community that the coronavirus has only exacerbated. Here's how Donnell Williams, president of the National Association of Real Estate Brokers, thinks the mortgage market can respond.

June 12 -

The current debate around changes to the Community Reinvestment Act should include discussions about how the law can be used to better support low-income communities in remote areas.

April 3 Hope Enterprise Corp., Hope Credit Union and Hope Policy Institute

Hope Enterprise Corp., Hope Credit Union and Hope Policy Institute -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 7 Duke Financial Economics Center

Duke Financial Economics Center -

The Office of the Comptroller of the Currency’s questions for the public to comment on the decades-old law could illuminate a path forward as regulators struggle to agree on an updated policy.

August 30 -

Call it mutual respect. Bankers from mutually owned British building societies and similarly structured U.S. thrifts recently gathered in New England to address common challenges and share ideas about staying relevant at a time of rapid change in financial services. Here are the takeaways from their meetings.

May 18 -

Carver Bancorp, which has spent 70 years serving minorities in Harlem and surrounding neighborhoods, is struggling to turn a profit. As black-run banks nationwide struggle to stay afloat, Carver's CEO insists the institution is on the right track.

November 20 -

Rather than pull up stakes and leave two low-income Mississippi towns at the mercy of payday lenders, Regions Bank donated the branches to a local credit union and kicked in another $500,000 for operating costs.

November 7 -

Capital Corps, led by Steven Sugarman, aims to provide financing to homeowners and small businesses that it believes are overlooked by banks. The firm features several former Banc of California executives.

November 6 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

President Trump’s proposed cuts to programs providing credit options for low-income and underserved communities would have a particularly negative effect in states that voted for him.

March 20

-

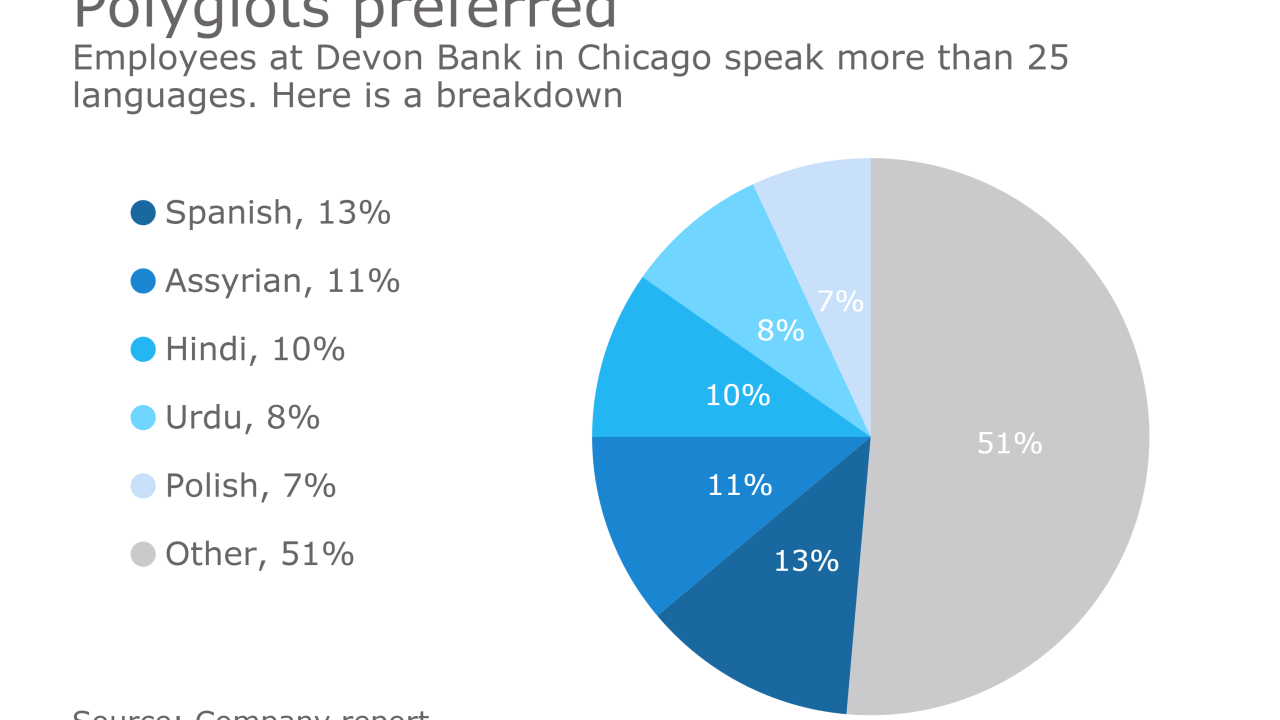

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16