-

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

With issuance of marketplace securitizations now exploding — rising 300% cumulatively in the past two years — the idea of online lending as a niche is quickly deteriorating.

October 13 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

The Tennessee bank said it has bought Professional Mortgage in Greenville, S.C., which services about $1.1 billion of commercial mortgage loans for 23 correspondent life company lenders.

October 11 -

A 38% increase in new loan originations led to another quarter of record earnings.

October 11 -

Demand for commercial loans has been weak for much of the past year and among the big questions bank executives will face this earnings season is when they can expect the pace to finally pick up.

October 10 -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28 -

In a business populated by extroverts, Diana Reid views herself as an introvert. The head of PNC Real Estate at PNC Financial Services Group says it's an attribute that she's made an asset as she looks to build consensus and drive business growth.

September 25 -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

As distressed inventory dries up and home prices soar, more investors are borrowing to buy flip houses. Here's a look at the 12 states with the largest share of financing for flipping houses.

September 20 -

The online lender has accelerated its search for a permanent CEO and is said to be seeking someone with a history of success in banking.

September 15 -

Banks could be busy supplying credit to manufacturers, hotels, multifamily developers and other businesses that will be helping residents get their lives back on track after two fierce storms.

September 14 -

The U.S. subsidiary of Japanese-owned Orix Corp. is adding another housing finance firm in the commercial and multifamily space to its stable of companies with its purchase of Lancaster Pollard.

September 13 -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

Lima One Capital is expanding its single-family investor financing business by acquiring the residential debt business of the marketplace lender RealtyShares.

September 12 -

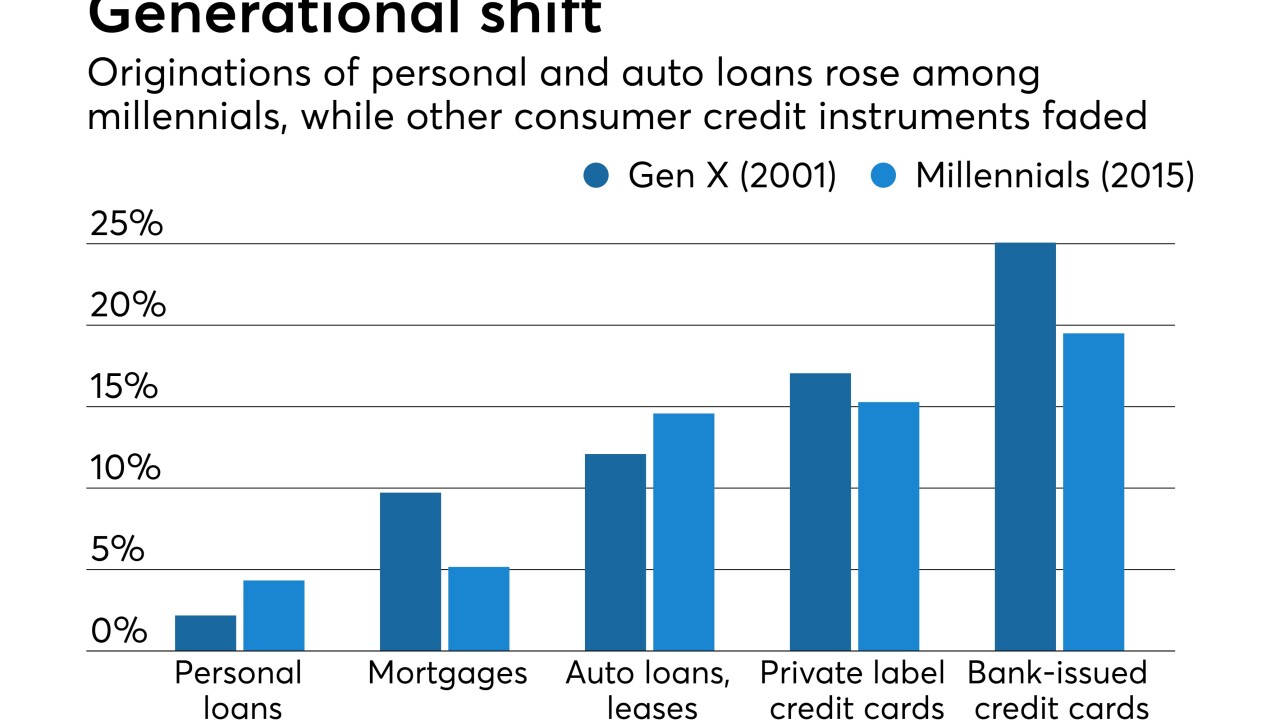

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

Quaint Oak in Pennsylvania is making a big push in real estate brokerage, a business that many state-chartered banks might think is illegal for them to pursue.

September 5