-

Call-report data on commercial and industrial loans does not fully capture small-business lending by smaller institutions, a recent FDIC survey suggests.

November 1 -

The delinquency rate for U.S. commercial real estate loans in CMBS is now 5.21%, a decrease of 19 basis points from the September level, according to Trepp. That is the second-largest rate drop measured in the last 19 months.

October 31 -

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

October 25 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24 -

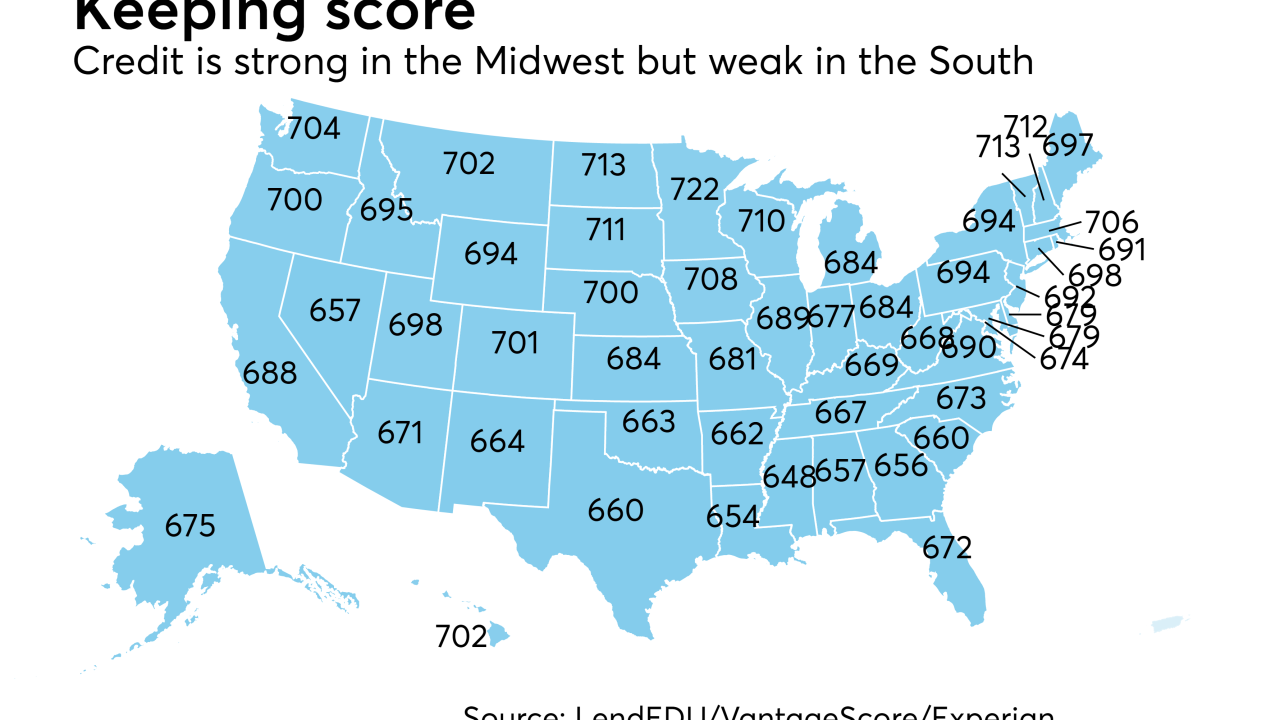

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

The $36.3 billion-asset bank reported double-digit growth in C&I loans, commercial real estate loans and specialty loans to the private-equity, entertainment and energy industries in the third quarter.

October 19 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16 -

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

With issuance of marketplace securitizations now exploding — rising 300% cumulatively in the past two years — the idea of online lending as a niche is quickly deteriorating.

October 13 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

The Tennessee bank said it has bought Professional Mortgage in Greenville, S.C., which services about $1.1 billion of commercial mortgage loans for 23 correspondent life company lenders.

October 11 -

A 38% increase in new loan originations led to another quarter of record earnings.

October 11 -

Demand for commercial loans has been weak for much of the past year and among the big questions bank executives will face this earnings season is when they can expect the pace to finally pick up.

October 10 -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28 -

In a business populated by extroverts, Diana Reid views herself as an introvert. The head of PNC Real Estate at PNC Financial Services Group says it's an attribute that she's made an asset as she looks to build consensus and drive business growth.

September 25 -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25