-

Democrats reintroduce a $100 billion housing equity bill to help first-generation buyers and address racial disparities in homeownership.

June 30 -

A large share of each generation, baby boomers, Gen X, Millennials and Gen Z, said another age group is the reason why homeownership is unaffordable, Clever found.

April 22 -

Recent housing trends more favorable to buyers will ease some of the pressure for higher down payments in order to secure a winning bid, Redfin finds.

February 25 -

The assistance is available for borrowers with sub-620 FICO scores with earnings less than 80% of the Area Median Income, or first-time home buyers with no restrictions.

May 16 -

Affordability challenges also have some aspiring homeowners taking second jobs or looking to draw from retirement savings, according to Redfin.

March 29 -

Fannie Mae also will be making a four-figure adjustment available next month and Freddie Mac is contemplating expanding its program to a new income tier.

February 5 -

While several communities offer monetary incentives to attract new residents, some are making overtures with down payment and other types of assistance aimed at building up their local housing markets.

January 9 -

The program is even lower than Freddie Mac's best of 3%, with Zillow offering to pay 2% of the down payment at closing, according to a statement Thursday.

August 24 -

The announcement comes as interest in Federal Home Loan bank funding has experienced a resurgence, with advances up 48% in the first six months this year.

August 23 -

The sharp increases of the pandemic era have added nearly a year to the amount of time the average consumer needs to save for a 20% down payment, according to Tomo.

September 28 -

Congress included funding for such assistance in its infrastructure bill.

August 20 -

Renters will need to reserve an additional $369 per month to keep up with rising listing prices over the next year, according to Zillow.

July 8 -

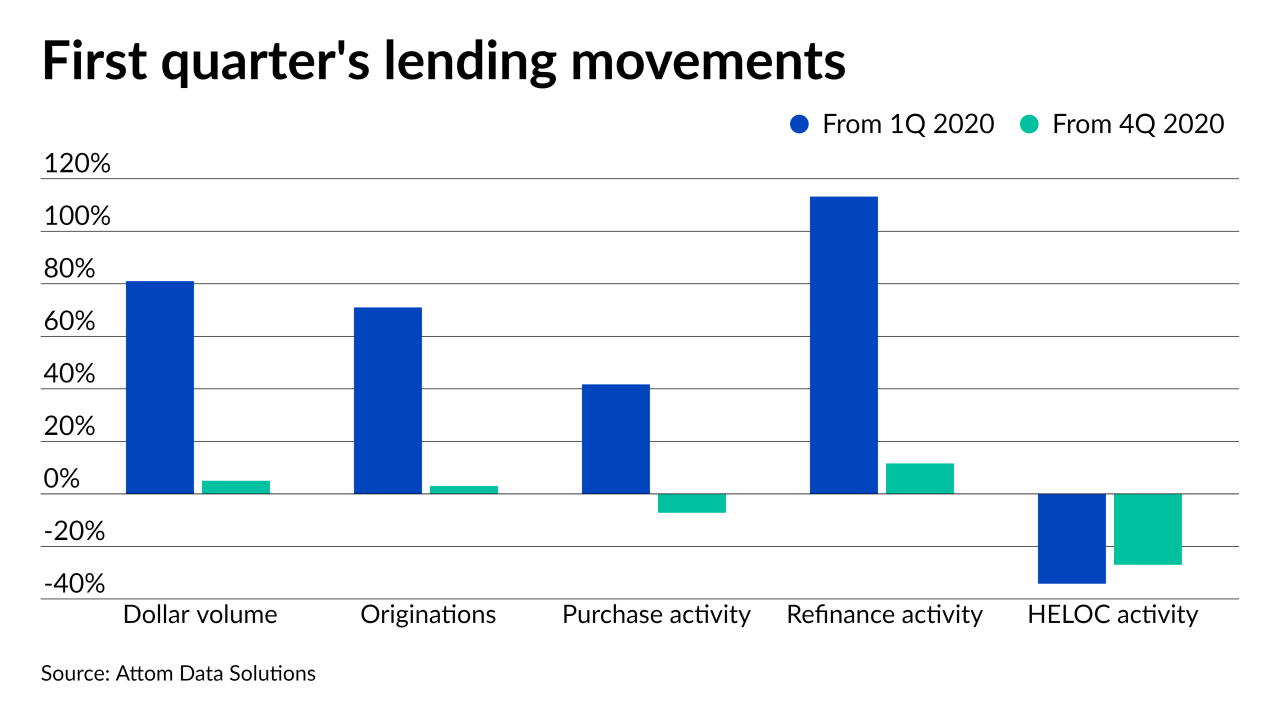

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Even in the best-case scenario, it would take 45 years to achieve an equal amount of housing-related capital between Blacks and whites.

April 26 -

The draft of the Downpayment Toward Equity Act of 2021 calls for grants for a limited segment of the market: those whose parents don't own homes.

April 19 -

The SmartBuy program, offered by the Illinois Housing Development Authority, has drawn interest from out-of-state buyers too.

April 5 -

But private mortgage insurers should not see significant impact on business if a 25 basis point reduction were to occur sometime after 2021, according to BTIG.

March 31 -

The $10 million program appears to be the first of its kind in the nation.

March 23 -

The Military Urban Development Initiative, which is also open to civilians, allows buyers to select a lot, house design and mortgage.

March 22 -

Apart from saving more money, millennials prefer to spend their savings on a home down payment, Zonda economist Ali Wolf said.

March 17