-

Aggressive restructuring moves and stock buybacks are giving CIT time to remold itself, but it will need to show core-banking growth to stave off calls for the company to sell itself.

May 30 -

Two Harbors Investment Corp. is spinning out its commercial real estate lending business to a newly created real estate investment trust, Granite Point Mortgage Trust Inc.

May 24 -

The trend of putting ever-smaller pieces of the same commercial mortgages into multiple securitizations requires investors to be extra careful, and will inevitably make workouts of bad loans more complicated.

May 19 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

Some believe that increased bank regulation is to blame for overall slower growth in commercial and industrial loans. Yet that assessment misses some important details.

May 17 Milken Institute

Milken Institute -

The GOP is working on a plan that could extend the Congressional Review Act's reach so that it may overturn certain policies all the way back to 1996.

May 12 -

Construction lending could make a comeback if bankers persuade Congress to reform capital and other complicated rules on so-called high volatility CRE loans. But will regulators go for it?

May 12 -

The U.S. Chamber of Commerce and Union Bank urged the Consumer Financial Protection Bureau on Wednesday to narrow its approach to collecting data on small-business lending, fearing it could add costs and compliance burdens.

May 10 -

The Consumer Financial Protection Bureau plans to launch an inquiry into small-business lending, the first step toward crafting a rule for the collection and reporting of data.

May 10 -

The next single-asset CMBS to hit the market is backed by the land under an iconic Manhattan address known as the Lipstick Building.

May 5 -

The Louisiana company also said that credit quality in its energy portfolio improved during the first quarter.

April 28 -

The Trump administration's initial tax plan may be short on details, but a bipartisan bill offers some very specific relief for the commercial real estate industry.

April 27 -

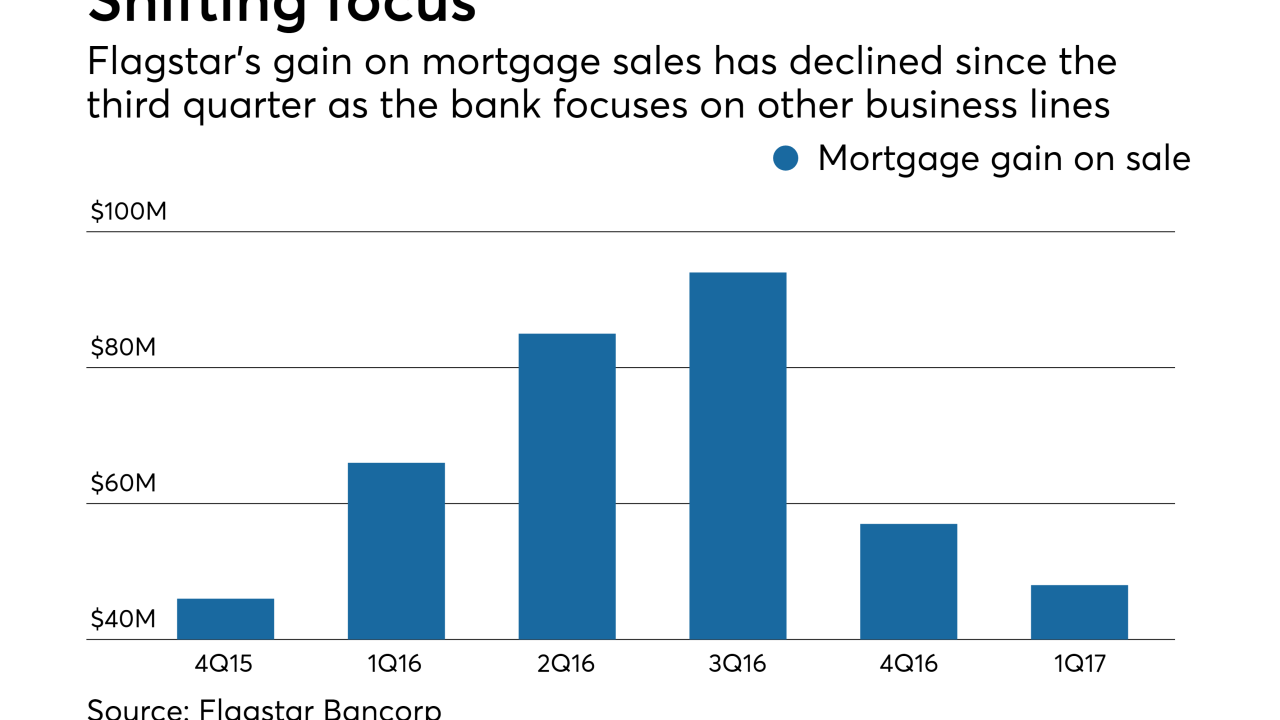

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Strong gains in low-cost health savings account balances helped fuel loan growth at the Waterbury, Conn., company.

April 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

Earnings per share fell a nickel short of estimates due in part to lower-than-expected revenue from the origination and sale of mortgages.

April 20 -

The New York bank has rapidly expanded its commercial real estate lending over the last several years, but now it is ready to slow down a bit and add more commercial and industrial loans to the mix.

April 19 -

Texas Capital Bancshares sharply reduced the size of its loan-loss provision as credit quality improved in its energy loan book. That helped the Dallas bank post a 77% rise in first-quarter profit.

April 19 -

The Mississippi company's first-quarter earnings rose 60% from a year earlier. Its results from last year were weighed down by a settlement with regulators.

April 19 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18