-

Texas is receiving $58 million from the Community Development Block Grant disaster recovery program that HUD administers.

October 20 -

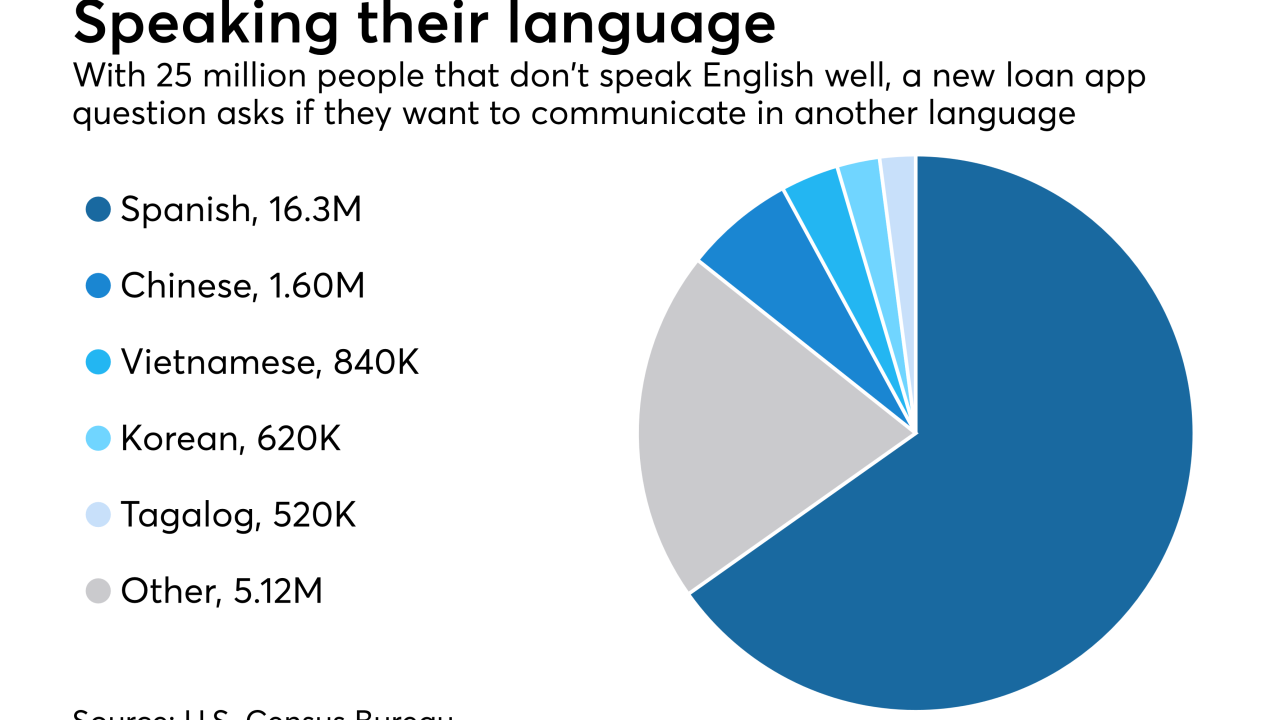

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

For the past eight years, Brian Montgomery has helped mortgage lenders fight penalties sought by the Federal Housing Administration. Now he's President Trump's nominee to lead the agency.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17 -

Fannie Mae used last year's Home Mortgage Disclosure Act data to increase its origination projections for both 2017 and 2018 even as its overall economic outlook remained unchanged from September.

October 17 -

A six-lane highway lined with strip malls cuts through a patchwork of tamed lawns and suburban houses in Delran, N.J., where population has sprouted rapidly in recent decades.

October 17 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Ginnie Mae and the Department of Veterans Affairs have described in more detail the VA loan refinancing practices they will crack down on to eliminate a long-running churning concern.

October 16 -

The latest version of Ellie Mae's Encompass loan origination system includes new features for Home Mortgage Disclosure Act compliance and digital mortgages.

October 16