-

Fannie Mae has obtained reinsurance for $510 million of credit losses on $20.4 billion of single-family residential mortgages through a pair of credit insurance risk transfer transactions.

March 24 -

The groups and industry trade associations want the Treasury Department and the FHFA to allow Fannie Mae and Freddie Mac to build up capital reserves.

March 23 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

Implementation of the second phase of the common securitization platform had been projected for next year, but the anticipated time frame was delayed following "lessons learned" from the first phase.

March 23 -

Higher interest rates have reduced prepayments to levels not seen since 2014.

March 23 -

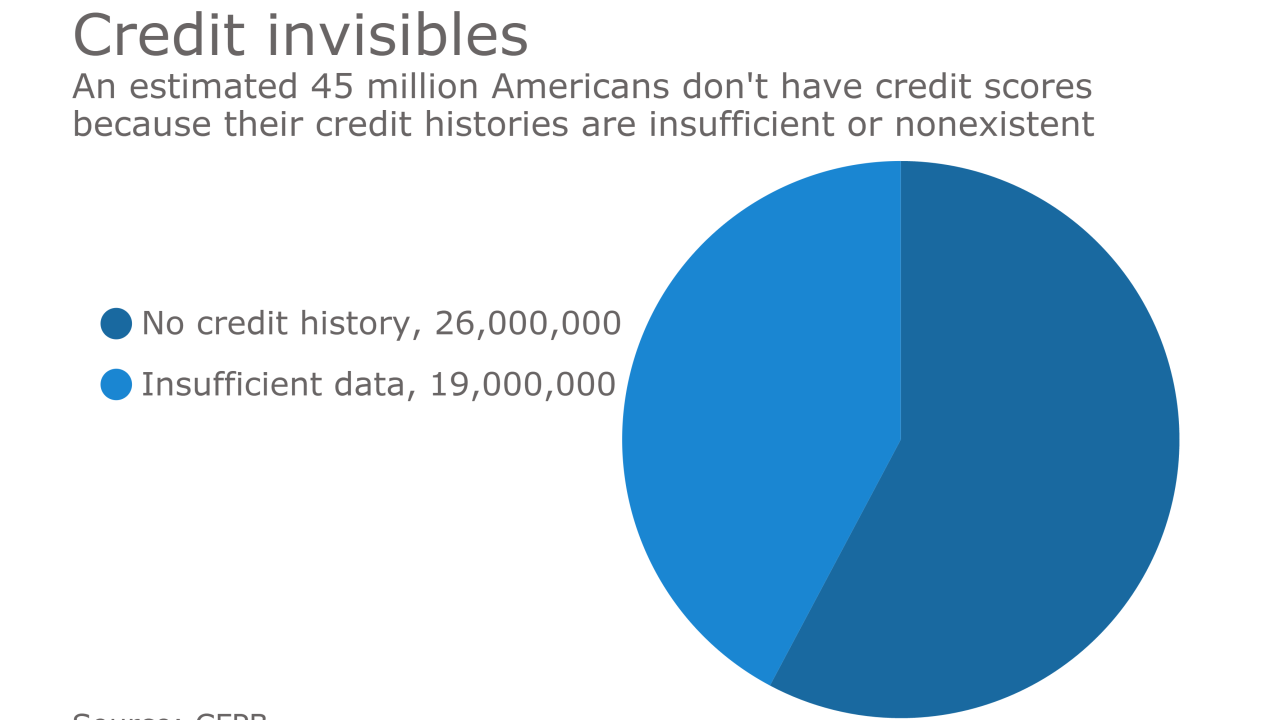

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Servicers are able to borrow more against their Ginnie Mae mortgage servicing rights as financing providers become more comfortable with the collateral.

March 23 -

Though it's too early to have a concrete plan regarding Fannie Mae and Freddie Mac, the administration is creating a set of principles that it hopes to release in a few months.

March 21 -

A federal jury has convicted two businessmen on multiple bank fraud charges related to falsifying loan documents to postpone foreclosure on a parcel of land in Aurora, Ill., worth nearly $2 million.

March 21 -

Bank of America has completed its legal settlement obligation with the Department of Justice to provide $7 billion in consumer relief nearly two years ahead of schedule.

March 20