-

As Rodrigo Lopez begins his term as chairman of the Mortgage Bankers Association, the Nebraska multifamily lender seeks to use the platform to embrace the challenges of improving diversity and technology throughout the industry, while remaining vigilant about the ever-changing regulatory landscape.

October 23 -

The Consumer Financial Protection Bureau's proposed changes to new mortgage disclosure requirements do not go far enough, according to many in the industry.

October 21 -

Moody's Corp. said federal officials are planning a lawsuit over its ratings of residential mortgage securities that critics contend were inflated to win business in the years leading up to the 2008 financial crisis.

October 21 -

A federal court appeals decision could theoretically mean that Comptroller of the Currency Thomas Curry now answers directly to Treasury Secretary Jack Lew, a significant break from the agency's history of independence.

October 21 -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

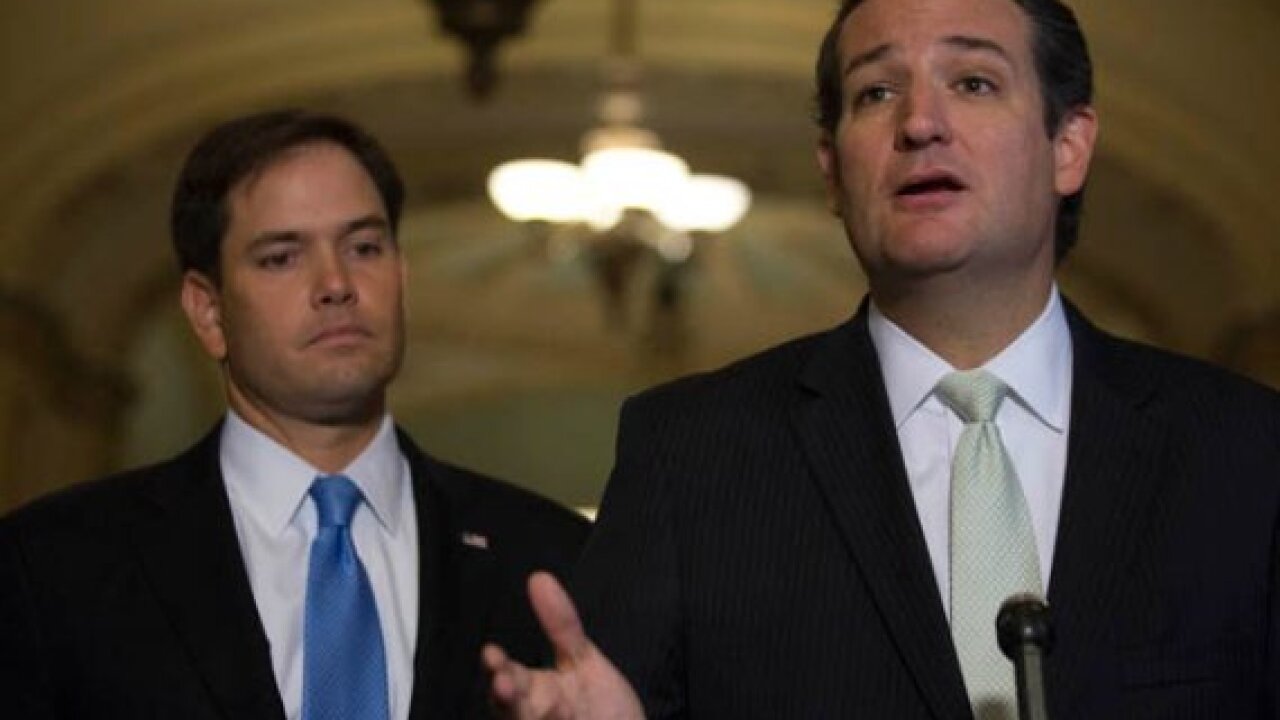

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

With the election just weeks away, here's a look at the mortgage industry firms whose employees have made the largest political contributions during the 2016 election cycle.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

Greg Carmichael, who has been on the job nearly a year as Fifth Third's CEO, has started putting his stamp on the company by aggressively trimming branches in favor of mobile, seeking to build up its consumer credit business and retooling the balance sheet.

October 20 -

The mortgage industry remains deeply uneasy with efforts by Fannie Mae, Freddie Mac and their regulator to experiment with front-end credit risk transfers, with some arguing it helps borrowers and lenders, while others fear it will cut out small institutions.

October 20