-

With an interest rate increase by the Federal Reserve Bank increasingly looking imminent, what else has to happen to set the stage for a return to adjustment-rate mortgages?

December 1 -

Anticipation of rising interest rates has stirred more talk among mortgage lenders about the need to originate loans to borrowers with low credit scores.

November 30 -

Broadway Financial Corp. in Los Angeles has been released from an enforcement action requiring it to improve its corporate governance.

November 30 -

Though regulation-mandated technology upgrades give vendors little time to rest, the growing acceptance of data standardization should appeal to both lenders and regulators.

November 30 eLynx

eLynx -

A plan by the government-sponsored enterprises to begin collecting the new Closing Disclosure data is designed to promote Fannie Mae and Freddie Mac's loan quality goals. But the initiative may also prompt broader use of e-signatures and paperless processing.

November 30 -

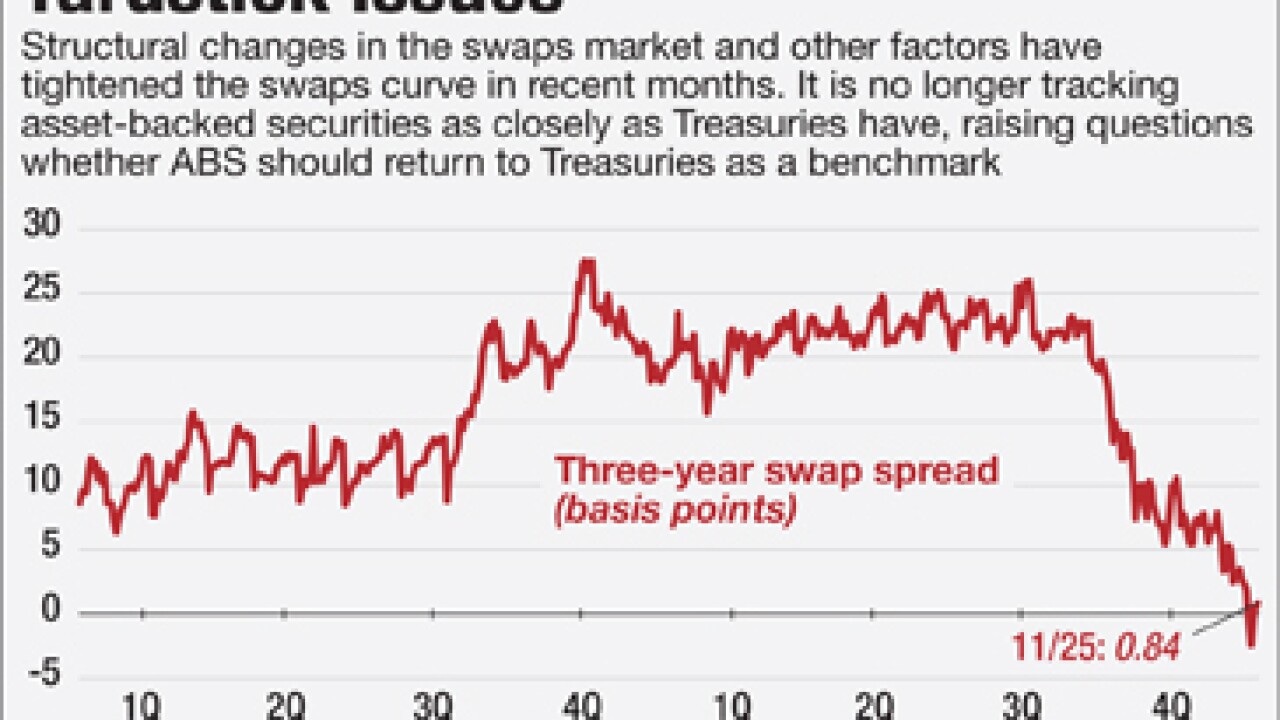

Commercial-mortgaged-backed, auto-loan and other securitizations use what is known as the swaps curve to price floating-rate deals. But pricing volatility is causing some to ask whether the market should go back to Treasuries after a 15-year hiatus.

November 25 -

The percentage of mortgage applications with defects declined in October, according to First American Financial Corp.

November 25 -

A recent CFPB action against a payday lender demonstrates why lenders across industries must disclose both the best and worst case repayment scenarios to consumers.

November 25 Offit | Kurman

Offit | Kurman -

Three county governments in metro Atlanta have sued Bank of America for engaging in the practice of equity stripping, where the bank targeted minority borrowers with high-interest mortgage loans.

November 25 -

Freddie Mac is prepping its next risk-sharing deal, according to presales from Fitch Ratings and Kroll Bond Ratings.

November 24