-

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

A proposal by a single utility threatens to upend California’s sweeping mandate requiring solar panels on almost every new home.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

A developer who swindled almost $400,000 from six families who sought new homes in Kirkwood, Mo., was sentenced to 12 months in prison.

November 11 -

Impac Mortgage Holdings generated $1.4 million in net income during the third quarter in earnings that were favorable compared to a string of losses in the past year.

November 8 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

Tighter mortgage regulations are making Canada's housing market less risky, according to the government agency responsible for its oversight.

November 6 -

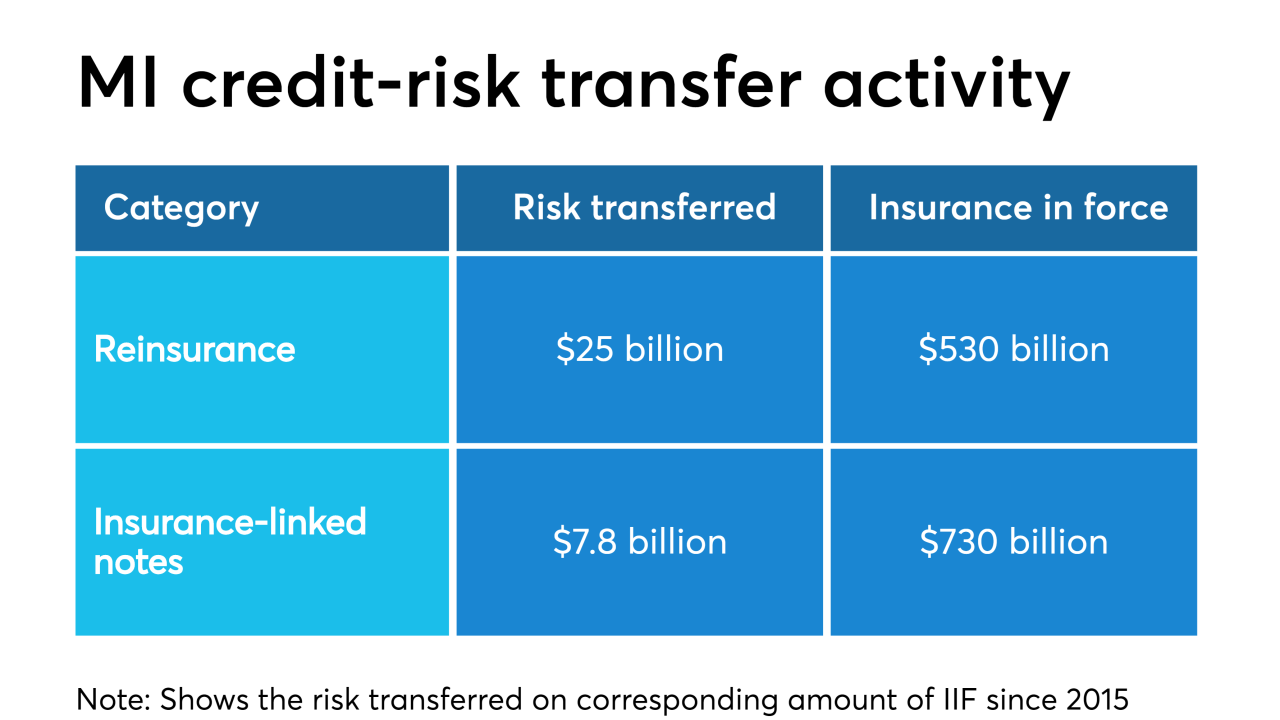

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5