-

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

The trend exists in all past-due categories for subprime mortgages, but the numbers are still below levels seen just before the pandemic, Vantagescore found.

November 30 -

A subprime-related settlement between the government and Deutsche Bank provided meaningful benefits to some U.S. consumers in need, according to a new report. But the author acknowledged that those gains could prove illusory for some consumers given the coronavirus crisis.

July 10 -

A former Hillsborough County, Fla., mortgage broker has been sentenced to 15 months in federal prison for his role in a scam to which banks lost more than $5 million.

June 15 -

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 4 -

The city of Philadelphia and Wells Fargo have agreed to resolve a 2017 lawsuit in which the city accused the bank of violating the Fair Housing Act by steering minority borrowers into risky, high-cost loans.

December 16 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11 -

Angelo Mozilo had a front-row seat during the collapse in housing prices a decade ago. Now the former chief executive officer of Countrywide Financial Corp. is predicting another drop, and for some homeowners it may be even worse.

May 9 -

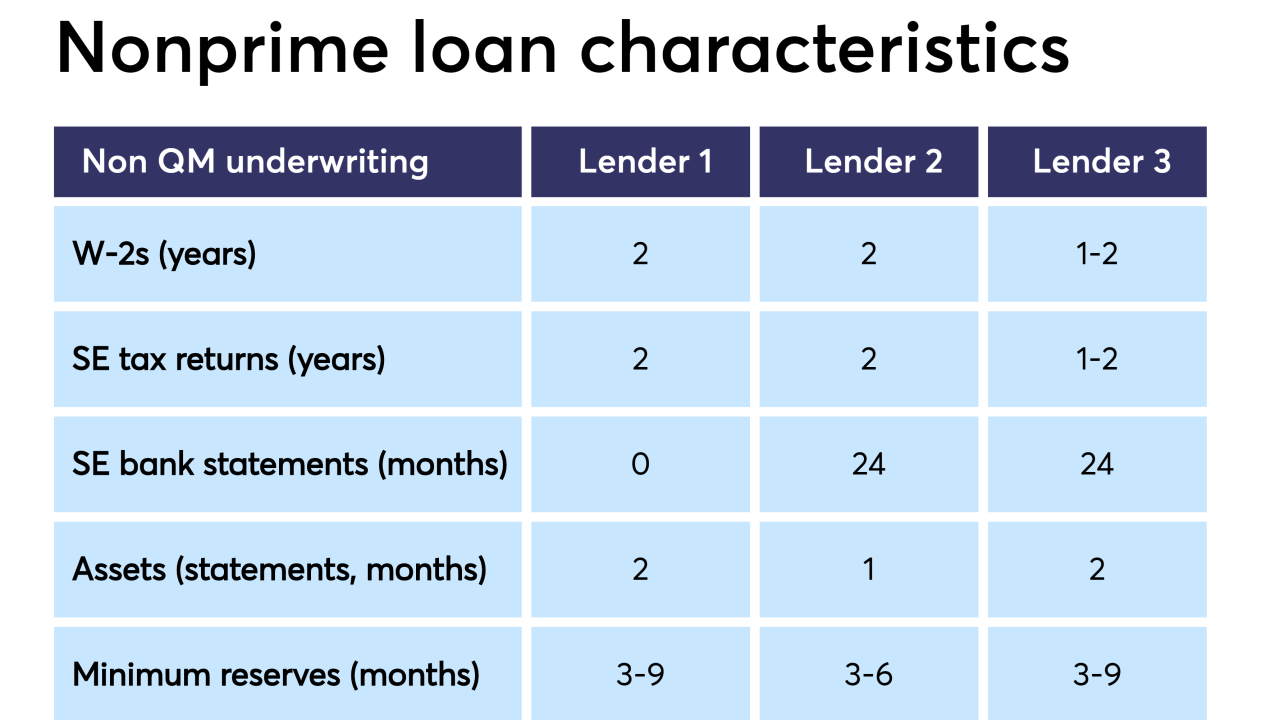

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

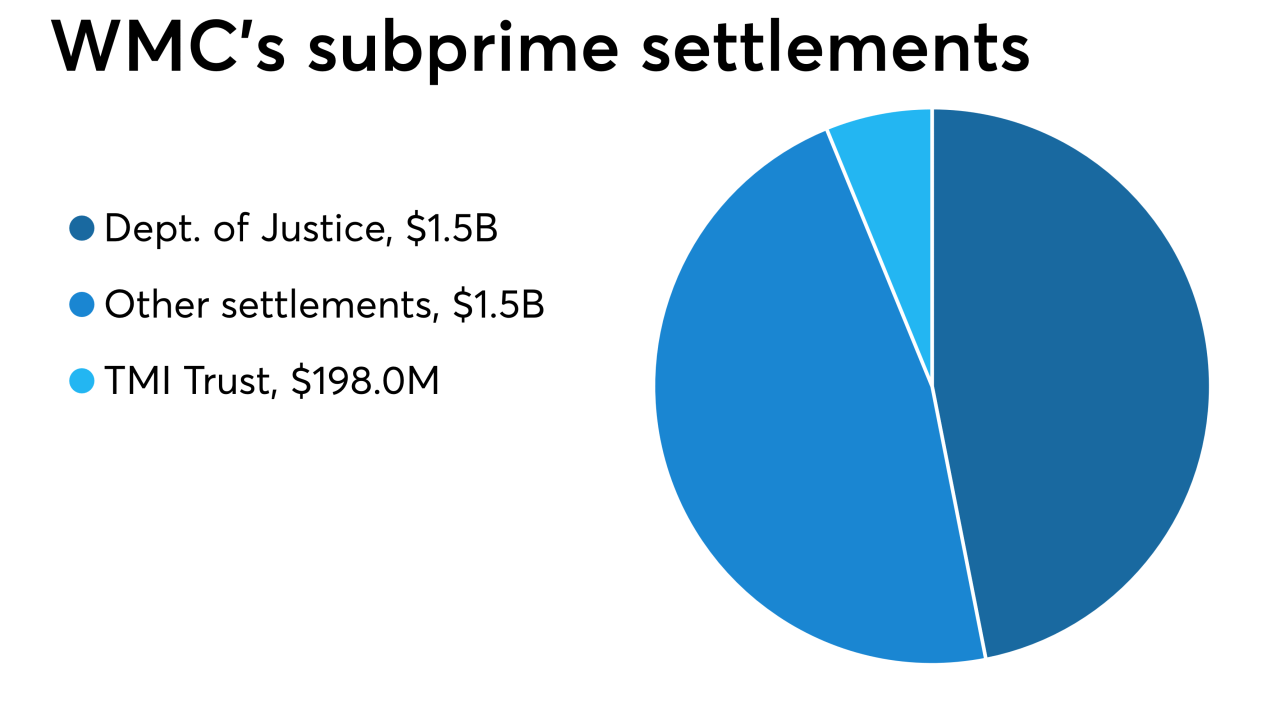

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Private-label residential mortgage-backed securitization is approaching a post-crisis high, according to Kroll Bond Rating Agency.

December 3 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23