-

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

The Trump administration is growing wary of taking bold steps toward freeing Fannie Mae and Freddie Mac from federal control before the 2020 election, said people familiar with the matter, in part because of the political risk of potentially upending the U.S. mortgage market.

July 12 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

Treasury and HUD are close to unveiling administrative and legislative options for ending the conservatorships of Fannie Mae and Freddie Mac. Will their findings be heavy on detail or leave a lot unanswered?

July 9 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

How the Trump administration can recapitalize Fannie Mae and Freddie Mac while remedying jilted private investors.

July 9 Boies Schiller Flexner LLP

Boies Schiller Flexner LLP -

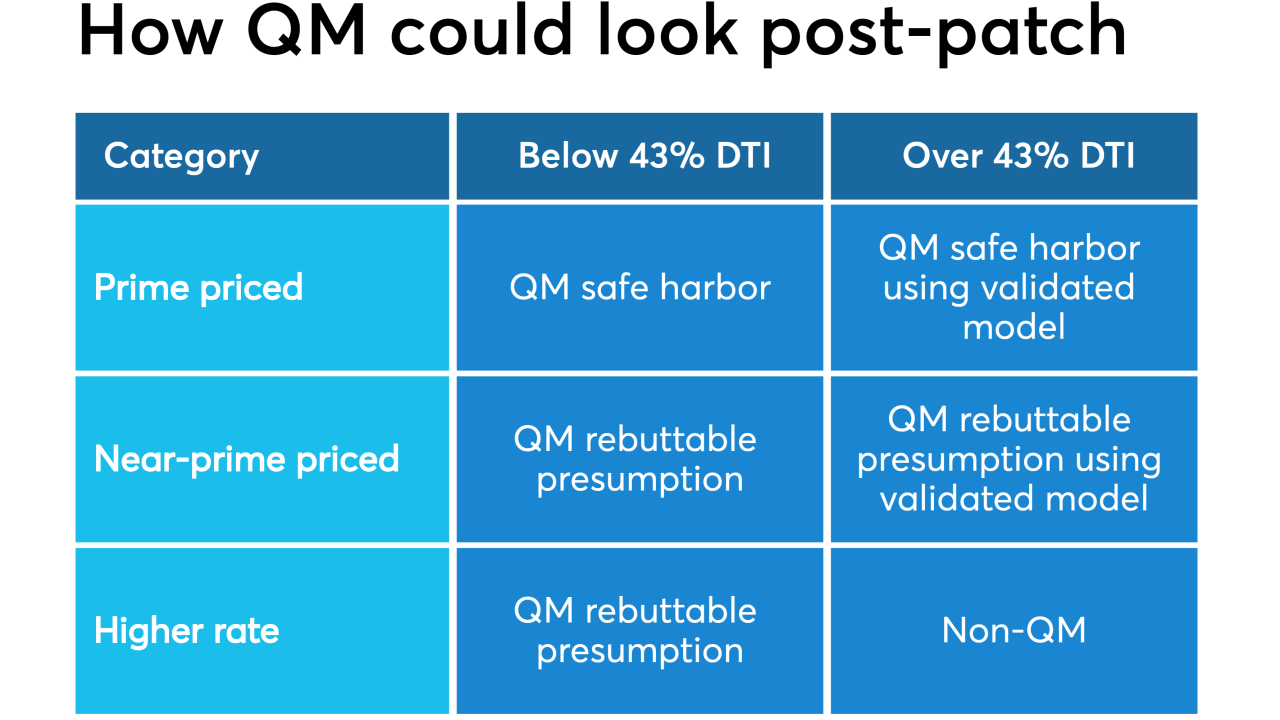

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

Critical comments about Wall Street in the first debates signal an unfriendly political environment for banks. Here is a sample of leading candidates’ financial policy views.

July 8 -

An Indiana man was sentenced to seven years in federal prison after his conviction for participating in a foreclosure rescue fraud scheme.

July 5 -

A Bay Area real estate agent has been indicted on charges of fraud and money laundering after allegedly promising home loans to clients then taking their money.

July 5