-

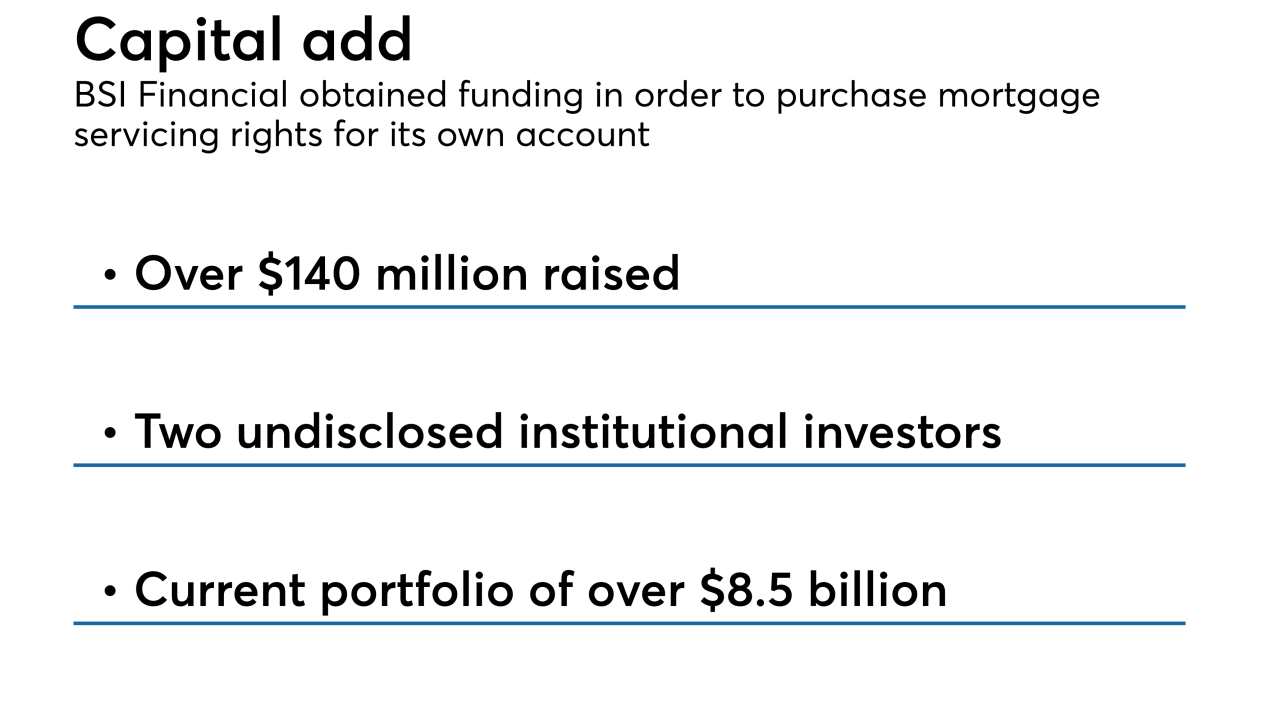

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

As ominous as the dark smoke that choked the Bay Area while California's most destructive wildfire raged 200 miles north, a second tragedy now is looming over the state — the loss of thousands of homes in an already housing-starved region.

December 5 -

The Woolsey Fire in Southern California destroyed or damaged as much as $6 billion in real estate, a new estimate shows.

November 28 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Challenges will likely increase as interest rates rise and investors grow more concerned about a downward turn in the economic cycle.

November 16 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

The uproar over the incendiary writings of a Consumer Financial Protection Bureau official have led to calls for his removal, but the agency’s interim chief says he won’t “let any outside group dictate who works here.”

October 11 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Bemortgage, currently a division of Chicago's Bridgeview Bank formed last November by a former Guaranteed Rate executive, will become a part of CrossCountry Mortgage.

September 26 -

As the House Financial Services Committee prepares to hold a hearing Thursday on oversight of the Federal Housing Finance Agency, the exact focus of the hearing remains somewhat in flux.

September 25 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

Level One Bank in Farmington, Mich., has hired a team of mortgage bankers from MB Financial, which previously announced it was shutting down this business line.

July 10 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6