-

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

The company, which launched last fall, announced a partnership with an organization that aids military families.

August 5 -

The overnight shift to working from home created a number of practical quandaries for mortgage firms large and small, according to a recent survey conducted by Arizent.

August 4 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

Record-low interest rates allowed homebuyers to purchase $32,000 more house for the same monthly payment compared to last July, boosting affordability to the highest level since 2016.

August 3 -

With low inventory and coronavirus limiting accessibility, nearly half of shoppers made offers sight-unseen in June, according to Redfin.

August 3 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

CEO Douglas Gordon credited the relationship between Waterstone Financial and the mortgage subsidiary for the boost in net income.

July 28 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

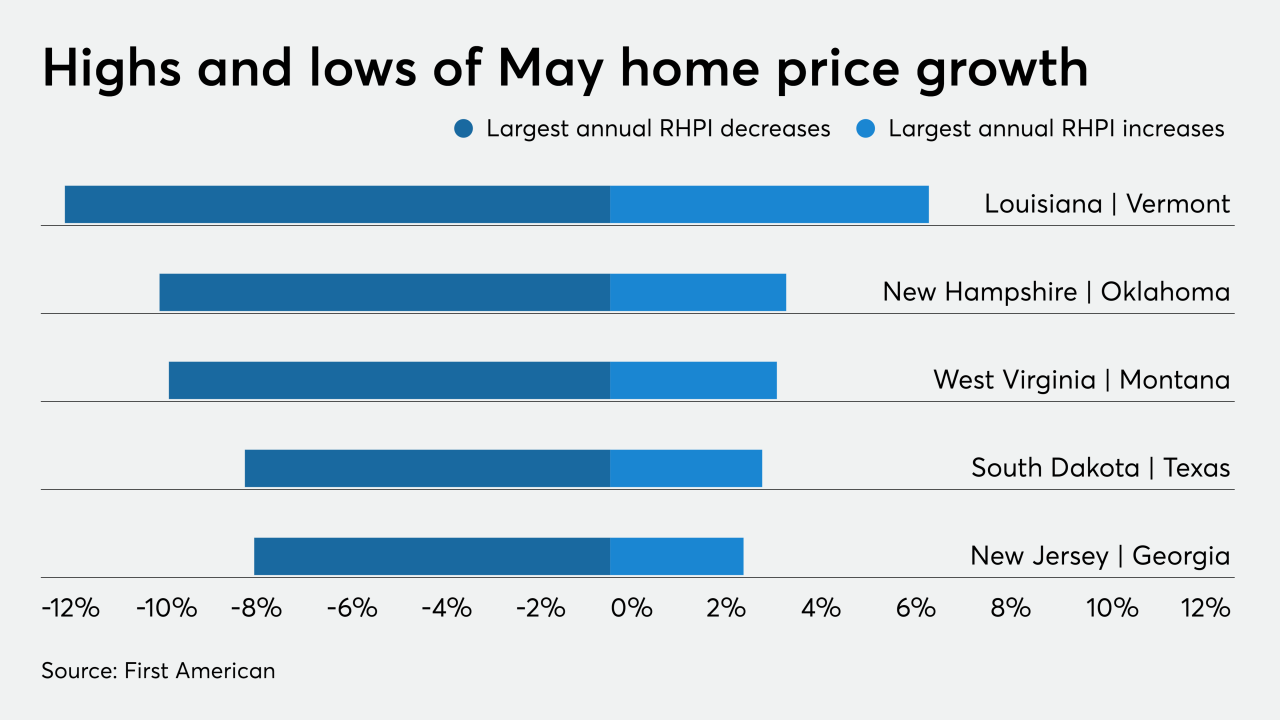

Tight inventory is expected to drive home prices higher over the summer, according to First American.

July 27 -

Whalen: "It is tempting to think that low interest rates will cure all ills in the housing sector, but this view is seriously in error, as we learned in 2008."

July 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As home loans surge and lenders look to expand, they're doing a cost-benefit analysis on the possibility of opening more commercial locations.

July 24 -

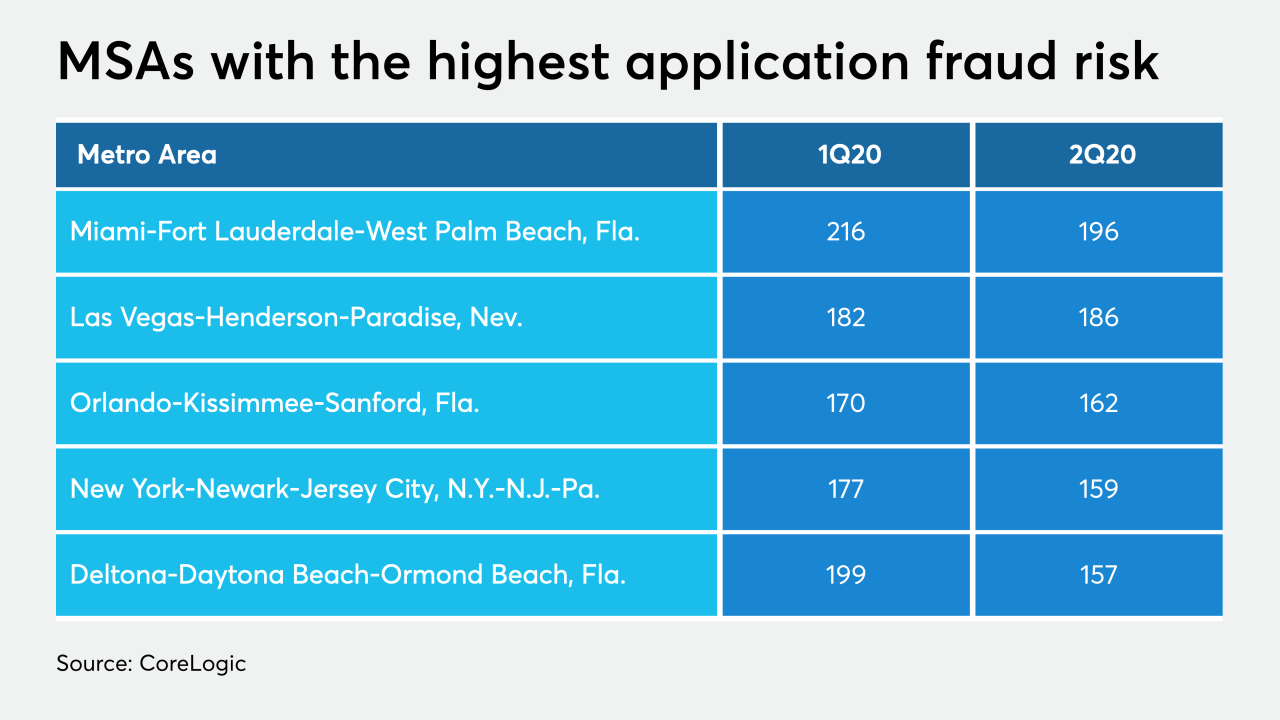

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

The Trump administration's executive order to terminate and replace federal enforcement of anti-discrimination policies at the local level, citing the burden it put on municipalities, enraged advocates of equitable housing practices.

July 23 -

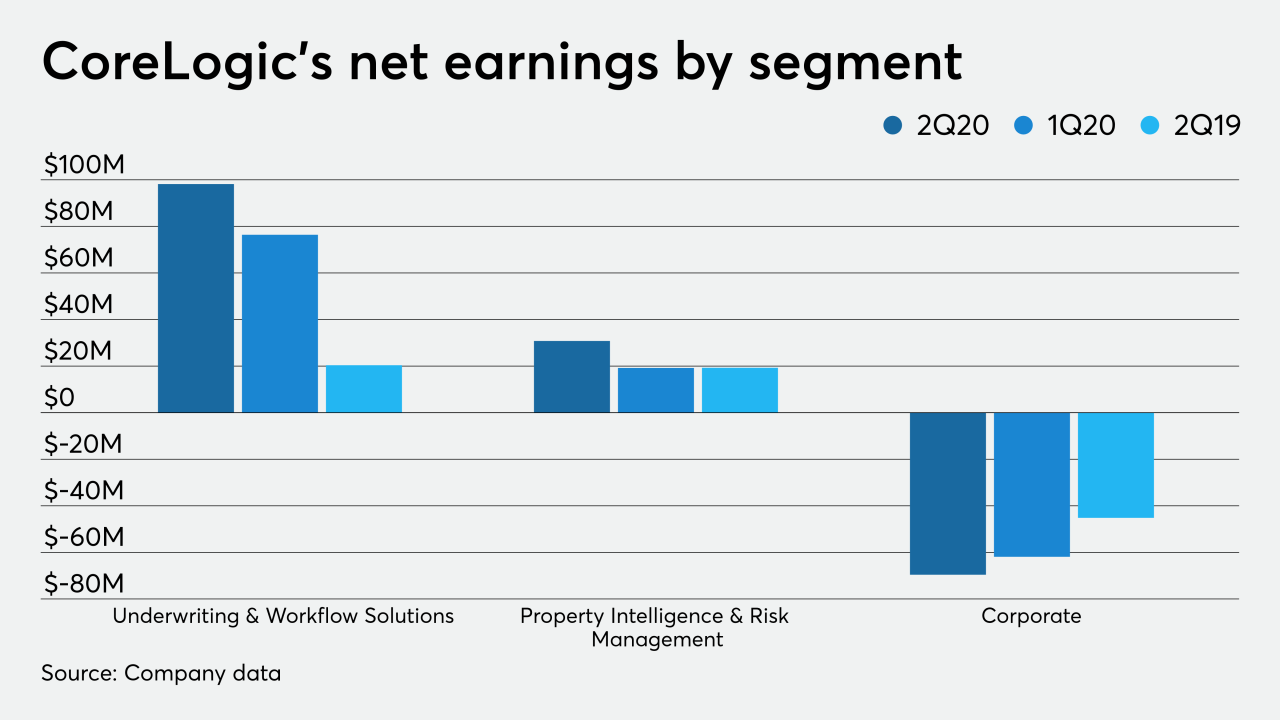

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23