-

Kathy Kraninger's first official action as head of the Consumer Financial Protection Bureau is to reverse course on acting chief Mick Mulvaney's effort to rename it the Bureau of Consumer Financial Protection, which consumer groups and others had sharply criticized as confusing and costly.

December 19 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

A motion to limit debate on the nominee to run the consumer bureau passed along strictly party lines, setting the stage for her to be confirmed as early as next week.

November 29 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

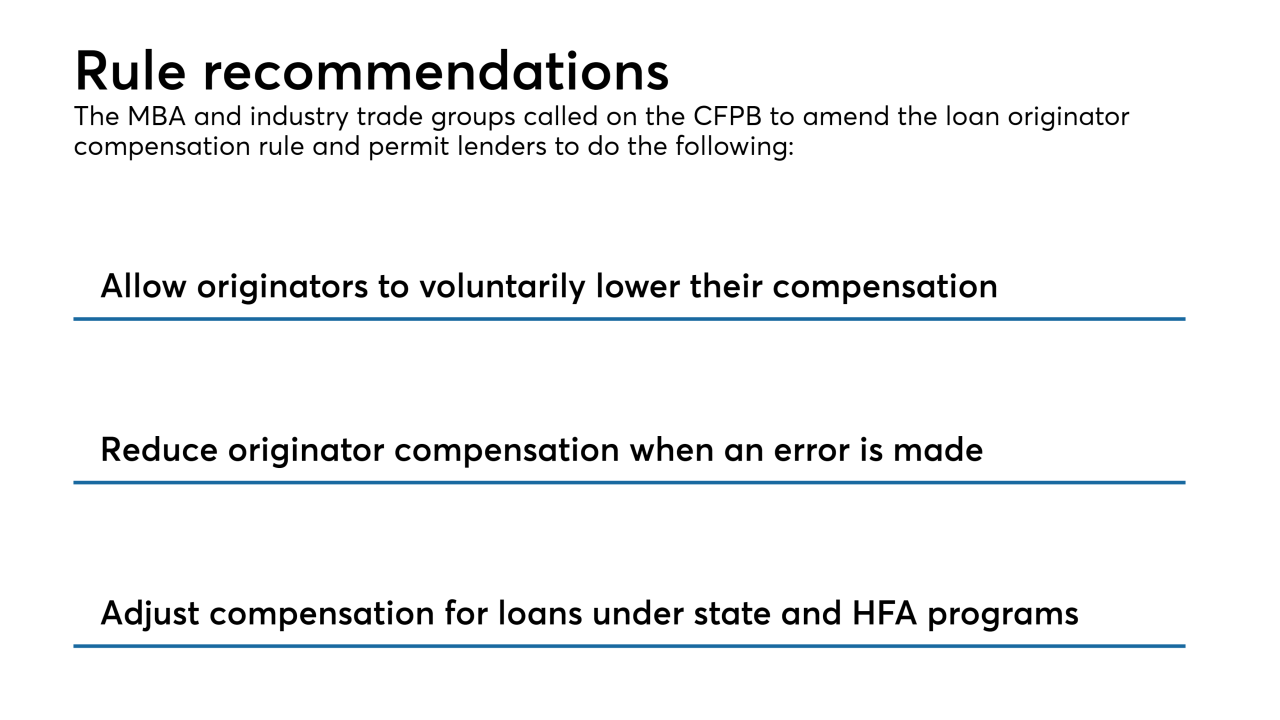

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10